Crypto Industry News:

The Russian Ministry of Finance raised the stakes in a protracted game with the country's central bank, formally presenting a law that proposes to regulate - rather than ban - digital assets.

The ministry presented the government with a draft federal law "On digital currency". As justification for the initiative, the Ministry of Finance referred to "the creation of a legal market for digital currencies together with the definition of the rules of their circulation and the scope of participants". Stressing that the bill does not intend to make digital currencies legal tender, its authors define cryptocurrencies as an investment vehicle.

The project proposes a platform licensing system to facilitate the circulation of digital assets and sets out the prudential, risk management, data privacy and reporting requirements that such operators would be subject to. It would only be possible to legally buy and sell cryptocurrencies through your bank account and it is proposed that both crypto platforms and banks implement KYC procedures.

The regulations also require digital asset operators to inform retail clients about the risks associated with cryptocurrency trading. Individuals would have to pass a test to assess their knowledge of cryptocurrency investing practices and awareness of the risks. Those who passed the test would be subject to an annual investment cap of 600,000 rubles (approximately $7,900), and those who failed the test could only invest up to 50,000 rubles ($650) per year. Firms and eligible investors are to be exempted from annual limits.

In addition, the project introduces a formal definition of cryptocurrency mining and defines a mechanism by which cryptocurrency market participants can report their activities to the tax authorities.

Technical Market Outlook

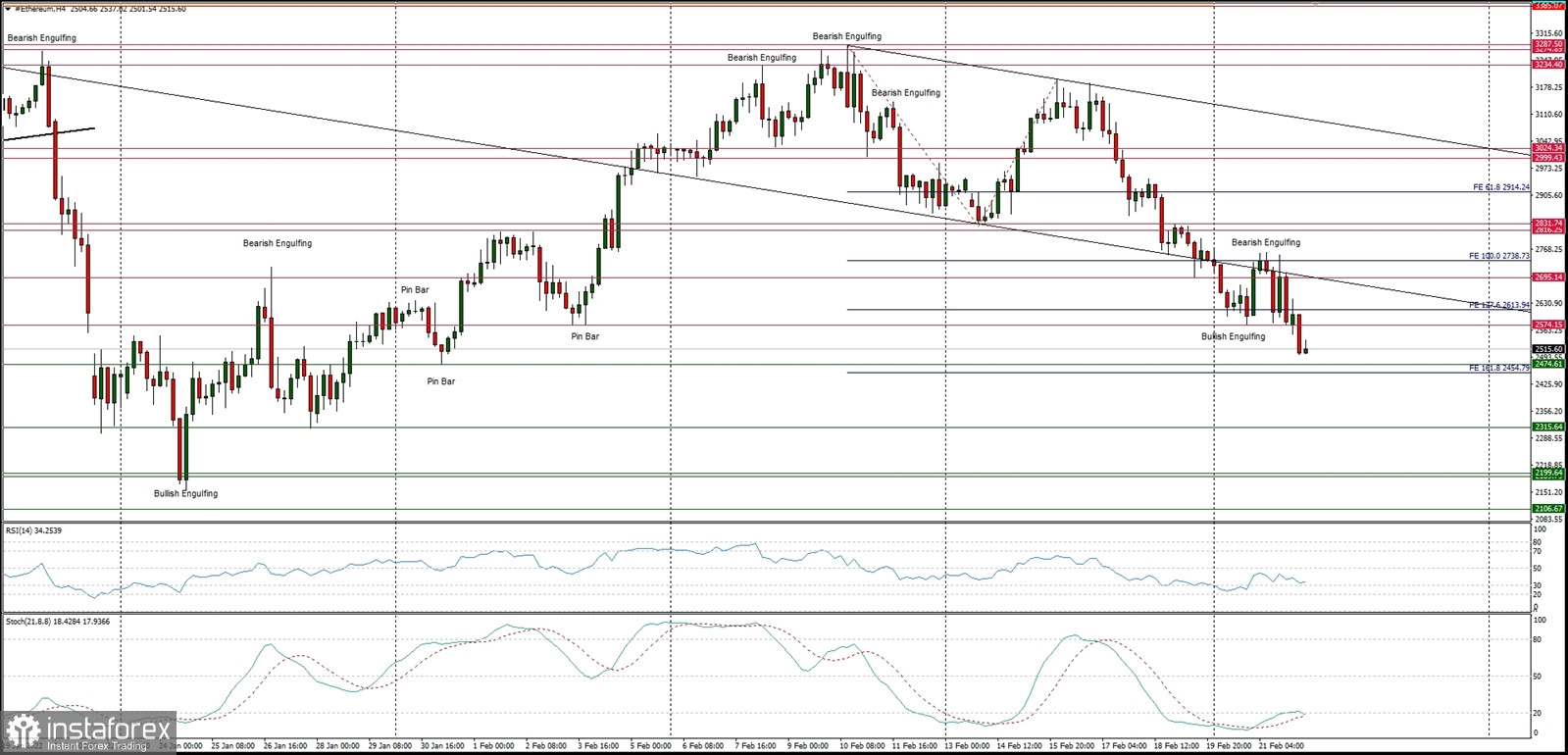

The ETH/USD pair has broken below the technical support located at $2,574 and is approaching the 161% Fibonacci extension level seen at $2,454. The down move continues after the breakout from the descending channel and the negative test of the channel. The nearest technical resistance is located at the level of $2,574 and $2,695. The momentum remains weak and negative, which support the short-term bearish outlook for ETH.

Weekly Pivot Points:

WR3 - $3,521

WR2 - $3,347

WR1 - $2,888

Weekly Pivot - $2,742

WS1 - $2,272

WS2 - $2,129

WS3 - $1,665

Trading Outlook:

The market is bouncing after over the 50% retracement made since the ATH at the level of $4,868 was made. The level of $3,436 is the next key technical resistance for bulls. On the other hand, the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română