In yesterday's trading, in the absence of significant macroeconomic statistics, market participants focused their attention on the presidential elections in the United States of America, which will be held today. Investors are cautious and do not want to risk operations because of the high probability that the election will be contested and the candidates will not recognize their results. Let me remind you that according to public opinion polls, the candidate from the Democratic Party of the United States, Joe Biden, has an advantage over the current head of the White House, Republican Trump. Nevertheless, knowing the obstinate nature and demeanor of the 45th US President, it is highly likely that if Biden wins, Trump will insist on fraud and urge Americans not to recognize the results of the vote. The situation is aggravated by the fact that due to the use of postal voting, the final election results may be delayed for 5-7 days. Regarding election statements, Biden promises US citizens victory over COVID-19, which is very frivolous and smacks of rotten populism. Trump at the last election speeches convinced everyone that he will win because he wins everywhere and always.

Meanwhile, American gun stores are doing a brisk trade, and shopkeepers in New York and other major cities are preparing wooden shutters for their windows and storefronts in case of riots and pogroms.

If we go back to the elections themselves, Trump expects to reduce the gap from his opponent Biden at the expense of undecided states. By the way, this is quite real. From an economic point of view, elections are evaluated differently. Some experts believe that Biden's victory will lead to a risky mood on global financial markets, however, this euphoria will not last long. Other economists believe that a second term for Donald Trump will carry more certainty for the world's leading economy, which is crucial. In general, the election of the American President will be a hot battle, and the markets will experience increased volatility.

Against the backdrop of the US presidential election, today's data on manufacturing orders in America is likely to remain unnoticed by market participants. But the extended meeting of the Federal Reserve System (FRS), the results of which will be announced on Thursday, at 20:00 (London time), and the press conference of the head of this department, Jerome Powell, at 20:30 London time, will certainly be taken very seriously by market participants. The same can be said about the data on the US labor market, which will be published on Friday, at 14:30 (London time).

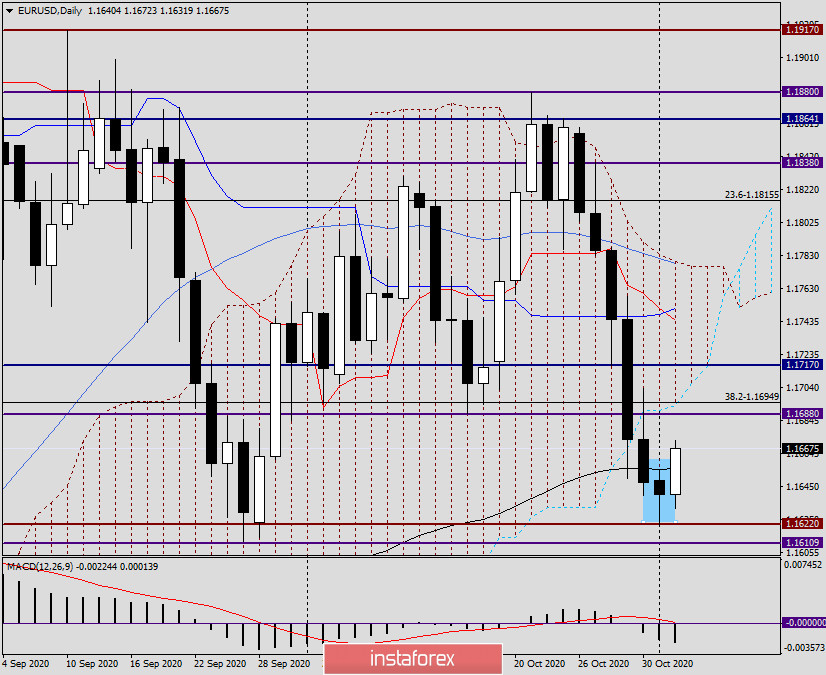

Daily

Moving on to the technical picture for the main currency pair of the Forex market, we can't help but pay attention to yesterday's candle, which formed with a long lower shadow, which touched the support around 1.1620. Most often, after the appearance of such candles, the quote increases, which is observed at the end of the article. However, in connection with the US elections, it is very difficult to assume what will be the outcome of today's auction. The reaction of market participants can be different and very unpredictable. Nevertheless, according to the technical picture, it is quite possible to assume the growth of EUR/USD, the goals of which may be the area of 1.1688-1.1717, that is, both broken support levels. If this happens, we will see a technical pullback to the previously broken levels, after which we can prepare for sales. In case of consolidation above 1.1717, the breakdown of both support levels will be considered false, and this will give grounds to expect further strengthening of the exchange rate.

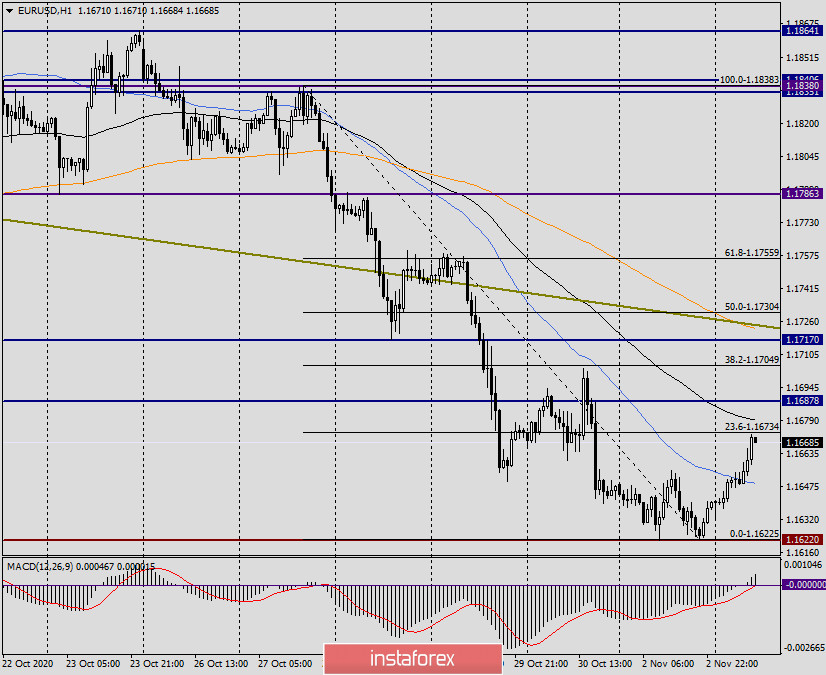

H1

On the hourly chart, the bullish divergence of the MACD indicator was defused, but the pair have already overcome the 50 simple moving average and continues to correct. On days like today, giving specific trading recommendations is like flipping a coin. If you rely solely on the technical component, then after adjusting to the area of 1.1680-1.1720 and the appearance of reversal candle signals there, you should try to sell EUR/USD. At least this positioning is based on the current downward trend and after a rollback to the landmark level of 1.1700, which has long been strong support.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română