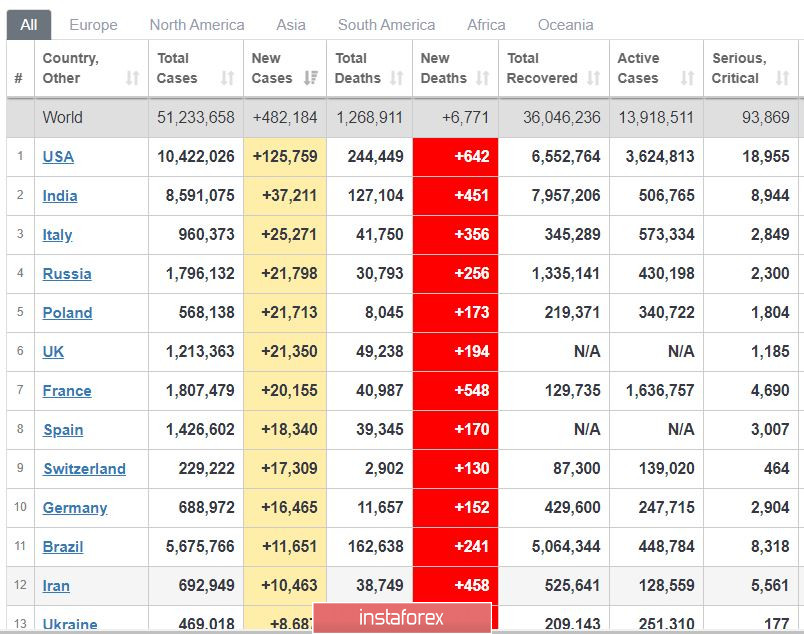

A slight decrease in (worldwide) COVID-19 incidence was recorded yesterday - from 620 thousand to 480 thousand a day. One of the major declines was seen in France, as new infections there dropped to 20 thousand a day. As for Europe, everything remains very tense.

Another good news is that Pfizer announced yesterday that its Phase 3 coronavirus vaccine test was successful, that is, the vaccine showed a 90% chance of protection against infection. If the remaining tests turn out successful as well, it is likely that the authorities will give permission to the company to release the vaccine.

The yen and the franc underwent a sharp reversal yesterday, which could indicate an upcoming growth in the US dollar. However, there is a chance that it is just a rebalancing in the market associated with the strong movements over the results of the US elections.

EUR/USD: Open long positions from 1.1750.

Open short positions from 1.1794.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română