Outlook on November 6:

Analytical overview of major pairs on the H1 TF:

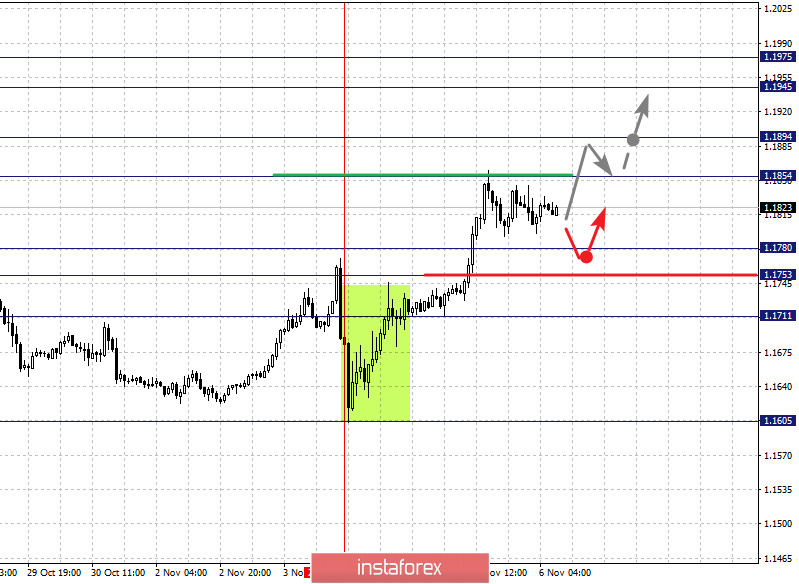

The key levels for the euro/dollar pair are 1.1975, 1.1945, 1.1894, 1.1854, 1.1780, 1.1753 and 1.1711. We are following the development of the upward pattern from November 4 here. A short-term growth is expected in the range of 1.1854 - 1.1894. If the last value breaks down, it will lead to the development of a strong movement. In this case, the potential goal is 1.1945. For the potential value for the top, we consider the level of 1.1975. Price consolidation and downward pullback are expected upon reaching this level.

A short-term decline is expected in the range of 1.1780 - 1.1753. If the last value breaks down, it will lead to a deep correction. Here, the goal is 1.1711, which is a key support for the top.

The main trend is the upward structure from November 4

Trading recommendations:

Buy: 1.1855 Take profit: 1.1892

Buy: 1.1895 Take profit: 1.1945

Sell: 1.1780 Take profit: 1.1754

Sell: 1.1751 Take profit: 1.1713

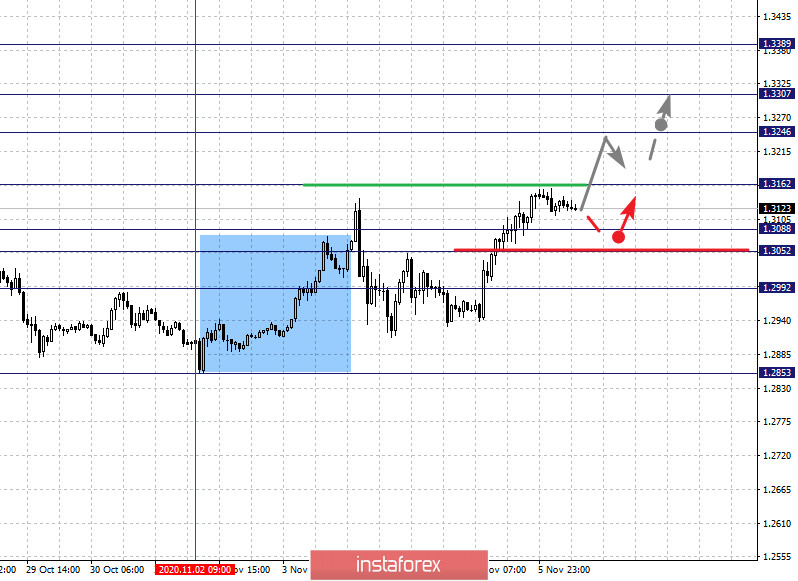

The key levels for the pound/dollar pair are 1.3389, 1.3307, 1.3246, 1.3162, 1.3088, 1.3052 and 1.2992. Here, we are following the formation of the rising pattern from November 2. The pair here is expected to continue rising after the level of 1.3162 breaks down. In this case, the goal is 1.3246. On the other hand, there is a short-term growth and consolidation in the range of 1.3246 - 1.3307. For the potential value for the top, we consider the level of 1.3389. Upon reaching which, a downward pullback is expected.

A short-term decline is expected in the range of 1.3088 - 1.3052. In case of breaking through the last value, it will lead to a deep correction. The target here is 1.2992, which is a key support for the top.

The main trend is the formation of an upward potential from November 2

Trading recommendations:

Buy: 1.3162 Take profit: 1.3244

Buy: 1.3247 Take profit: 1.3306

Sell: 1.3088 Take profit: 1.3053

Sell: 1.3050 Take profit: 1.2994

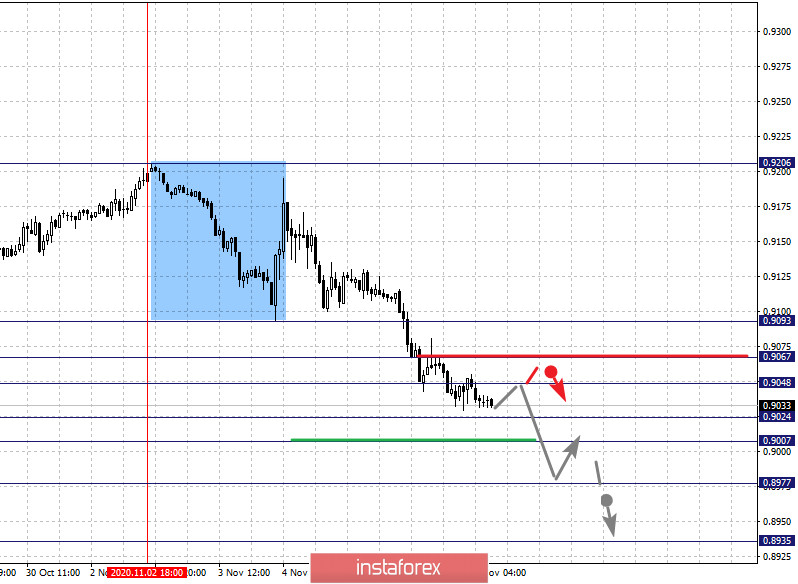

The key levels for the dollar/franc pair are 0.9093, 0.9067, 0.9048, 0.9024, 0.9007, 0.8977 and 0.8935. The formation of the descending structure from November 2 is being monitored. Here, the decline is expected to continue after the price passes the noise range of 0.9024 - 0.9007. In this case, the target is 0.8977 and there is consolidation near this level. For the potential value for the bottom, we have the level of 0.8935. Upon reaching which, an upward pullback is expected.

A short-term upward movement is possible in the range of 0.9048 - 0.9067 and breaking through the last value will lead to a deep correction. The goal here is 0.9093, which is the key support for the downward structure.

The main trend is the descending structure from November 2

Trading recommendations:

Buy : 0.9048 Take profit: 0.9066

Buy : 0.9068 Take profit: 0.9093

Sell: 0.9024 Take profit: 0.9008

Sell: 0.9005 Take profit: 0.8978

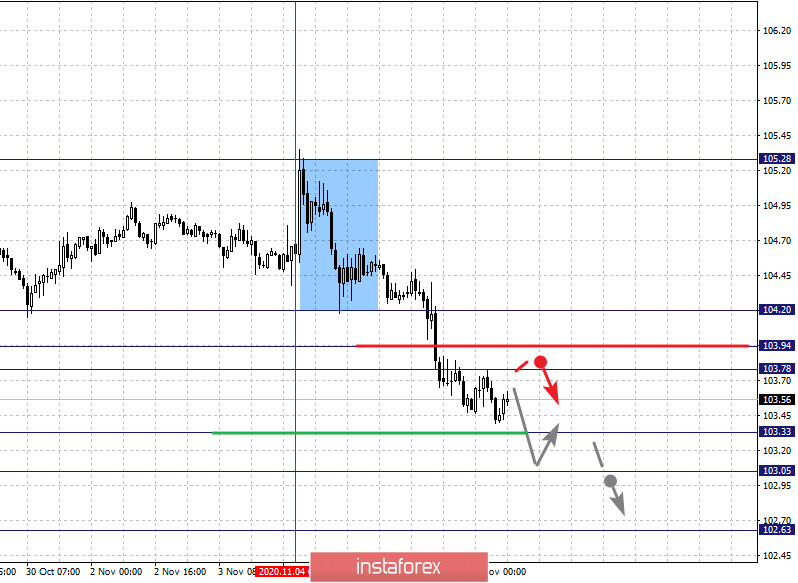

The key levels for the dollar/yen are 104.20, 103.94, 103.78, 103.33, 103.05 and 102.63. The development of the descending pattern from November 4 is being followed here. Now, the decline is expected to continue after breaking through the level of 103.33. In this case, the goal is 103.05. Price consolidation, in turn, is near this level. If the goal breaks down, it will lead to a strong decline. Here, the potential target is 102.63.

A short-term rise is likely in the range of 103.78 - 103.94. In case that the last value breaks down, it will lead to a deep correction. The goal is 104.20, which is the key support for the downward structure.

The main trend is the downward trend from November 4

Trading recommendations:

Buy: 103.78 Take profit: 103.93

Buy : 103.96 Take profit: 104.20

Sell: 103.33 Take profit: 103.07

Sell: 103.03 Take profit: 102.65

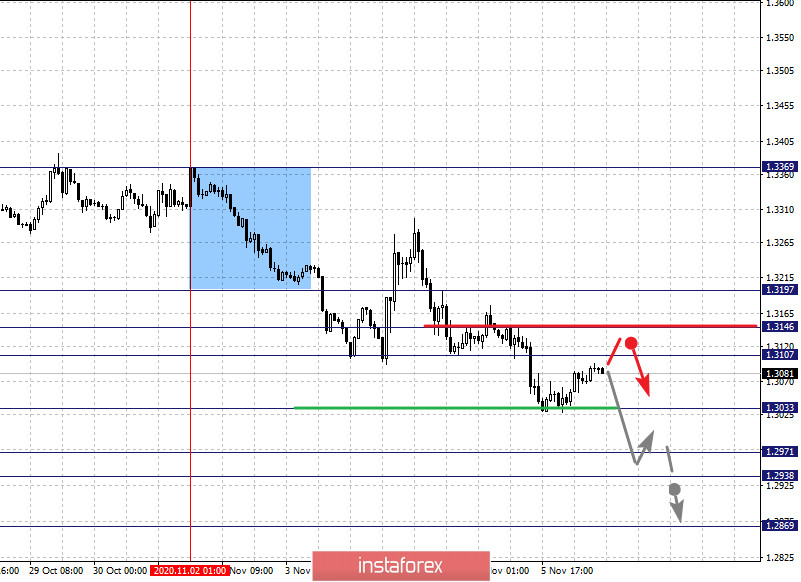

The key levels for the USD/CAD pair are 1.3197, 1.3146, 1.3107, 1.3033, 1.2971, 1.2938 and 1.2869. Here, we are following the development of the descending structure from November 2. The pair is expected to decline after the level of 1.3033 breaks down. In this case, the goal is 1.2971. On the other hand, there is a short-term decline and consolidation in the range of 1.2971 - 1.2938. As a potential value for the bottom, we consider the level 1.2869. Upon reaching which, an upward pullback is possible.

In turn, a short-term growth is possible in the range of 1.3107 - 1.3146, breaking through the last value will lead to a deep correction. The goal here is 1.3197, which is a key support for the downward structure.

The main trend is the descending structure from November 2

Trading recommendations:

Buy: 1.3107 Take profit: 1.3144

Buy : 1.3147 Take profit: 1.3195

Sell: 1.3031 Take profit: 1.2971

Sell: 1.2936 Take profit: 1.2873

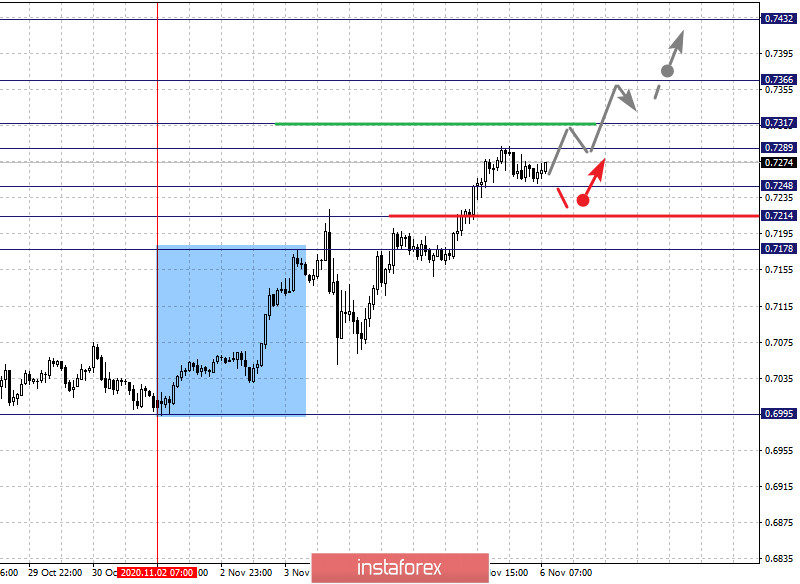

The key levels for the AUD/USD pair are 0.7432, 0.7366, 0.7317, 0.7289, 0.7248, 0.7214 and 0.7178. We continue to monitor the formation of the rising pattern from November 2. Now, a short-term rise is expected in the range of 0.7289 - 0.7317. If the last value breaks down, it will lead to a strong rise. Here, the target is 0.7366 and price consolidation is near this level. For the potential value for the top, we consider the level 0.7432. A downward pullback is likely upon reaching this level.

A short-term decline, in turn, is expected in the range of 0.7248 - 0.7214. If the last value breaks down, a deep correction will occur. Here, the target is 0.7178, which is the key support for the top.

The main trend is the upward cycle from November 2

Trading recommendations:

Buy: 0.7289 Take profit: 0.7317

Buy: 0.7319 Take profit: 0.7365

Sell : 0.7246 Take profit : 0.7216

Sell: 0.7212 Take profit: 0.7180

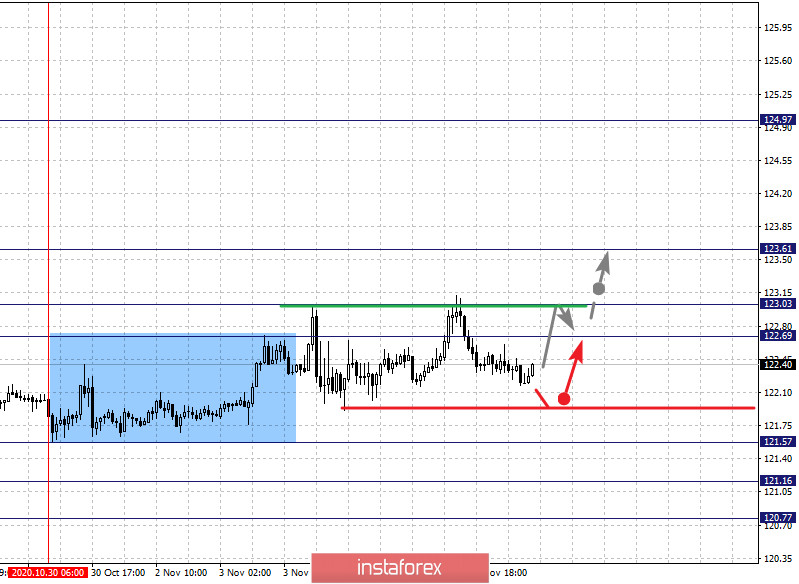

The key levels for the euro/yen pair are 123.61, 123.03, 122.69, 121.57, 121.16 and 120.77. The development of the downward trend cycle from October 20 is being followed here and the price is also forming a potential for the October 30 high. At the moment, a short-term increase is possible in the range of 122.69 - 123.03. In case that the last value breaks down, it will lead to the development of an upward structure from October 30. In this case, the goal is 123.60.

On the other hand, we expect the decline to continue after the breakdown of 121.57. In this case, the target is 121.16. For the potential value for the bottom, we consider the level of 120.77. Upon reaching which, price consolidation and upward pullback is possible.

The main trend is the downward cycle from October 20, the correction stage

Trading recommendations:

Buy: 122.70 Take profit: 123.02

Buy: 123.05 Take profit: 123.60

Sell: 121.55 Take profit: 121.18

Sell: 121.14 Take profit: 120.80

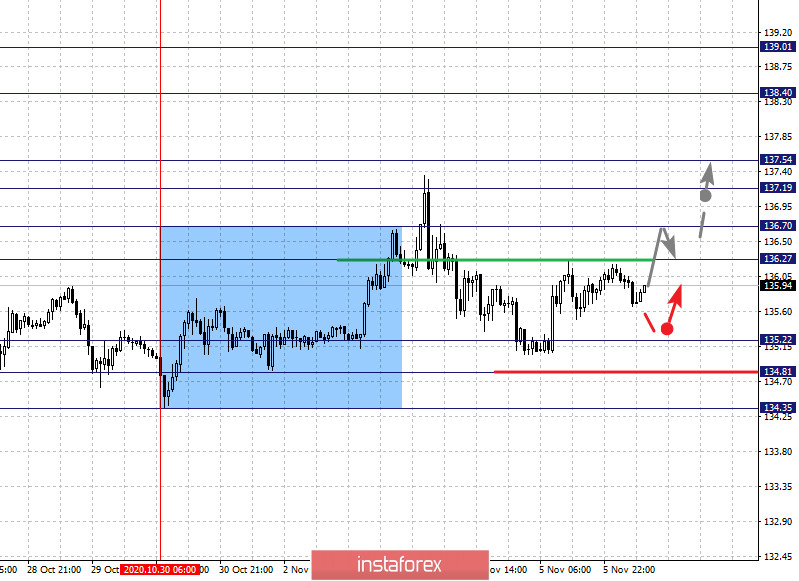

The key levels for the pound/yen pair are 139.01, 138.40. 137.54, 137.19, 136.70, 136.27, 135.22, 134.81 and 134.35. Here, we follow the formation of the potential for the top from October 30. A short-term growth is possible in the range of 136.27 - 136.70. Now, we expect the upward trend to continue after the level of 136.70 breakdown. In this case, the target is 137.19. On the other hand, there is a short-term rise and consolidation in the range of 137.19 - 137.54. If the level of 137.55 breaks down, it will lead to a strong growth. The target here is 138.40. As a potential value for the top, we consider the level of 139.01. Upon reaching which, price consolidation and downward pullback is possible.

A short-term decline is possible in the range of 135.22 - 134.81. If the last value breaks down, it will lead to the development of a downward trend. In this case, the goal is 134.35.

The main trend is the upward structure from October 30

Trading recommendations:

Buy: 136.27 Take profit: 136.68

Buy: 136.72 Take profit: 137.19

Sell: 135.20 Take profit: 134.81

Sell: 134.78 Take profit: 134.35

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română