The dynamics of the market lately have fantastic opportunities for making money, just look at the numbers:

- 339 points, and this is only one direction, upward;

- 280/220/260 points, when calculating local fluctuations UP & DOWN;

- 5 trading days combined such high speculations.

The information noise associated with the presidential elections in the US, where the dollar came under strong pressure, which led to high turbulence and, as a result, its weakening by more than 300 points, is rightly considered to be the culprit of speculation.

This competition between Trump and Biden is still coming to a logical end, despite the sea of emotions and lawsuits. Joseph Biden bags victory by an impressive margin, however, the current president cannot yet face defeat, so speculators are still preparing for Trump's non-standard antics.

While the media talks about the presidential race, the allotted time for negotiations on a trade agreement between Britain and Europe is gradually coming to an end, but there is still no result.

On Saturday, November 7, the head of the European Commission, Ursula von der Leyen, held a telephone conversation with British Prime Minister Boris Johnson, where they discussed the progress of bilateral meetings of the negotiating teams and agreed that there is a result, but differences remain.

"We summed up the results of our talks with British Prime Minister Boris Johnson today. Some progress has been made, but big differences remain, especially regarding equal conditions and fishing," Von der Leyen poted on her Twitter account.

In turn, Boris Johnson confirms that there are differences on a number of issues, including fishing and common rules of the game (competition).

The parties agreed that negotiations will resume from November 9, but the time remains only until November 15, which may provoke speculators to another manipulation.

Recall that the UK is currently under quarantine, the economy is going through the worst times in history, and in addition, there is a risk of a hard Brexit, all this can lead to a sharp weakening of the pound sterling.

Thus, speculative growth, which led to a sharp increase in the value of the sterling against the background of the US presidential race, may eventually be replaced by a collapse, and the local overbooking of the pound will play as an additional lever for sellers.

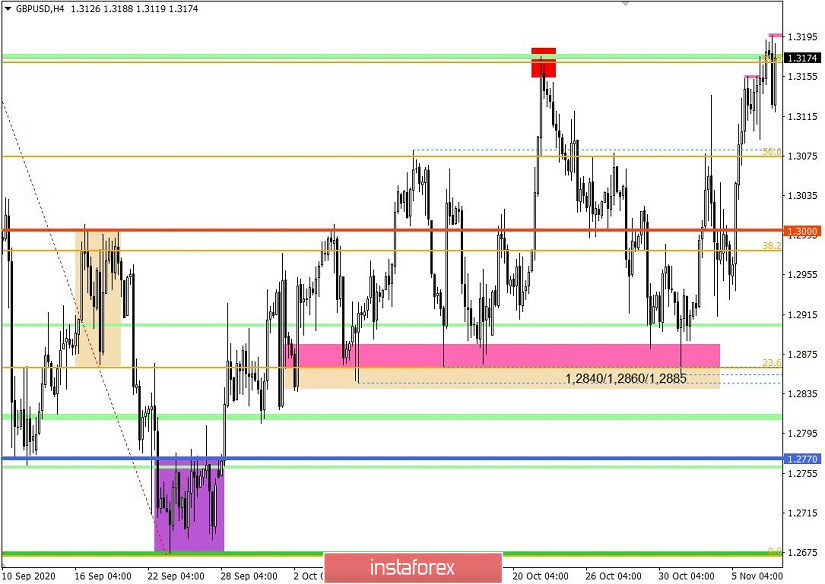

In terms of technical analysis, it is worth highlighting an inertial upward move based on which the local maximum of October 21, 1.3175, was broken, but the joy of buyers was short-lived and already in the area of 1.3175/1.3200 there was a slowdown with a reduction in the volume of long positions.

In fact, we already have the first signals of a possible reversal, where overbought indicators are literally off the scale. The only tool for further growth can only be information noise in the US since all other instruments are already signaling a sale.

As for the dynamics for November 6, a sharp slowdown of 83 points is recorded, but if we take into account an overactivity on November 4 and 5 by 223 points, then, in principle, a stop is possible.

Looking at the trading chart in general terms (daily period), you can see a high risk of a break in the downward tact set in the September period, where most of the tact is played out taking into account the current growth of the pound sterling.

Today, in terms of the economic calendar, we do not have particularly important statistics for Britain and the US, all attention, as before, will be reduced to monitoring the information background.

Analyzing the current trading chart, you can see that during the European session there was a surge in short positions, but the echoes of bullish speculation do not let the pound go from the heights of inertia.

In fact, we are faced with a dilemma: the noise of Biden's victory exerts local pressure on dollar positions, which keeps the quotes at such an impressive height.

At the same time, overbought is growing hourly, where the information background of Britain's economic problems, coupled with Brexit, can very painfully hit the value of the pound sterling.

Thus, we are working on the speculators but adjusted for the fact that in the near future there may be an impressive weakening of the pound.

Based on the above information, we will display trading recommendations:

- Buy positions are considered higher than 1.3200 with the prospect of a move to 1.3250-1.3300.

- Consider sell positions lower than 1.3100 towards 1.3000.

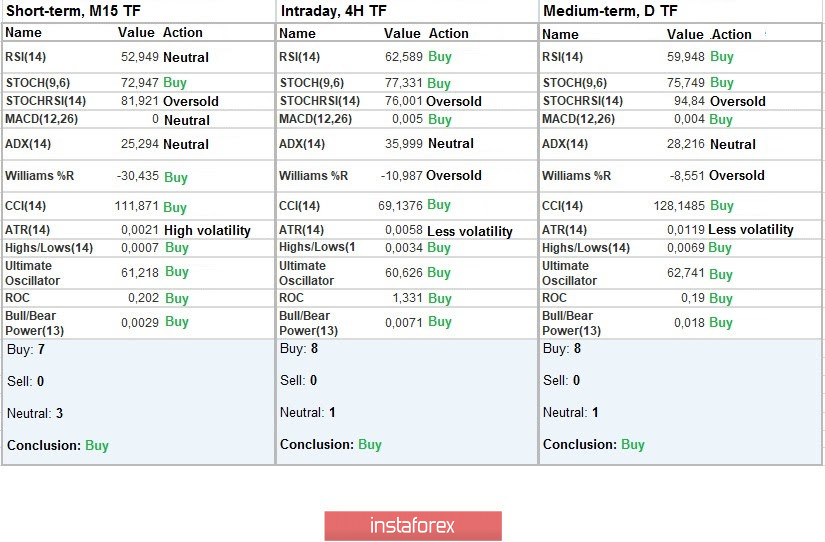

Indicator analysis

Analyzing different sectors of timeframes (TF), we see that the indicators of technical instruments unanimously signal a purchase due to price fluctuations within the conditional maximum of the inertial move.

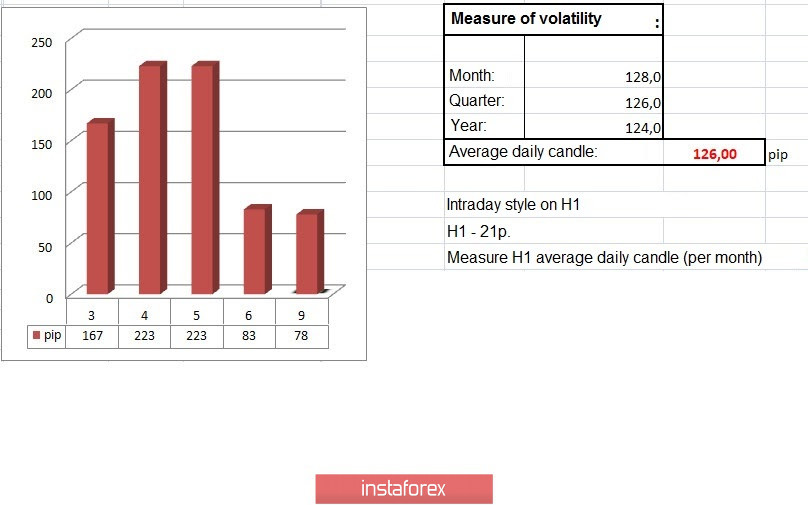

Weekly volatility / Volatility measurement: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated per Month / Quarter / Year.

(November 9 was built taking into account the publication time of the article)

The dynamics of the current time is 78 points, which is considered an even low indicator in comparison with the general dynamics. It can be assumed that after a short stagnation, speculative fluctuations will arise again, which will lead to an acceleration of volatility in the market.

Key levels

Resistance zones: 1.3175 (1.3200); 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support Zones: 1.3000 ***; 1.2840 / 1.2860 / 1.2885; 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411).

* Periodic level

** Range level

*** Psychological level

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română