The United States continues to please us with stability. For many days, Mr. Trump is just blabbering about election fraud and is filing more and more lawsuits in various courts to achieve a recount of votes and the analysis of all cases of fraud. On the other hand, Mr. Biden announced his unconditional victory and demands to immediately begin the process of transferring power to him. And this is despite the fact that the counting of votes is still ongoing. The main argument of the Democrats is that even if there will be a recount of votes in individual States, Mr. J. Biden still gets more electoral votes than D. Trump.

The overall result is still unchanged. It is not surprising that people around the world have less and less confidence in politicians and state institutions. Nevertheless, the suspense of the issue with the results of the US presidential election is gradually beginning to agitate. The markets are somewhat undecided, and investors have no idea where to run or what to do. This is clearly seen in the currency market, which shows no action; although, the single European currency showed a clear downward trend yesterday. This is related to the fact that the United States has successfully tested a coronavirus vaccine. However, this is hard to believe, since we did not see a widespread strengthening of the dollar. Therefore, the strange surge in activity on the single European currency is more like an early speculation. Nevertheless, such a scenario only shows us once again that both the pound and the single European currency are fairly overbought, and the market is just waiting for a reason to adjust.

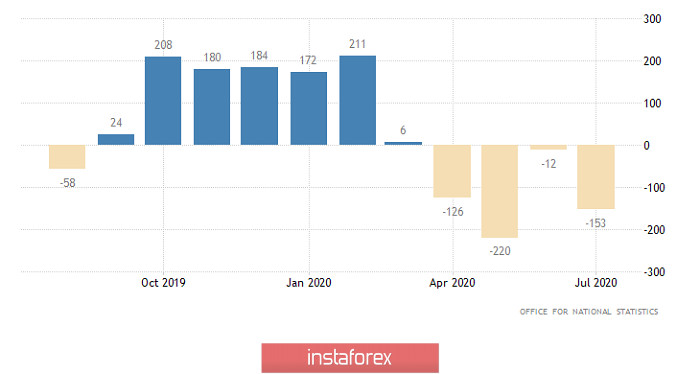

Since the single European currency has slightly weakened, it is logical to expect a similar activity from the pound. The UK data on the labor market have been published, but it lacks response. The unemployment rate rose from 4.5% to 4.8%, which is quite significant. The employment declined by 164 thousand, so unemployment continues to grow steadily. Although we were pleased with applications for unemployment benefits, the total number of which declined by 29.8 thousand, with a forecasted growth by 36 thousand. As we can see, the situation in the labor market continues to deteriorate, but the pound is more likely to show an upward trend. Unfortunately, the market is still dominated by the US presidential elections.

Employment Change (UK):

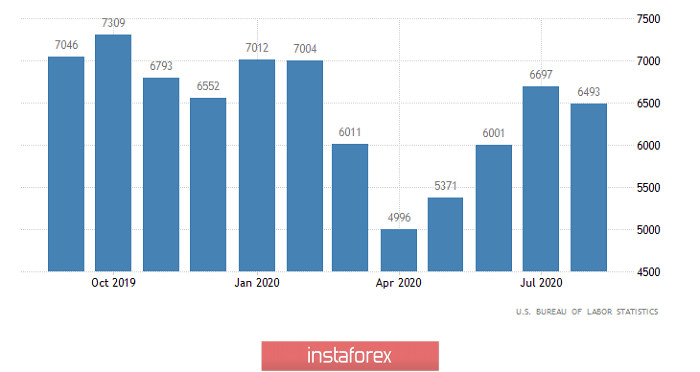

The US data on open vacancies is still being published today, the total number of which may decline from 6,493 thousand to 6,200 thousand. However, this is not surprising, as unemployment in the United States is steadily declining, which means that open vacancies should be increasing. But if the market still continues to focus exclusively on the issues related to the earlier presidential elections, then this data will not affect anything.

Job Openings (United States):

The EUR/USD pair found a volatile pivot point within the level of 1.1800 after a sharp decline, which was followed by a stop and a 30-point pullback. We can assume that if the price consolidates below 1.1790, there will be another round of short positions, which will direct the quote towards 1.1750-1.1700. Otherwise, we are waiting for a side turn within the limits of the current pullback.

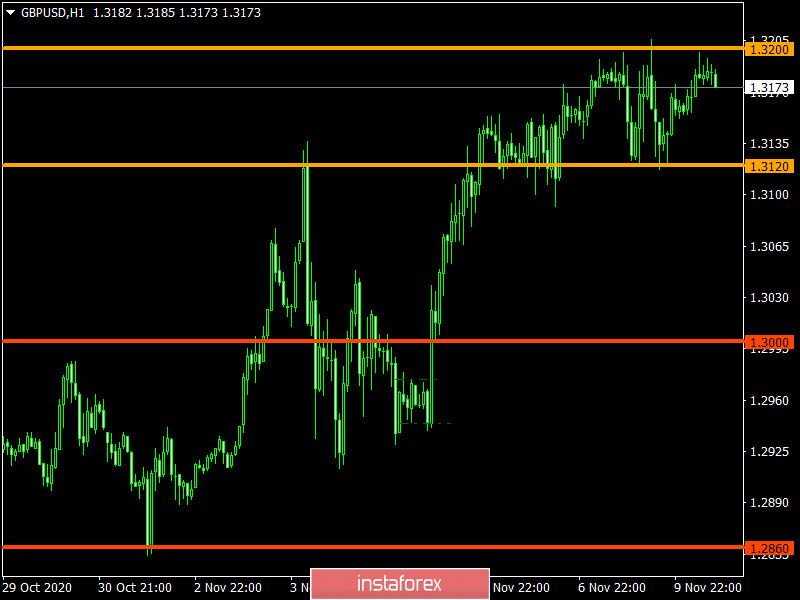

The GBP/USD pair has been moving in the side channel 1.3120/1.3300 for several days in a row, consistently working out the set boundaries. We can assume that the variable amplitude will soon come to its logical conclusion, which will be reflected by a sharp surge in market's activity. The most optimal trading tactic is considered to be the method of breaking the established boundaries.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română