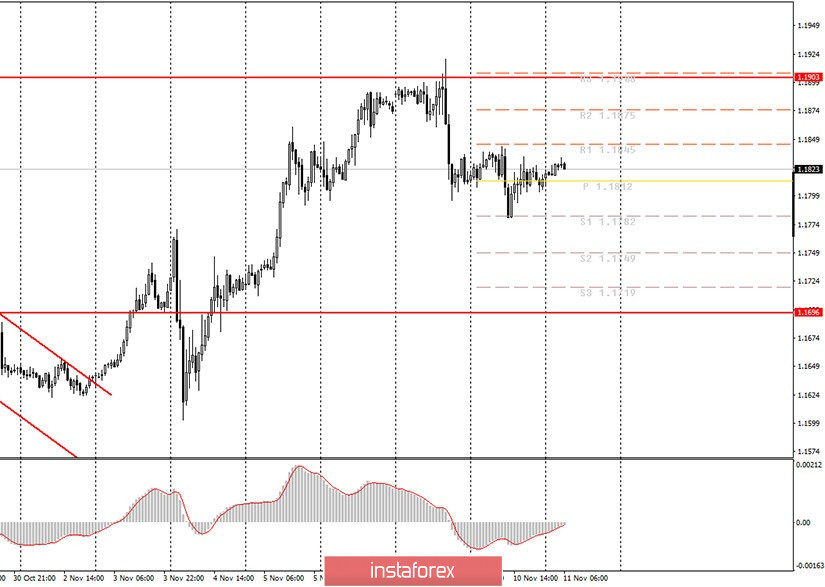

Hourly chart of the EUR/USD pair

The EUR/USD pair continued a new round of corrective movement last night. After the price rebounded off the 1.1903 level, we expect the downward movement to continue and the current trend should be a downward trend. Unfortunately, there is still no way to build a trendline or trend channel, which slightly complicates the trading process. Especially for novice traders. Therefore, each trader must decide for himself whether to trade at a given time. Yesterday's sell signal from MACD was weak. Today this indicator has recovered to the zero level, which means that a strong sell signal may appear in the near future. Novice traders are advised to wait for today's MACD downward reversal. In general, the EUR/USD pair continues to trade within the horizontal channel. And this is in the long run. From time to time, the price leaves the channel and tries to form a new upward or downward trend. However, all previous attempts to do this have failed.

European Central Bank President Christine Lagarde will deliver a speech today, no other events planned. Thus, it is highly likely that today's fundamental background will be extremely weak or it might even be absent. We believe that Lagarde is unlikely to mention anything of vital importance that will force traders to be more active. The second wave of coronavirus continues to rage in the eurozone, so Lagarde can only draw the attention of listeners to possible problems that the European economy may face due to a new wave of the pandemic, lockdowns that have been introduced by many EU countries. Therefore, if her speech touches on monetary policy or the economy, then it is unlikely that she will be hawkish (this term means strong speech, a speech that can support the euro's growth). Accordingly, in the best case (for the euro currency), Lagarde will not touch upon the topic of economics and monetary policy at all. Otherwise, we can expect the euro to fall. Of course, one shouldn't forget about the US political background as well. We do not believe that Donald Trump will simply and easily give up and hand over the reins of the country to Joe Biden. However, in the past few days, Trump has done nothing to match his recent threats to "fight to the end", "sue" and "count the votes." Therefore, if we do not receive new information on this topic, the US currency may continue to gradually strengthen.

Possible scenarios for November 11:

1) Buying the EUR/USD pair is irrelevant at this time, since the upward trend is not determined. We expect to see a downward movement towards the 1.1696 level. So now it is possible to buy the euro/dollar pair, but only when the current downward trend has ended, which is not expected in the near future, or after overcoming the 1.1903 level.

2) Trading for a fall is more relevant at this time, since the price rebounded from 1.1903. So now novice traders are advised to wait until a small upward correction has been completed and after that - a new sell signal from the MACD indicator, which can be worked out with targets of 1.1782 and 1.1749. Unfortunately, there is still no downward trend line or channel, which complicates the process of working with an assumed downward trend.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română