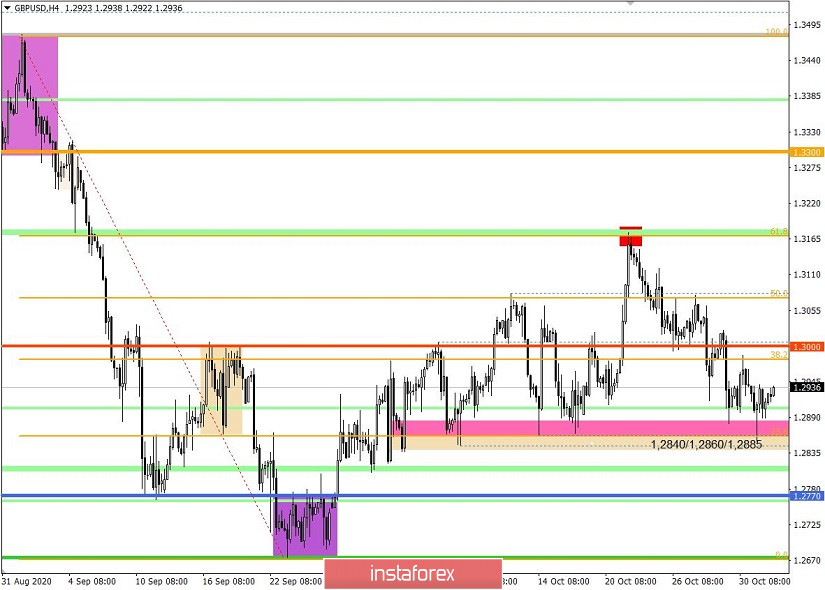

The GBP/USD pair managed to reach the interaction area of trade forces 1.2840 // 1.2860 // 1.2885 yesterday. This resulted in a stop, followed by a price rebound above the level of 1.2900. In fact, we are faced with a logical basis that has been pursuing the interaction area of trade forces for a long time.

The overall market sentiment is still inclined to a downward trend, but in order to increase the volume of short positions, the quote needs to be consolidated below the level of 1.2840. Otherwise, the quote will continue to repeat the natural basis of the rebound.

If we look at the fifteen-minute TF, we can see that there was a formation of V-shaped in the period 02:00-12:00 UTC+00, where the interaction area was affected. But as a result, there was a complete recovery

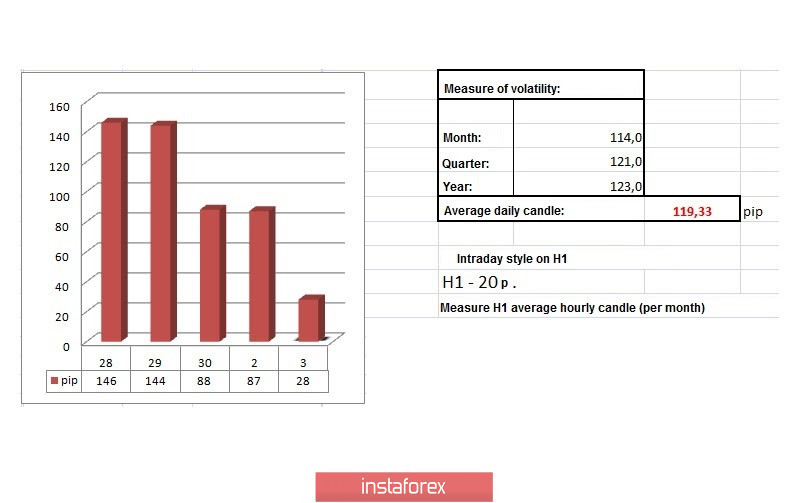

In terms of yesterday's daily dynamics, a low figure of 87 points is recorded, which is 27% below the average. The slowdown is due to a decline in trading volumes and pending positions among many traders.

It was previously discussed that traders are ready to further increase the volume of short positions, but only if price consolidates below the level of 1.2840 in the four-hour TF.

Looking at the trading chart in general terms (daily period), you can see that the pound has weakened by about 300 points in two weeks, which is not so much compared with the scale of the medium-term upward trend.

On another note, yesterday's news background only includes the index of business activity in the manufacturing sector of the United States, which is not much interesting for those who are focusing their attention on hot topics such as COVID and the US presidential election.

For the information background, special attention will be focused on hot topics, ignoring all the statistics to be released. Today is voting day in the US, which means that investors will wait for the first results, after which there will be speculative price surges.

If Biden wins, the US currency will decline, but if Trump leads, the same currency will strengthen.

Further development

Analyzing the current trading chart, a variable gap can be seen within the levels of 1.2885/1.2940, where market participants make it clear that the downward interest is still relevant, but a break is needed, probably from voting day.

In case of a sharp decline in trading volumes, the stagnation may extend throughout the day and there will be a surge in activity during the Asian session on November 4, depending on who wins the presidential election.

The overall downward trend may be adjusted locally amid high speculation.

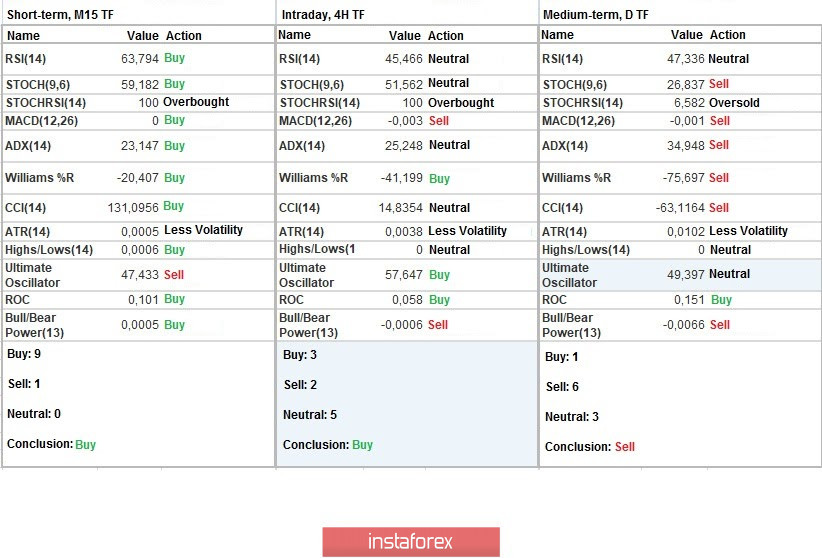

Indicator analysis

Analyzing different sectors of time frames (TF), we see that the technical indicators on minute and hourly TF have a buy signal due to the price rebound from the area of interaction of trading forces. The daily TF, in turn, signals a sell through a two-week downward trend.

Weekly volatility / Volatility measurement: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated per Month / Quarter / Year.

The dynamics of the current time is 28 points, which is obviously considered a very low value. Volatility may still accelerate by 1-2 times, but the pressure from the election will remain in the market.

Key levels

Resistance zones: 1.3000 ***; 1.3200; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support zones: 1.2840/1.2860/1.2885; 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411).

* Periodic level

** Range level

*** Psychological level

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română