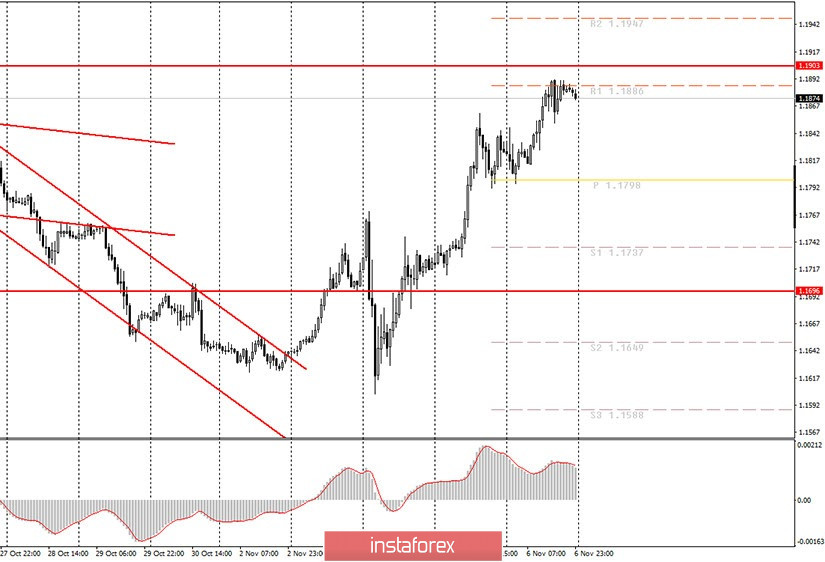

Hourly chart of the GBP/USD pair

Trading the GBP/USD pair last week as a whole was quite typical for the current fundamental background. Take note that the US elections has been the number one topic for the foreign exchange market. Therefore, the pound/dollar pair also traded in line with it. However, this pair did not show such a strong movement as the euro/dollar. However, by the end of the week, it also approached the important resistance level of 1.3177, which is the high of October 21. In addition, a narrowing ascending channel appeared, near the upper border of which the price is now. Therefore, the price can rebound off two important lines at once today. A rebound in the price will make it possible for the pair to start falling towards the lower channel line, near the support level of 1.2998. At the same time, if the price manages to overcome the 1.3177 level, then the upward movement may continue. But we are still leaning towards the option of a correction of 100-120 points down.

The fundamentals for the British currency have been very important over the past week. However, running a little ahead, most of the events and news were in the shadow of the US presidential elections. And traders simply did not react to them. Nevertheless, it is quite possible that next week, traders will begin to work out all the information that they ignored. And I must say that the balance of power here is not in favor of the British currency. Firstly, the next stage of talks regarding the Brexit deal failed. Second, the Bank of England expanded its quantitative easing program, recognizing that the economy needs help. Third, after the dollar fell, based only on elections, quotes could return to their original positions, since none of the presidential candidates is convenient for the US dollar. Accordingly, the markets can now simply return their assets back to the dollar, which they got rid of in recent days. Plus we have a really very convenient level of 1.3177, from which you can trade this week. Bank of England Governor Andrew Bailey is set to deliver a speech on Monday, and if his rhetoric is still as dovish as before, then the pound may start falling on Monday. At the same time, if we receive news regarding a political crisis from America, it can push the pair up. Such news can be of a very different nature. For example, Donald Trump will refuse to hand over power to Joe Biden and will initiate a trial, accusing Democrats of electoral fraud. All this will very much question the democratic principle in the United States, as well as the validity of the US Constitution.

Possible scenarios for November 9:

1) Buying the pair looks more relevant now, as the upward trend remains, which is signaled by the upward channel. However, we do not recommend opening new buy orders until the 1.3177 level is overcome. If this level is overcome, we recommend trading upward with targets at 1.3220 and 1.3298.

2) Selling, from our perspective, is much more appropriate now, but only from the point of view of the expectation of a downward correction. We expect the price to rebound from the upper channel line and the 1.3177 level. If this does not happen, then you are advised to open short positions in the future but only if the price settles below the ascending channel, that is, approximately below the 1.3000 level. Much of this week will depend on the fundamentals in the US and UK. The US political background has an advantage over the British, so you should pay attention to it first.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română