While America was summing up the voting results, EUR / USD bulls were thrown into heat and cold. And even if we managed to form euro longs from the very attractive level of $1.164, future dynamics is still uncertain. Donald Trump's chances of re-election came as a complete surprise to financial markets. In this situation, the US dollar began to strengthen naturally, fortunately, not for long. Joe Biden began to build up his advantage, and the USD index rolled down.

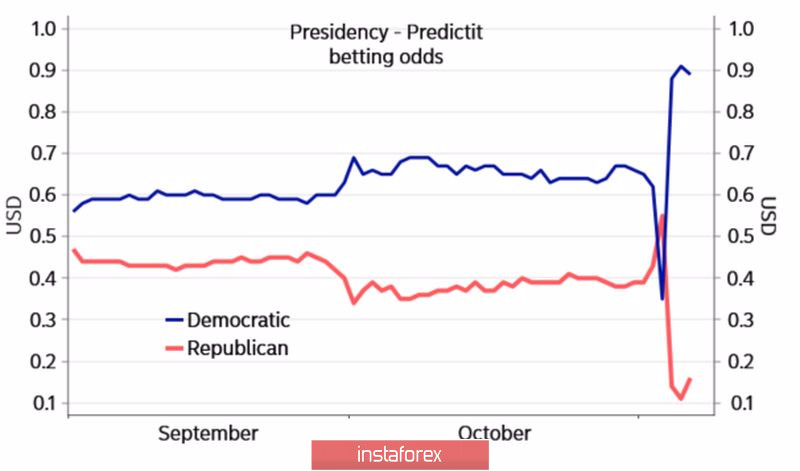

The dynamics of chances for the presidency:

Currently, the most likely option is the Democratic takeover of the White House and the House of Representatives, and the Republicans - the Senate. In this situation, one should not expect a large-scale fiscal stimulus, it will most likely be rejected by the Upper House of Congress. The budget may amount to less than $2 trillion. On the other hand, the chances of tax hikes and stricter regulation of tech companies are also diminished. As well as the risks of a renewed trade war with China and the EU. All of this is clearly positive for the S&P 500 and negative for safe-haven assets, including the US dollar.

At the same time, in the short term, Donald Trump, who is dissatisfied with the election results, is quite capable of making hell for his opponents, which, coupled with the worsening epidemiological situation in the United States and Europe, will limit the growth potential of risky assets and allow the USD index to regain some of its losses.

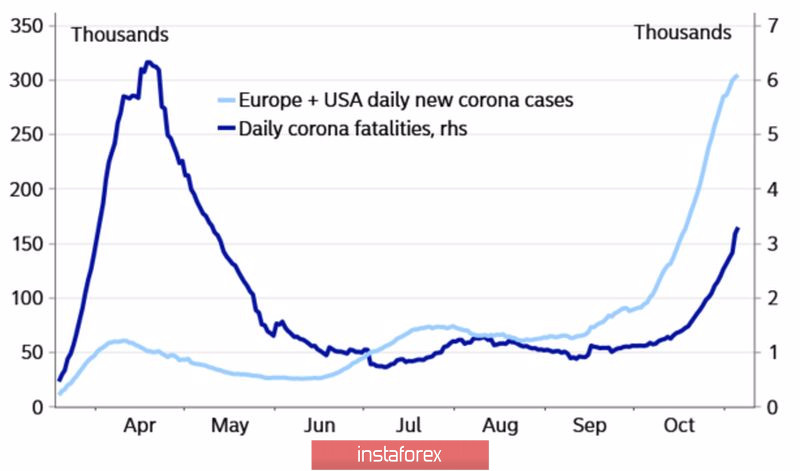

Dynamics of infected and deaths from COVID-19:

It should be borne in mind that the dollar does not always go in the opposite direction to the movement of US stock indices. The rally in US stocks often supports bears on EUR / USD. Moreover, such factors as divergence in economic growth and in monetary policy play on their side. With the imposition of new social distancing restrictions by Germany, France, and other eurozone countries, the currency bloc is in danger of falling into a double recession. Goldman Sachs expects European GDP to sag by 2.3% in the fourth quarter, in line with the consensus estimate of the Financial Times experts.

In such a situation, the ECB has no opportunity to sit idly by. The central bank must do something to support the economy. At the very least, expand the program of emergency asset purchases due to the pandemic by €500 billion. The Fed, on the contrary, does not see the need for additional monetary stimulus. At a press conference following the November meeting of the FOMC, Chair Jerome Powell stressed that the program for buying bonds worth $120 billion a month is too much and noted that if the regulator had to act, it would most likely change the structure of asset acquisition.

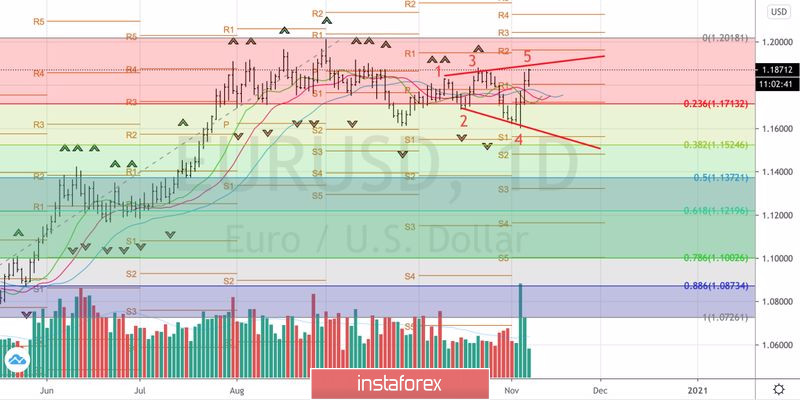

Technically, the EUR / USD clearly worked out the 5-0 pattern on the daily chart allowing us to form longs from the level of 1.164. Currently, a Broadening Wedge pattern is being formed. If the bulls manage to take the resistance at 1.188 by storm and keep the quotes above it, there is no point in getting rid of long positions. The recommendation is "hold". If you fail to gain a foothold above 1.188, it makes sense to fix part of the profit and wait for new signals.

EUR / USD daily chart:

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română