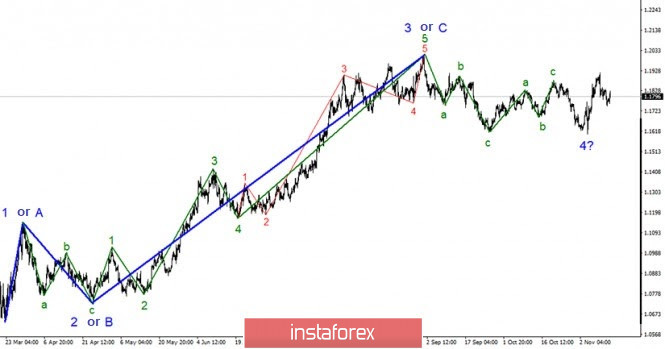

The wave marking of the EUR/USD instrument continues to look quite confusing. So far, I am inclined to the option with the completion of the construction of the proposed global wave 4 and the construction of an upward wave 5. However, it is also possible that the instrument will continue to move in three-wave structures, therefore, waves b and C of the next upward section of the trend will now be built. In any case, according to the current markup, the instrument's quotes are expected to increase in the next week or two.

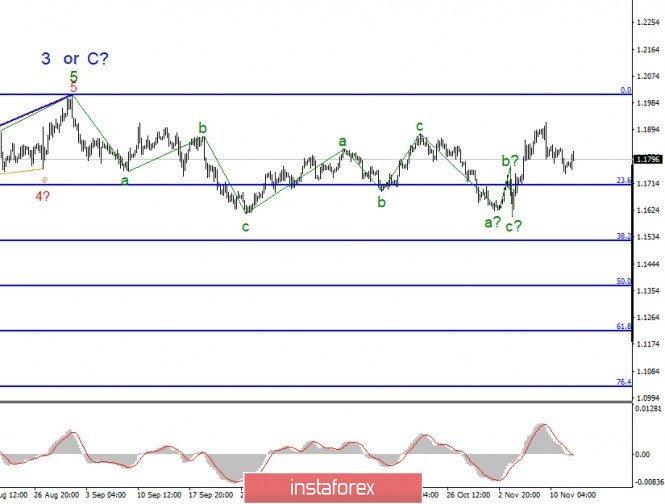

A smaller-scale wave marking also indicates the possible end of the downward section of the trend that begins on October 21. With the final decrease, the instrument could form a wave from the next three. Thus, after its completion, a new three can be built up or the upward trend section within the global wave 5 will resume altogether, as I mentioned when analyzing the 24-hour timeframe. If this is true, then wave 2 or b is currently building, after which the price increase will resume.

Demand for the US currency, which has been observed in recent days, began to slowly subside. It seems that the market has found an equilibrium point, which, however, is almost exactly in the middle of the hypothetical channel within which the instrument has been trading in recent months. Indeed, the level of 1.1800 is approximately the middle of the price range in which the instrument has been moving since August 2020. This suggests that the markets are still waiting for new important information that would help the instrument move more actively. In recent months, an important topic has been "US elections". However, the election was held, the results were counted, Donald Trump lost, and since then no other important events have occurred. Therefore, the markets once again lay low and wait for the end. They can be understood. You can expect anything from Donald Trump. No one wants to take risks and buy, for example, the dollar, and in a week it will become known that Trump refuses to leave the White House and will protest the election results in all states.

In addition, ECB President Christine Lagarde delivered a speech in the European Union yesterday. Her speech focused on monetary policy incentives through the TLTRO and PEPP programs. Simply put, the purchase of securities from the open market. Lagarde said that these programs have already proved their effectiveness and are the main ones in supporting the European economy. The ECB President also said that these programs can be expanded if necessary. And the need may arise in the near future. In the European Union, lockdown continues in many countries, which means that the economy may experience new problems at the end of 2020. The European Union has already announced the purchase of 300 million doses of the coronavirus vaccine from Pfizer, however, this does not mean that the problem of the pandemic has already been solved and there is nothing to worry about anymore.

General conclusions and recommendations:

The euro/dollar pair presumably completed the construction of a three-wave downward trend section. Thus, at this time, I recommend buying a tool with targets located near the 1.2010 mark, which corresponds to 0.0% Fibonacci, for each MACD signal "up", based on the construction of wave C. The expected wave b may complete its construction in the near future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română