The market has clearly taken a wait-and-see attitude, and investors do not intend to take risks until the preliminary results of the presidential elections in the United States are known. The single European currency did not move at all. The caution of market participants is quite justified, since the overwhelming majority of opinion polls predict the victory of Joseph Biden, and investors do not understand what to expect from him. The fact is that during the pre-election race, both candidates were engaged only in the exchange of mutual accusations in all imaginable and inconceivable crimes, but they did not discuss economic issues. As a result, investors have absolutely no idea what to expect. And uncertainty scares investors the most. This was noticeable in the steady weakening of the dollar and the decline in stock market indices, which were taking place at the time of publication of such opinion polls. But with Donald Trump, everything is relatively clear, since he did not need to talk about the economy. If he wins, he will continue the same policy, which is relatively understandable. At the same time, its effectiveness is confirmed by the results that were observed in 2019. Take note that the unemployment rate in the United States fell to the lowest ever values in 2019. Therefore, it is quite possible to assume that in the event of Joe Biden's victory, the euro will demonstrate steady growth. And it will decline only if Donald Trump wins. But today the market will stand still. Everyone is waiting for the vote count. Some kind of revival in the markets will begin only after the closing of polling stations.

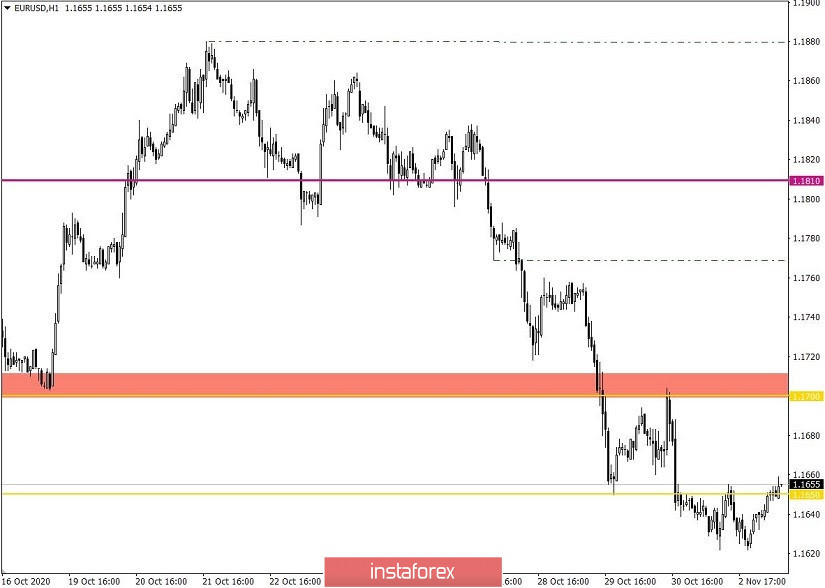

After an intense downward movement, the euro/dollar pair found a pivot point within the value of 1.1620, where a stop occurred, followed by a magnitude of 30 points. In fact, there is a high degree of ambiguity in the market, which entails a decrease in trade volumes.

If we proceed from the quote's current position, then the same stagnation will be seen, where the quote is trying to correct, but in the end it only manages to fluctuate within the boundaries of 1.1620/1.1660.

A decrease in trading volumes is recorded in relation to market dynamics, which leads to low volatility in the market.

Looking at the trading chart in general terms (daily period), one can see that the price returns to the local low on September 25, which signals the restoration of the downward cycle set in the first half of September.

We can assume that due to the US presidential elections, we will see a temporary ambiguity in actions, which will be expressed in the subsequent price fluctuations in stagnation at 1.1620/1.1660. The main surge in activity will occur during the Asian session of the next day.

From the point of view of a comprehensive indicator analysis, we see that the indicators of technical instruments on the hourly and daily periods indicate a sell signal due to the price convergence with the local low on September 25.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română