All efforts that were made these previous months to ensure that the economy would recover may end up in vain, especially now that the euro region has again implemented quarantine restrictions to curb the returning coronavirus pandemic.

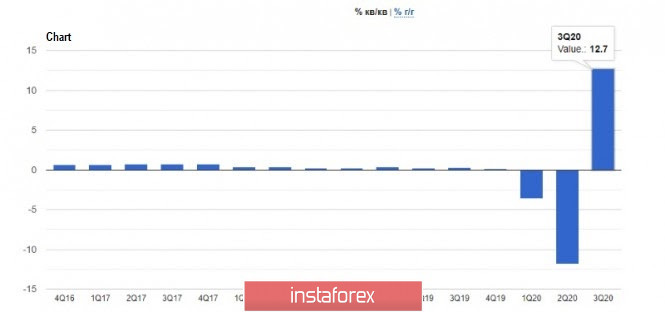

In fact, the eurozone economy has grown much better than expected this 3rd quarter, even surpassing that of the US economy. According to some experts, this is maybe due to what we call "the rebound effect", since the bloc faced a stronger decline than the United States in the second quarter.

Now, given the fact that many European countries have brought back restrictions to stop the further spread of the coronavirus, the prospects for the 4th quarter have taken a different direction. If in the 3rd quarter, the EU's GDP grew by 12.7%, a strong decline is expected to occur in the 4th quarter, mainly because of the serious threat the restrictions pose on the service and manufacturing industries.

For example, Germany's GDP in the 3rd quarter increased by 8.2% compared to the 2nd quarter. But now that the country has implemented new restrictive measures, it will be impossible to see such growth rates again in the 4th quarter. So far, these new restrictions are bypassing industries, and today's data on economic activity will prove this. A one-month closure will not give serious damage (especially since the government promised a maximum support on businesses), however, a long-term implementation will become a serious problem for the entire economy.

Another case is Italy's economy during the pandemic, which contracted sharply as well in the 2nd quarter, but rebounded strongly in the 3rd quarter. According to a report, Italy's GDP grew by 16.1% in Q3, while economists had expected it to grow by only 10.6%. As for the revised data, Italy's GDP dropped by 13% in Q2, not by 12.4% as previously thought. Compared to the same period last year, Italy's economy contracted by 4.7%, not 10.2%, as predicted by economists.

With regards to the United States, all focus is on the presidential elections, on which a lot depends. Joe Biden's victory could turn everything around, but the problems with the coronavirus pandemic remain a priority.

In addition, the slowdown in the Chicago PMI does not pose a serious threat yet, but nonetheless is the first call for the economy. According to the MNI Indicators, the index fell from 62.4 points to 61.1 points in October, while economists had expected the index to be 57.9 points.

As for the consumer sentiment index, an increase was observed, as indicated by the report released by University of Michigan. According to data, the index rose from 80.4 points to 81.8 points in October, while economists had expected a value of only 81.2 points. Unfortunately, some experts say that the lack of fear among the respondents could have created a deceptive sense of stability in consumer sentiment, especially since the consumer expectations index rose from 75.5 to 79.2 despite the current stubborn rise of the coronavirus in the country.

Nonetheless, personal incomes of Americans have increased, which will positively affect the economy in the 4th quarter of this year. According to the data, revenues rose 0.9% in September this year, along which household spending jumped more significantly. It rose 1.4% in September, while economists had forecasted an increase of only 1%.

With all these, the technical picture of the EUR/USD pair indicates that the market completely ignores the oversold euro and continues to decline against the background of lack of activity from new investors, which is reflected in the COT reports submitted to the CME. As shown by the data on October 27, there was a reduction in both long and short positions. Long non-commercial positions fell to 217,443, while short non-commercial positions fell to 61,888. The total non-commercial net position fell to 155,555 from 165,943 a week earlier. All this speaks of a real cautious approach to risks and a lack of desire to build up long positions, which will keep the pressure on the euro in the near future.

Thus, bears will seek to break the support at 1.1615, which will make it easier to reach the levels 1.1580 and 1.1540. Sales will increase on the grounds of weak data on activity in the manufacturing sector of the eurozone, but if Joe Biden wins the US elections, demand for the dollar will significantly decrease, which will help the European currency regain its position. A return above the level of 1.1650 will make it easier to reach the 17th figure, a breakout of which will lead to price levels 1.1760 and 1.1835.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română