To open long positions on GBP/USD, you need:

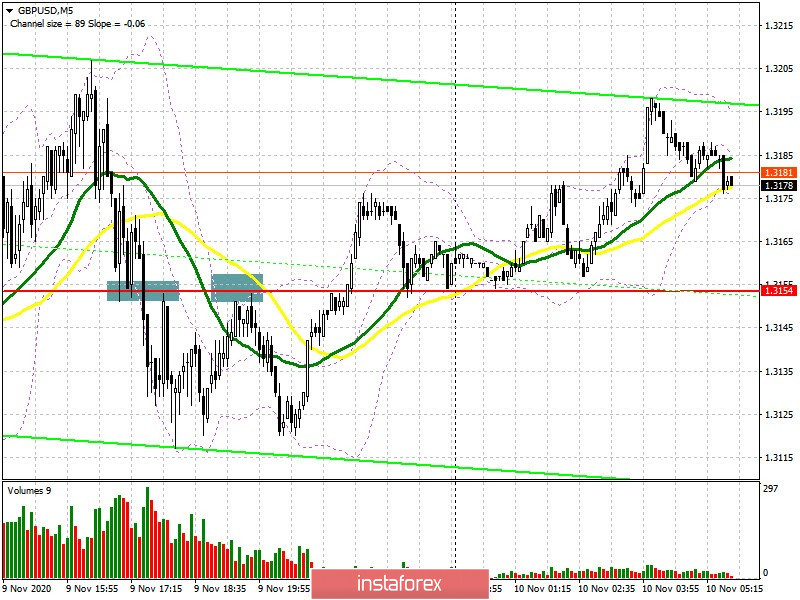

The bulls' unsuccessful attempt to stay above support at 1.3154, which was tested at the beginning of the US session, caused the pair to fall below this range. If you look at the 5-minute chart, you will see how the breakout and being able to settle below 1.3154, and also testing this level from the bottom up, had produced a signal to open short positions. The movement was around 30 points.

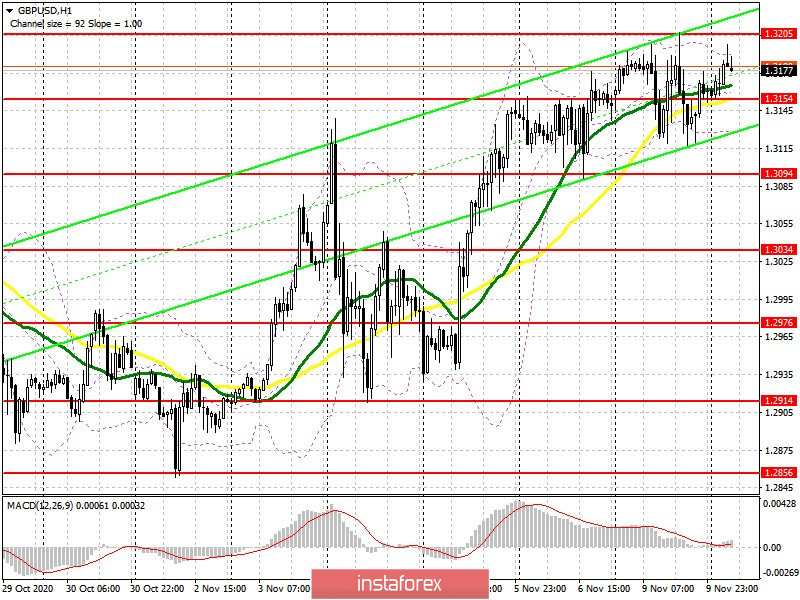

Take note that the technical picture has practically not changed, except for the appearance of two new resistances. We can count on the pound's succeeding growth in the short term as long as it keeps moving above the 1.3154 level. Testing the 1.3154 area from top to bottom and forming a false breakout on it in the first half of the day will be a signal to open long positions. But this will only happen if we receive a good report on the UK labor market. The rate of unemployment is of particular importance, where growth is expected. In case a false breakout is formed at 1.3154, GBP/USD will aim for a high of 1.3205, being able to settle above will open a direct path to the 1.3261 area, and the next goal will be resistance at 1.3315, which is where I recommend taking profit. However, this scenario will only be realized if we receive good news on Brexit. If the pair returns to the area below 1.3154, similar to yesterday, it is best to postpone long positions until the 1.3094 low has been updated, or buy GBP/USD immediately to rebound from support at 1.3034, counting on a correction of 20-30 points within the day.

To open short positions on GBP/USD, you need:

Sellers need to regain the 1.3154 level again, since being able to settle below it will increase the pressure on the pair and could also bring back the bear market. The initial goal is to test the 1.3094 level, which the bears failed to reach yesterday. However, we can only speak of a larger downward trend if we settle below this range, which will create a new signal to sell the pound and lead to updating support at 1.3034. The sellers' main target for the middle of this week will be the 1.2967 area, where I recommend taking profits. An equally important task for the bears is to protect resistance at 1.3205 in the first half of the day. Forming a false breakout there along with weak data on the UK labor market will be a signal to sell the pound. In the absence of activity at this level, it is best to postpone short positions and wait until the 1.3261 high has been tested, where you can sell the pound immediately on a rebound. Also, a rather interesting area for opening short positions is the high of 1.3315, from which we expect a correction of 20-30 points within the day.

The Commitment of Traders (COT) report for November 3 showed a reduction in long positions and a slight increase in short ones. Long non-commercial positions fell from 31,799 to 27,701. At the same time, short non-profit positions only rose to 38,928, from 38,459. As a result, the negative non-commercial net position was 11,227, against 6,660 a week earlier, which indicates that sellers of the British pound remain in control and have a minimal advantage in the current situation.

Indicator signals:

Moving averages

Trading is carried out in the area of 30 and 50 moving averages, which indicates the equality of buyers and sellers.

Note: The period and prices of moving averages are considered by the author on the H1 chart and differs from the general definition of the classic daily moving averages on the D1 daily chart.

Bollinger Bands

A breakout of the upper border at 1.3188 will lead to a new wave of growth in the pound. A break of the lower border of the indicator around 1.3130 will increase the pressure by the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română