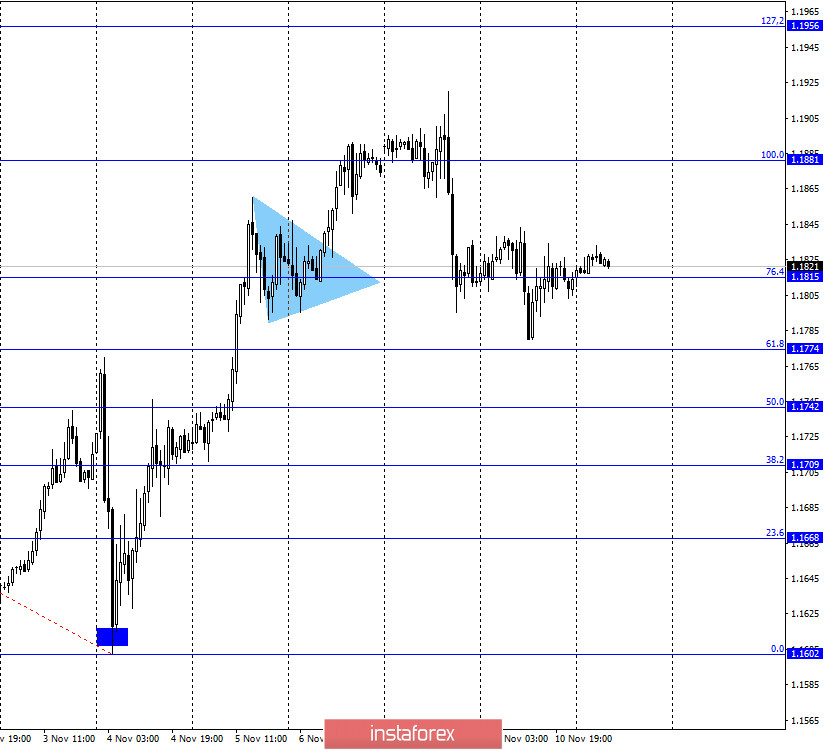

EUR/USD – 1H.

On November 10, the EUR/USD pair performed a slight drop in quotes under the corrective level of 76.4% (1.1815), however, it very quickly performed a reversal in favor of the EU currency and returned to the level of 76.4%. Thus, a new closing of quotes under the Fibo level of 76.4% will again work in favor of the US currency, and some fall in the direction of the corrective level of 61.8% (1.1774). Meanwhile, the topic of presidential elections in America does not subside. Donald Trump has been quite tight-lipped on comments and statements for several days, but yesterday he again said via Twitter that his team is "making great progress, and the results will be next week". It seems that this comment is related to the revision of the election results, although it is quite difficult to talk about it with absolute probability. In turn, Joe Biden called Trump's refusal to transfer power and recognize the election results as a "disgrace". However, Biden also said that he is not worried about the transfer of power and does not even believe that judicial intervention will be required to force Trump to leave the White House. Biden has already said that his team is beginning a transition period, and Trump's statements do not affect the process of preparing for the inauguration of the US President in any way. Nevertheless, I still fear that Trump will take certain steps in the direction of challenging the results of the vote. However, it is difficult to say now what are these steps.

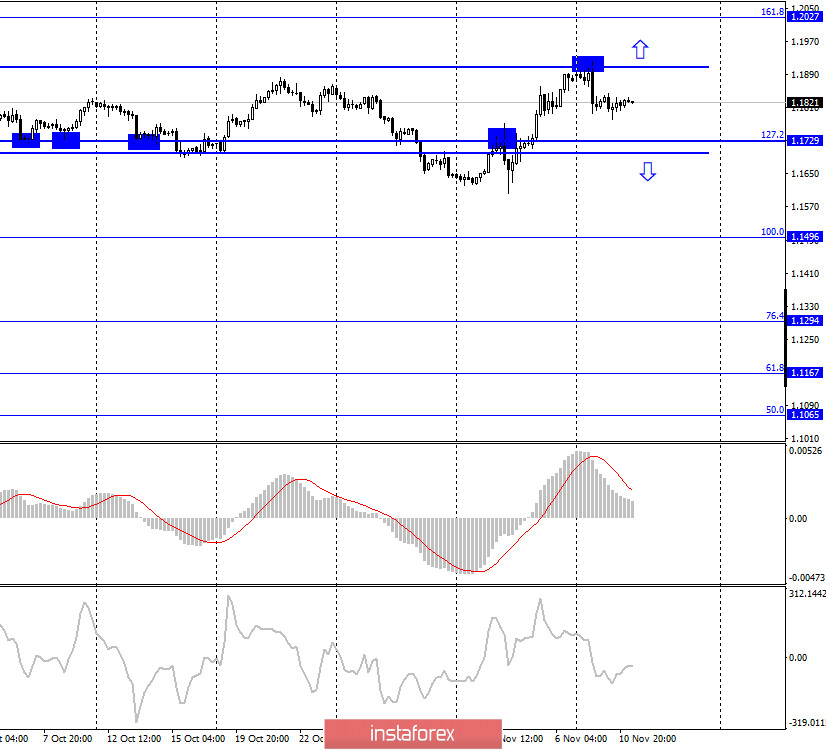

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed a rebound from the upper border of the side corridor and a reversal in favor of the US currency. As a result, the process of falling in the direction of the corrective level of 127.2% (1.1729) and the lower border of the corridor began. A rebound of the pair's quotes from the level of 127.2% will work in favor of the European currency and some growth. Fixing above the side corridor will also allow us to expect growth in the direction of the Fibo level of 161.8% (1.2027).

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair consolidated above the corrective level of 261.8% (1.1825). However, this level remains weak, and now we need to pay more attention to the lower charts, which respond more quickly to changes in the market.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair, but in the long term. In the short term, a drop is preferable.

Overview of fundamentals:

On November 10, the European Union and America did not have a single economic report. The ZEW Institute sentiment index did not attract any attention from traders. Thus, the rather modest activity of traders is explained by a weak information background.

The news calendar for the United States and the European Union:

EU - ECB President Christine Lagarde will make a speech (16:00 GMT).

On November 11, the calendar of the European Union and America again does not mean any important reports. There will be a speech by Christine Lagarde, the ECB President, and it may arouse interest among traders.

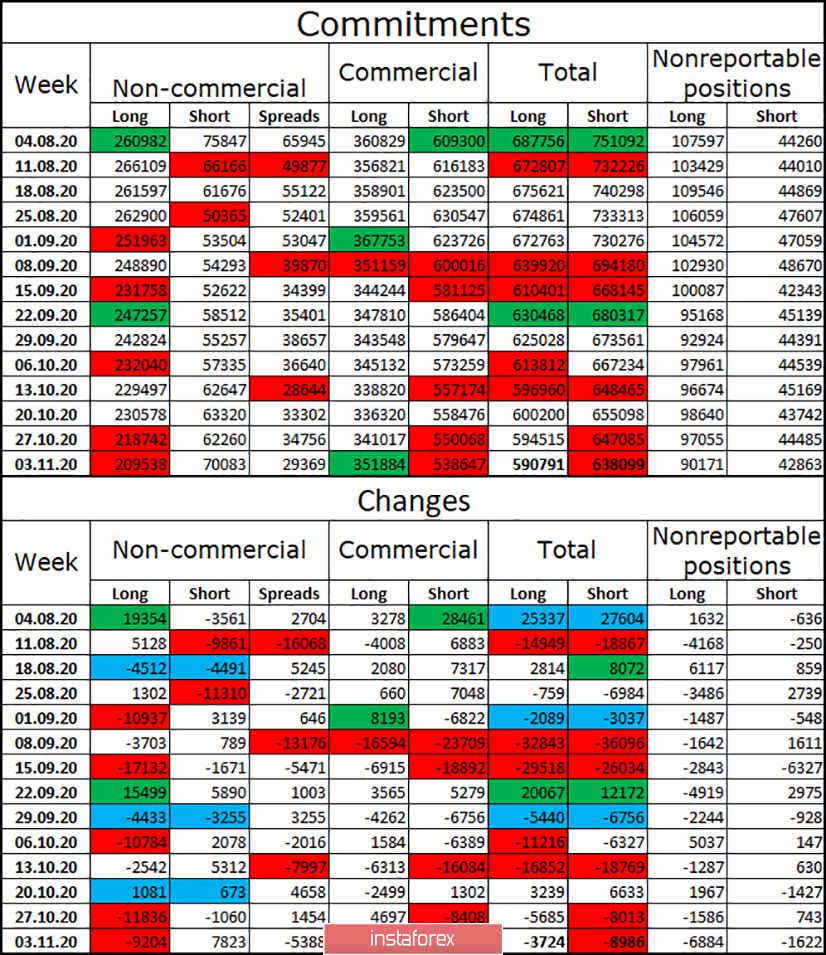

COT (Commitments of Traders) report:

The latest COT report was quite informative. The most important category of "Non-commercial" traders got rid of another 9 thousand long contracts during the reporting week (-12 thousand a week earlier), so speculators continue to get rid of purchases of the euro currency. At the same time, they are also increasing short-contracts, the total number of which has increased by 7.8 thousand. Thus, the strengthening of the "bearish" mood is evident. Based on this, I could conclude that the European currency will fall further, but last week's trading may change the mood of major traders dramatically. The euro has grown by 250 points over the past week, but this growth is not taken into account in the COT report. Only the next report will show how the major traders traded after November 2.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro with targets of 1.1774 and 1.1742, if the pair closes again at 76.4% (1.1815) on the hourly chart. Purchases of the pair will now be possible with targets of 1.1956 and 1.2027 if the quotes perform a consolidation above the side corridor on the 4-hour chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română