The last week of October was the worst for oil since April. The rise in the number of COVID-19 cases to record highs in Europe and the imposition of restrictions by Germany, France, and other countries of the Eurozone seriously scared Brent and WTI and led to a drop in futures prices to a 5-month low. The strong dollar and the increase in OPEC production did not add optimism to fans of black gold against the background of political uncertainty in the US. However, the bulls seemed to have found their trump cards.

Goldman Sachs estimates that new social distancing measures in Britain, Germany, France, Belgium, and other European countries will reduce global demand for black gold by about 2% to levels seen in May when the Eurozone lifted the lockdown. Trafigura Group predicts that the rapid spread of COVID-19 across the globe is fraught with a reduction in global oil demand to 88-89 million b/d, which is 11-12% lower than in 2019. At the same time, traders are seriously concerned that an additional 2 million b / d production from OPEC + will seriously worsen market conditions. Starting January 1, 2021, the organization intends to reduce the volume of reductions from 7.7 million b / d to 5.7 million b / d.

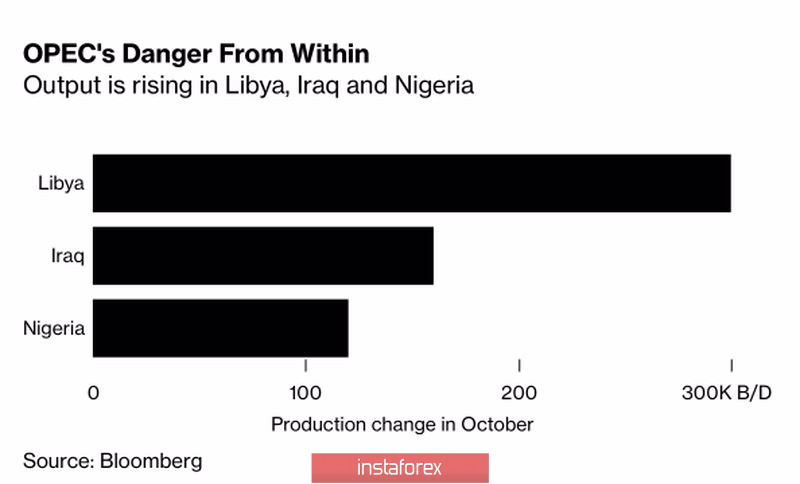

The cartel is upsetting the Brent and WTI bulls by their reluctance to comply with current regulations. According to Bloomberg research based on tanker tracking data, OPEC production in October increased by 470,000 b/d to 24.74 million b/d due to Libya being spared to fulfill its obligations, as well as due to Iraq and Nigeria's unwillingness to fulfill the terms of the agreement.

OPEC production increase in October:

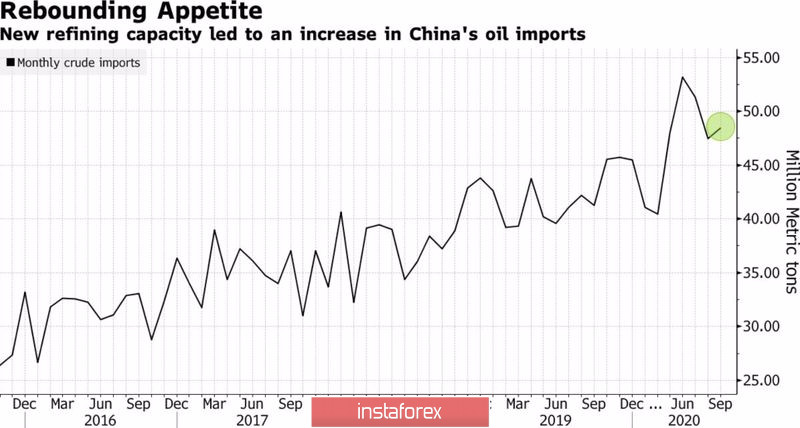

Reduced global demand and increased production by OPEC create a serious headwind for the bulls on Brent and WTI. However, there is some good news. Russia is discussing with its own producers the possibility of retaining the previous restrictions on production after January 1, which gives hope that OPEC + will also make such an important decision for the entire market. China increases the import quota for black gold by 20%, which is equivalent to 823,000 b/d, or the entire volume of oil production in Algeria. China is satisfied with current prices, it has successfully coped with COVID-19, and the IMF expects its GDP to expand by 1.9% in 2020, while the economies of the lion's share of the world's countries are likely to contract. Why shouldn't Beijing increase purchases of black gold in such conditions?

Dynamics of Chinese oil imports:

The US dollar's response to the November 3 election results is an important factor for Brent and WTI. The Blue Wave will increase the likelihood of a rally in the S&P 500 amid hopes for additional fiscal stimulus, which will improve global risk appetite and push the USD index down. Joe Biden's victory and Republican control over the Senate will keep the uncertainty behind the USD.

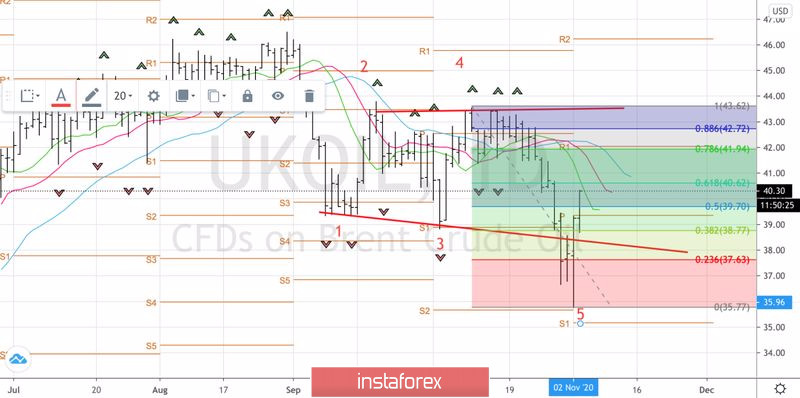

Technically, an Expanding Wedge pattern has been formed on the daily Brent chart. A return of quotes to resistances near the Fibonacci levels at 78.6% and 88.6%, corresponding to $41.95 and $42.7 per barrel, with their subsequent successful test will allow opening longs. On the contrary, the return of the North Sea variety to the supports at $38.75 and $37.65 with a close below these levels is a signal for selling.

Brent daily chart:

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română