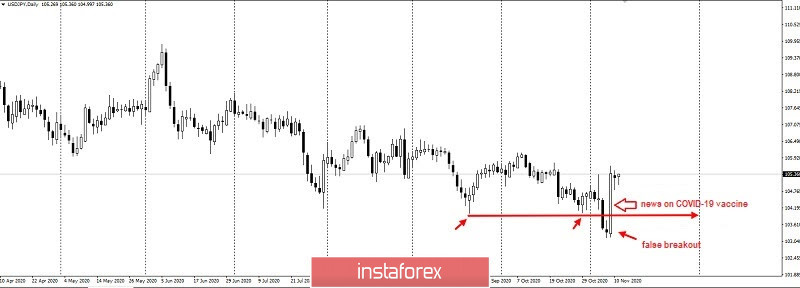

On the news that a COVID-19 vaccine is almost ready for launching, many currency pairs changed their trends, but the most radical of them, perhaps, was the USD / JPY pair.

In fact, the pair has falsely broken through the monthly level of 104 and is now trading above the level of 105.

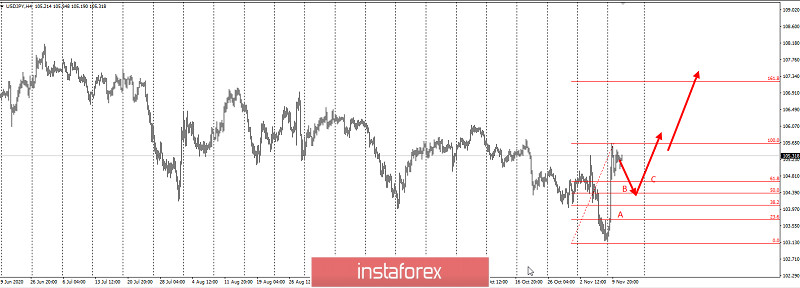

In order to continue this upward move in the market, long positions have to be retained, and then increased after a slight pullback in quotes.

So since the pair has already formed a three-wave (ABC) pattern on the daily chart, in which wave "A" was the upward impulse yesterday (amid news of Pfizer's COVID-19 vaccine), longs should be placed at 61.8% and 50% Fibonacci retracement levels, which are located 104.6 and 104.3, respectively.

This bullish idea will be relevant until the quote breaks out of 103.

But of course, there is still the need to manage and control the risks in order to avoid losing profit. As we all know, trading in this market is very precarious and uncertain, but also very profitable provided that we use the right strategies.

Price Action and Stop Hunting were used for the above trading idea.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română