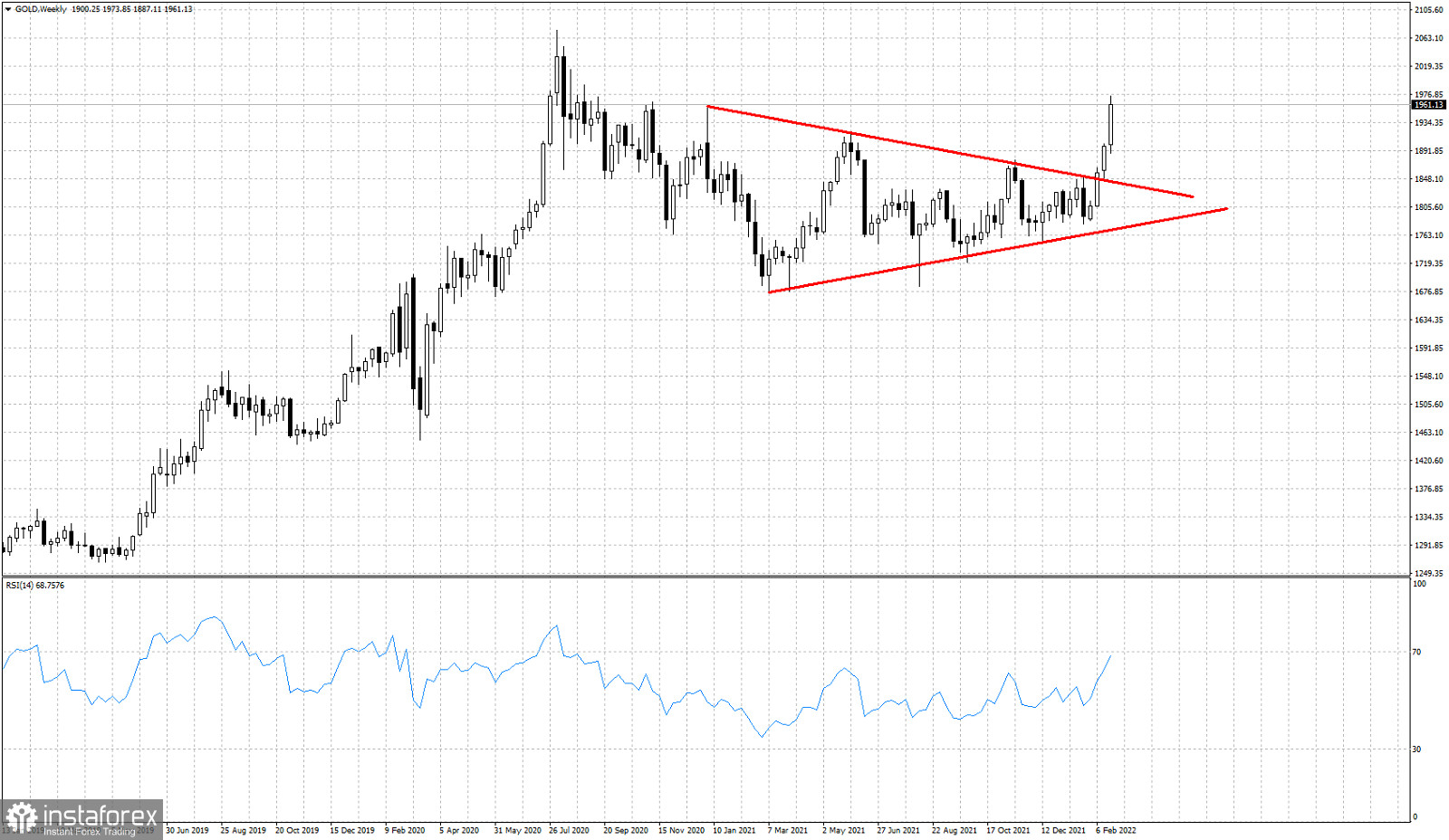

In previous posts we noted that although Gold price remained in a bullish trend, there were some warning signs that the up trend could soon end. The RSI was providing bearish divergence signals. Today these signals were cancelled as the events in Ukraine have pushed traders into buying Gold, exploding price above $1,940.

At the beginning of February Gold price broke out and above the triangle pattern. At the time we mentioned the importance of that bullish signal and as long as Gold price was trading above $1,780, we were to remain bullish. In more recent trading sessions Gold price showed signs of a weakening up trend. Support was respected and as we mentioned in our analysis, as long as Gold is trading above $1,890, trend would remain bullish. Recent events with the escalating tension in Ukraine, have pushed Gold price to new higher highs towards $1,973. This upward explosion have cancelled the RSI bearish divergence. This week's low in Gold is now our major support and key pivot point. As long as Gold is above $1,887, trend will remain bullish and we should target new all time highs towards $2,100-$2,200.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română