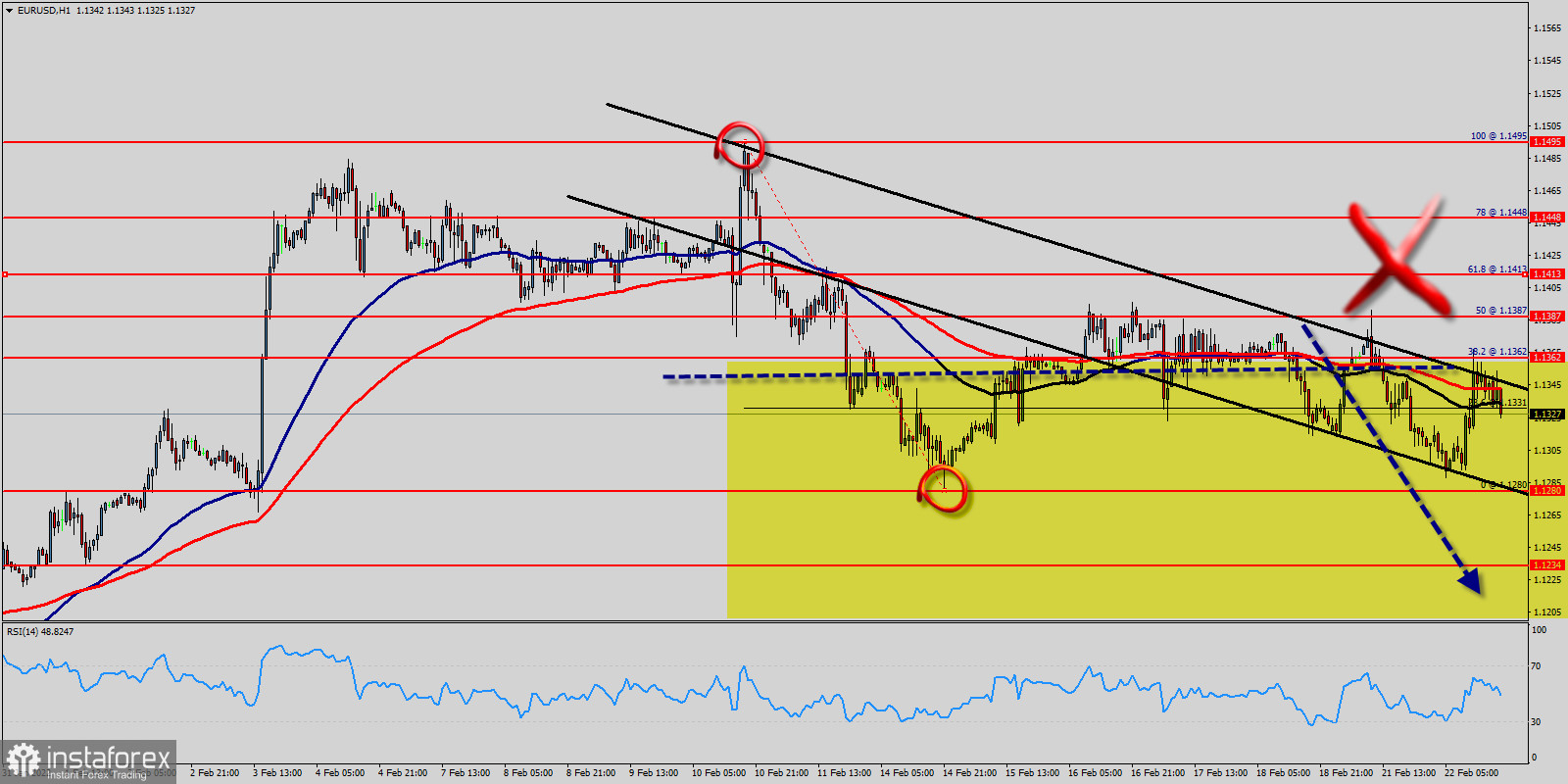

The EUR/USD pair faced resistance at the level of 1.1387, while minor resistance is seen at 1.1362.

Support is found at the levels of 1.1280 and 1.1234. Pivot point has already been set at the level of 1.1362.

Equally important, the EUR/USD pair is still moving around the key level at 1.1362, which represents a daily pivot in the H1 time frame at the moment.

Yesterday, the EUR/USD pair continued moving upwards from the level of 1.1280. The pair rose to the top around 1.1280 from the level of 1.1362 (coincides with the ratio of 38.2% Fibonacci retracement).

In consequence, the EUR/USD pair broke support, which turned into strong resistance at the level of 1.1387. The level of 1.1387 is expected to act as the major resistance today.

We expect the EUR/USD pair to continue moving in the bearish trend towards the target level of 1.1280.

On the downtrend: If the pair fails to pass through the level of 1.1387, the market will indicate a bearish opportunity below the level of 1.1387.

So, the market will decline further to 1.1280 and 1.1234 to return to the weekly support.

Moreover, a breakout of that target will move the pair further downwards to 1.1203.

On the other hand, if a breakout happens at the resistance level of 1.1387, then this scenario may be invalidated.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română