The pound-dollar pair continues to update price horizons: GBP/USD buyers have reached the middle of the 32nd figure today. Traders have not been at these heights since the beginning of September. The pair retreated, having renewed a two-month high (1.3277), but it continues to show bullish sentiment at the same time. The pound looks "unsinkable": despite a difficult epidemiological situation in Britain, a repeated lockdown, conflicting macroeconomic reports and uncertainty with Brexit, the pound stubbornly keeps afloat and even shows character, reclaiming previously lost points.

Today's GBP/USD price momentum was driven by two factors. First, the UK has published fairly good data on labor market growth. The second factor is much more important: the upper house of the British Parliament blocked a resonant bill, which, in fact, crossed out many of the provisions of the Brexit deal.

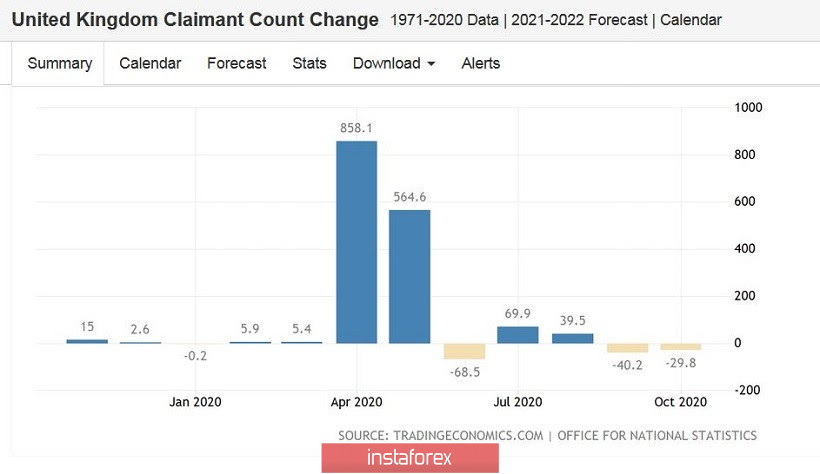

Let's start with UK statistics. So, according to published data, the number of applications for unemployment benefits fell by almost 30,000 in September, while most experts expected to see the indicator grow by 20,000. The UK began to gradually tighten quarantine in September, so this dynamic came as a complete surprise to market participants. The salaries were also pleasing. Average earnings (excluding bonuses) jumped by almost 2%, while this indicator increased by only 0.9% in the previous month. Taking into account premiums and bonuses, this indicator also entered the green zone, reflecting healthy trends in the labor market. But the unemployment rate was slightly disappointing: instead of falling to 4.5%, it slightly grew - to 4.8%. But this component of the release does not react so quickly to the current situation (the indicator refers to lagging economic indicators). Therefore, traders ignored it, focusing on the positive aspects of the report.

But this report only provided background support for the British currency. The impulsive growth of the GBP/USD pair was triggered by another fundamental factor. As mentioned above, members of the House of Lords (the upper house of the British Parliament) blocked a scandalous bill that actually violated the Brexit deal.

Let me remind you that the deputies of the House of Commons (the lower house of Parliament) supported it, despite a barrage of criticism from both the Laborites and some Conservatives, and from Brussels and the world community. According to critics, the legislative initiative of Prime Minister Boris Johnson violates international law and destroys the compromise between Britain and the EU regarding customs procedures on the border of Northern Ireland and the Republic of Ireland.

The head of the British government continued to insist that this bill is just a safety net in case the UK and the European Union are unable to conclude a trade deal. At the same time, many Conservative MPs agree with the position of the cabinet of ministers - at least in the first reading, 340 MPs voted for the bill. But, as you know, the British Parliament consists of two chambers, and the Conservatives have a majority only in the lower - in the House of Commons. Whereas in the House of Lords, the Conservatives have only 250 supporters (this figure may fluctuate depending on the situation) against more than 500 oppositionists - Labour supporters. Therefore, as a rule, the Tories' initiatives are perceived there with hostility.

It happened this time too. 433 members of the House of Lords voted against the Internal Market Bill, while only 165 peers voted in favor. At the same time, Johnson's legislative initiative was criticized not only by representatives of the opposition parties (primarily the Labour Party), but also by some members of the ruling Conservative Party.

Thus, the pound received a kind of "protection" from the pro-European-minded House of Lords, where the Conservatives do not have majority support. This fact suggested that the current negotiations between London and Brussels on the conclusion of a trade deal will get off the ground. Earlier, the leaders of the EU countries criticized the aforementioned draft law, mentioning it among the factors hindering a compromise. It is necessary to take one important factor into account . The upper house is not an appellate instance that can cancel or block certain bills. The peers expressed their opinion in the form of amendments, which could later be rejected by members of the Lower House.

However, at the moment this aspect is not taken into account - there is a general confidence in the market that the parties will eventually come to a compromise in one form or another: either conclude a trade deal or prolong the transition period. Today's decision of the House of Lords served as an additional argument in favor of a happy ending.

Technically, the pair has broken through the upper line of the Bollinger Bands indicator on the daily chart and is currently above all the Ichimoku indicator lines. This indicates the priority of the growth movement. However, the next resistance level is located quite high - at around 1.3400 (the upper line of the Bollinger Bands indicator on the weekly chart), so it's not worth considering for now. The first target of the upward movement can be chosen at the round level of 1.3300. This price level is a psychologically important barrier, once overcome, this will open the way for GBP/USD buyers to reach not only the 34th figure, but also to this year's high (i.e. to the 1.3481 level).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română