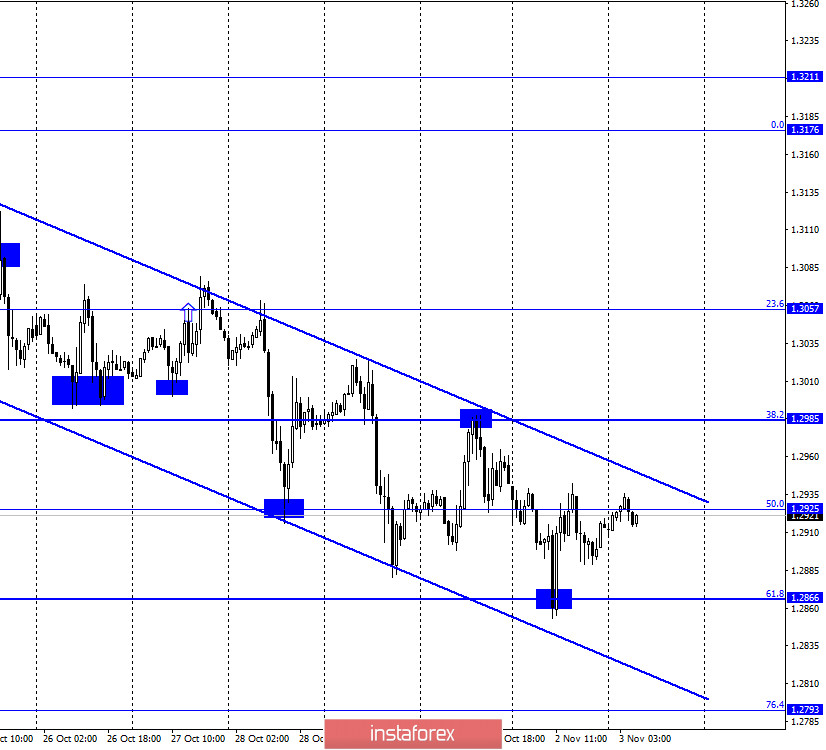

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair fell to the corrective level of 61.8% (1.2866), rebounded from it, and rose to the upper border of the downward trend corridor. A rebound of the pair's quotes from this line will work in favor of the US currency and resume falling towards the corrective levels of 61.8% and 76.4%. However, today it is impossible to predict the movement of the pair. The pair can go several hundred points in any direction today, and the reason for this movement can only be the elections in America, which will begin in the afternoon (early in the morning in the United States). Meanwhile, the UK is completely quiet and smooth. The country has gone on a second "lockdown", thus, most British citizens stay at home and go only to the store, work or study. It is the coronavirus that is now the biggest problem for Britons, the country, and the British economy. We need to reduce the number of cases as quickly as possible to return to normal life as soon as possible (in the context of a global pandemic). So far, 24-25 thousand cases of infection continue to be recorded every day in Britain. Indicators do not decrease. As for the Brexit negotiations, which are generally unclear whether they are continuing in London or have already ended, but the heads of the negotiating groups forgot to report the results to the press, there is no information. The next stage of negotiations was supposed to end last week, however, the parties did not announce a new extension of the deadline and did not announce the end.

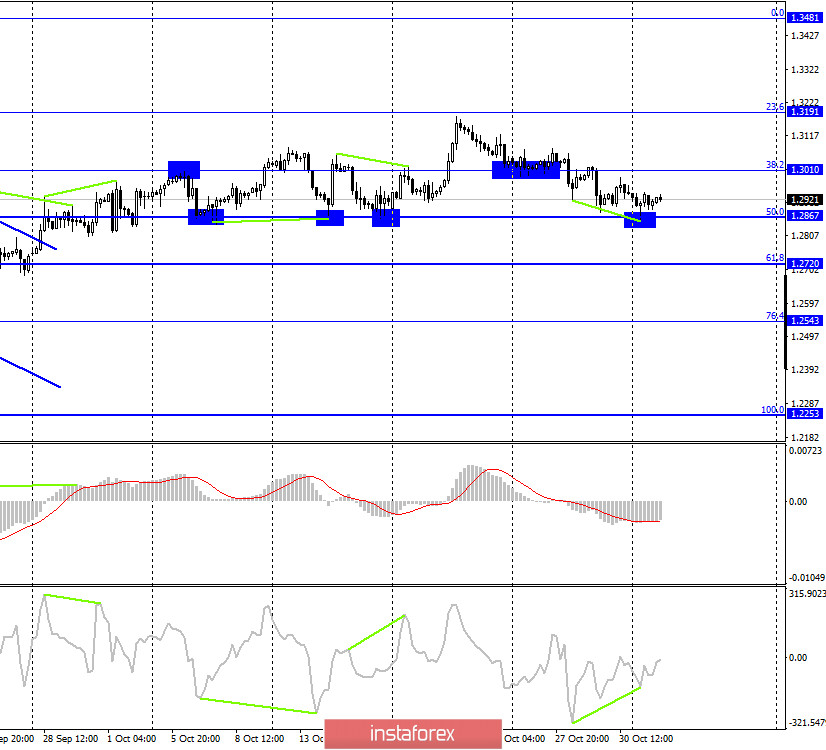

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair fell to the corrective level of 50.0% (1.2867). Rebound from it allows traders to count on a reversal in favor of the British currency and some growth in the direction of the Fibo level of 38.2% (1.3010). The bullish divergence of the CCI indicator also worked in favor of the beginning of the growth of quotes. Fixing the pair's exchange rate below the level of 50.0% will work in favor of the US currency and resume falling in the direction of the corrective level of 61.8% (1.2720).

GBP/USD – Daily.

On the daily chart, the pair's quotes have consolidated below the corrective level of 76.4% (1.3016), which now allows us to expect a fall in the direction of the next corrective level of 61.8% (1.2709).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downtrend line, so a false breakout of this line followed earlier. However, in recent weeks, the pair has made new attempts to gain a foothold over both trend lines.

Overview of fundamentals:

On Monday in the UK, the index of business activity in the manufacturing sector was higher, which exceeded the expectations of traders but did not cause any reaction. There was also still no official information about the progress of negotiations between the UK and the European Union.

News calendar for the US and the UK:

On November 3, the UK news calendar is empty, so traders will be closely monitoring the US election, and also hoping for information about the negotiations on the trade agreement from London.

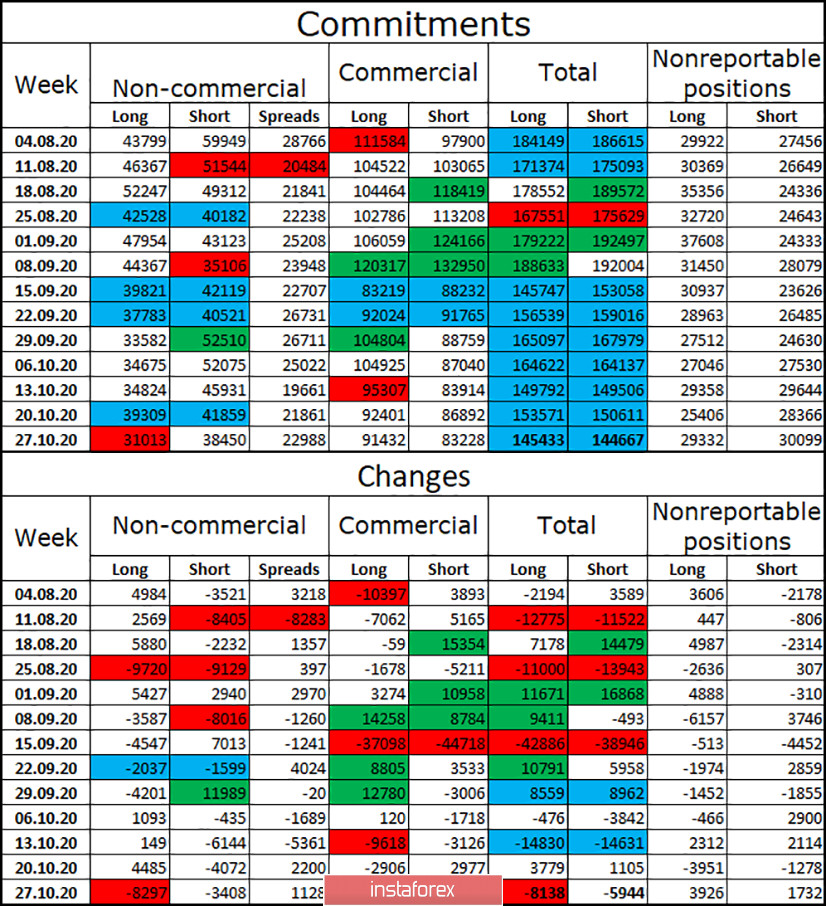

COT (Commitments of Traders) report:

The latest COT report on the British pound showed that the mood of the "Non-commercial" category of traders became more "bearish" over the reporting week. Speculators got rid of 8,297 long contracts and 3,408 short contracts. Thus, in general, speculators got rid of any contracts for the British. However, it is mostly from long contracts. This suggests that the major players do not believe in the pound. It is extremely difficult to do this in the current conditions, as the prospects for the British economy remain extremely vague. Since August, the total number of long contracts in the hands of speculators has decreased to an absolute minimum – only 31,013. The total number of open contracts among all categories of traders has been almost the same for two months.

Forecast for GBP/USD and recommendations for traders:

Today, I recommend selling the GBP/USD pair with targets of 1.2866 and 1.2793, if a rebound is made from the upper border of the descending corridor. I recommend buying the British dollar with the goals of 1.2985 and 1.3057 if the consolidation above the corridor on the hourly chart is completed.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română