The end of October was a real benefit for the US dollar. Despite the rise in the number of COVID-19 cases in the US to record highs and the probable loss of Donald Trump in the presidential election, the EUR / USD quotes fell to a monthly low. The second wave of the pandemic in Europe, the imposition of severe restrictions by Germany and France, as well as the ECB's hints of expanding monetary stimulus, played into the hands of the bears on the euro.

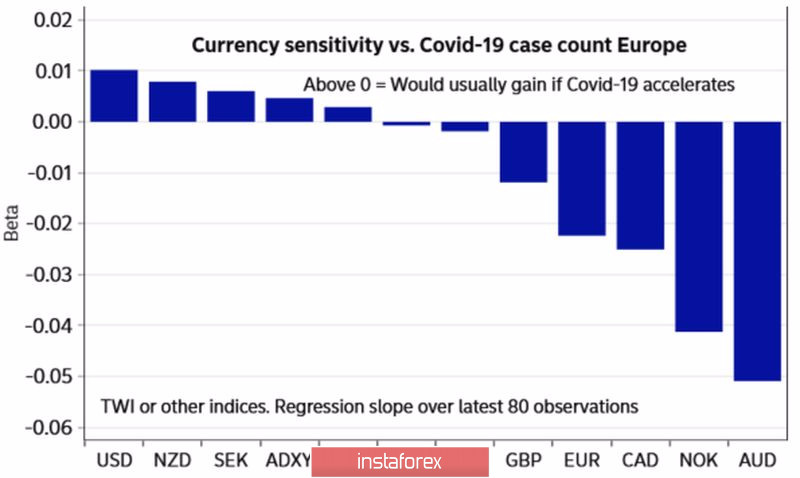

The rise in the number of COVID-19 cases in the Eurozone put the US dollar in a good purchase position. On the contrary, currencies such as the euro, loonie, aussie, and the Norwegian krone were ignored.

Reaction of G10 currencies to rising incidence of COVID-19 in Europe:

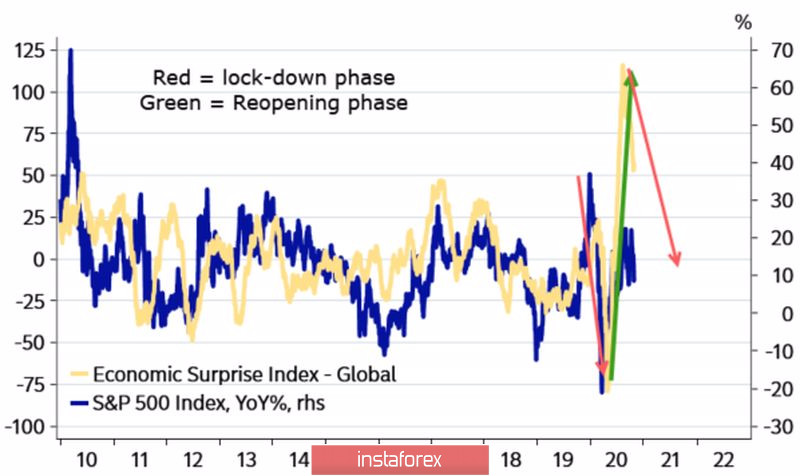

Most likely, the fourth quarter will be similar to the second, only the collapse of world stock indexes and the strengthening of the USD will not be as rapid as in the spring. I would like to believe that vaccines are on the way and the world will be able to cope with the pandemic. Currently, the global index of economic surprises is moving away from its extremes and heading downward, which creates preconditions for the development of a correctional movement in the S&P 500, a deterioration in risk appetite, and an increase in demand for safe-haven assets, particularly, the US dollar.

Dynamics of S&P 500 indexes and economic surprises:

The ECB is forced to act against the background of repeated lockdowns, the associated risks of a significant slowdown in the eurozone's GDP, and the possibility of a double recession. At a press conference following the ECB's October meeting, Christine Lagarde said that there is no reason to doubt the expansion of the monetary stimulus in December. This circumstance allows investors to sell EUR / USD due to divergence in the monetary policy of the European Central Bank and the Fed. But there are also discrepancies in economic growth and in the number of COVID-19 cases.

In this regard, the correction of the main currency pair looks logical. It is unlikely that Joe Biden's victory will lead to a restoration of the upward trend in the S&P 500: the market is too scared of repeating the history of the second quarter to buy shares at breakneck speed. It's another matter if the Fed adds monetary stimulus at its November 5 meeting, and news about vaccines and drugs for coronavirus will be positive.

History repeats itself, and often rhymes, which allows us to count on the strengthening of the euro as the epidemiological situation develops. This takes time, therefore, at the moment, there is a high probability of a corrective movement in EUR / USD. Adjustments to this plan can be made by the US presidential elections and the FOMC meeting.

Technically, the "Shark" pattern was formed on the daily chart of the main currency pair with targets at 88.6% and 113%. They correspond to the levels of 1.164 and 1.159. A pullback from supports with the closing of the test bar higher will become a signal for the formation of long positions. The euro may rise if Biden wins the November 3 elections, however, without overcoming the dynamic resistance in the form of a combination of moving averages, it is premature to expect the upward trend to recover.

EUR / USD daily chart:

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română