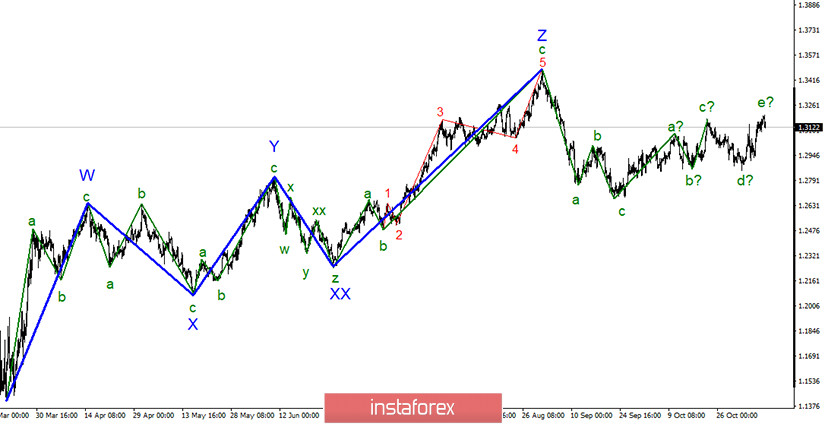

In the most global sense, the construction of an upward section of the trend can resume, however, the entire wave marking takes a complex form. The section of the trend that begins on September 23 takes a five-wave form, however, it is not impulsive. Thus, after the end of the next rising wave, the construction of a new three-wave section of the trend can begin. However, given that there is no classical wave marking now, the section of the trend from September 23 can be complicated as many times as necessary. The news background is now of great importance for the markets.

The lower chart clearly shows two failed attempts to break the 50.0% Fibonacci level, which are currently interpreted as the lows of waves b and d. Thus, the wave marking really takes on a rather non-standard appearance, and the construction of the next ascending wave can be completed already around the 23.6% Fibonacci level. An unsuccessful attempt to break the 1.3189 mark indirectly indicates the completion of the wave e. Thus, even a new downward section of the trend may begin now.

On Friday, a fairly large amount of important information was released in America. The most significant information was about the number of new jobs created outside the agricultural sector, the so-called Nonfarm Payrolls. Their number increased in October by 638 thousand against market expectations of 600 thousand. The unemployment rate also dropped significantly in October – from 7.9% to 6.9%. Thus, in fact, there were quite a lot of reasons for the markets to increase demand for the US currency on Friday. And these reasons were economic, not political. However, elections in the United States outweighed all the same. The US currency continued to lose demand, and even strong statistics did not help it. But the wave marking helped. An unsuccessful attempt to break through the 23.6% Fibonacci level indicates a possible completion of the wave e. Thus, the US currency may trade with an advantage over the British in the next few weeks. The news background from the UK continues to be negative. If markets only looked at news from Britain, they would not have any questions about what to do with the pound. Everyone would sell it. And this is exactly what the markets can start doing in the near future. Wave marking supports the decline of the British. The news background supports the decline of the British dollar. There is still no agreement on trade between the EU and Britain. There are still differences between the EU and the UK on key issues of the trade agreement. And Boris Johnson, by the way, when extending the terms of negotiations, set the final date by which the deal should be agreed, November 15. November 15 is 6 days away. After that, Johnson promised to stop any negotiations with Brussels. Therefore, the British currency may soon again rush down, as once again it faces the threat of an absolutely gloomy economic future.

General conclusions and recommendations:

The pound/dollar instrument resumed building an uptrend section, however, its last wave may end near the 23.6% Fibonacci level. Thus, in case of a successful attempt to break the 1.3189 mark, I recommend buying the instrument again with targets located near the 1.3484 mark, which corresponds to 0.0% Fibonacci. Now we can consider cautious sales of the instrument in the expectation of building a new downward trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română