To open long positions on EUR/USD you should:

Lack of important fundamental statistics and the reduction of tensions amid the United States election kept EUR/USD trading in a narrow sideways channel where volatility plummeted after Friday's trading. As a result, the pair failed to reach any of the target levels. Therefore, I had nothing to rely on when making a decision to enter the market. The focus is shifted to the second half of the day, where the technical picture remained unchanged.

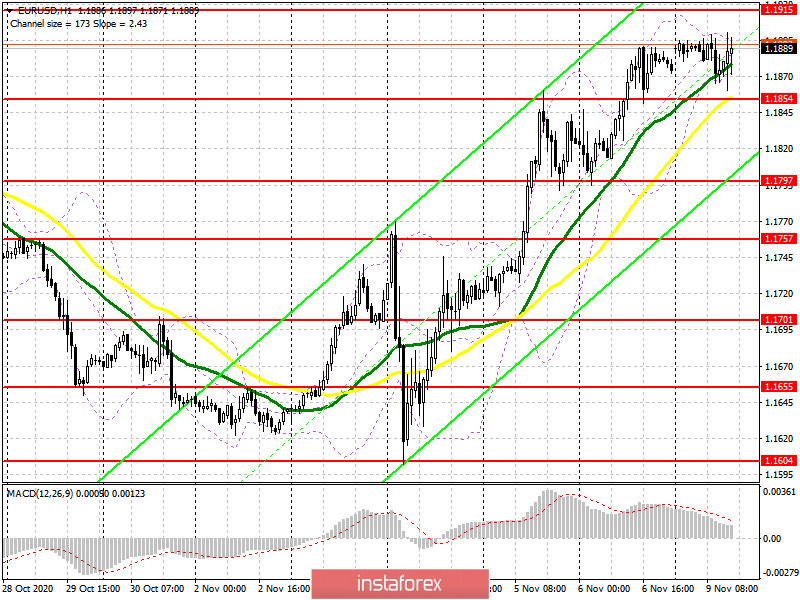

Buyers of the euro will also be focused on protecting the support level of 1.1854, which the pair failed to reach this morning. The market did not react to the speech delivered by President of the European Central Bank Christine Lagarde. The moving averages are just above the level of 1.1854. Thus, only the formation of a false breakout pattern will become a signal to open long positions. Consequently, the bullish trend that we have been observing since the middle of last week will be able to continue. An equally important target for bulls will be a breakout and consolidation above the resistance level of 1.1915. From this mark, the price may rise to the high of 1.1964. Taking into account that we have no crucial fundamental data set for release at the beginning of the week, the 1.1854 level will be of great importance. If bulls are not active at this point, a downward correction is likely to occur. Therefore, I recommend opening new long positions only after the price reaches the support at 1.1797 or the level of 1.1757, taking into account a possible rebound of 15-20 pips within the day.

To open long positions on EUR/USD you should:

The formation of a false breakout in the area of the resistance level of 1.1915 will be a signal for sellers to open short positions. As a result, they can expect the bullish market to come to the end and a small downward correction to begin. The first target in this case will be the low of 1.1854. However, short deals below this range will be possible only if the price as consolidates and as tests this area from the bottom up. In this case, the downward wave will continue to the area of the low of 1.1797, where I recommend taking profits. A further target will be the support level of 1.1757. If bears do not show activity in the area of the resistance of 1.1915, I think it is best to refrain from selling the pair until the price tests the new high at 1.1964. Otherwise, you should open short positions immediately on the rebound from the resistance of 1.2008, taking into account the possibility of a 15-20 pips correction within the day.

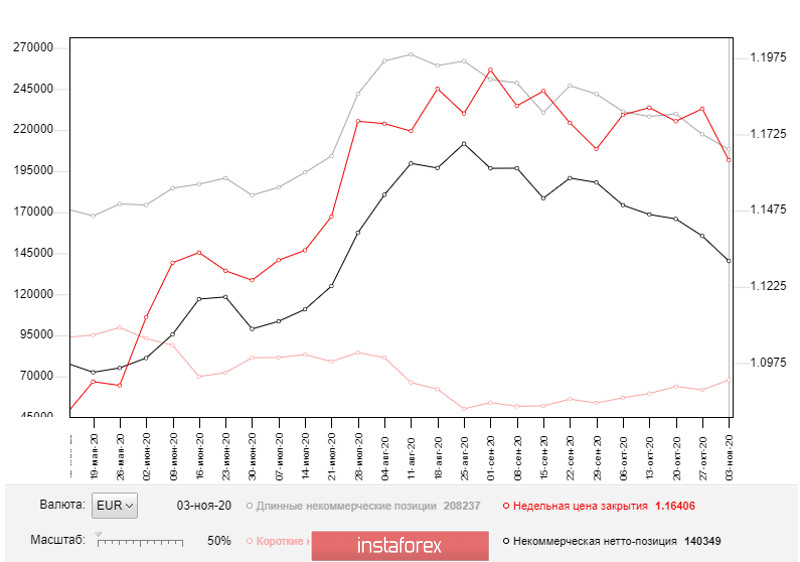

As for the Commitment of Traders (COT) report presented on November 3, the number of both short and long positions decreased. Despite this fact, buyers of risky assets believe in the continuation of the bullish market. Nevertheless, they prefer to trade cautiously. Thus, long non-commercial positions fell to 208,237 from 217,443, while short non-commercial positions rose to 67,888 from 61,888. The total non-profit net position fell to 140,349 from 155,555 recorded a week earlier. Notably, the mid-term bullish sentiment on the euro remains rather strong, especially after the victory of Joe Biden, who is expected to introduce a $2 trillion monetary stimulus package to support the American economy.

Indicator signals:

Moving averages

Trading is taking place above the 30 and 50 day averages which indicates that the euro is likely to continue its upward movement.

Note: The period and prices of moving averages are considered by the author of the article on the hourly chart and differ from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

A breakout at the upper border of the indicator in the area of 1.1845 may boost the euro.

A breakout at the lower border of the indicator in the region of 1.1797 is likely to increase pressure on the pair.

Description of indicators

- Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

- Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands. Period 20

- Nonprofit traders are speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română