The main event of yesterday and the entire trading week was the scheduled meeting of the European Central Bank (ECB) on monetary policy, followed by a press conference by ECB President Christine Lagarde. As expected, there was no change in interest rates at yesterday's meeting and they remained unchanged: the main rate was at zero, the deposit rate was also kept at minus 0.5%, and the margin rate remained at 0.25%. In this regard, market participants were waiting with interest for the speech of the head of the European Central Bank to understand his next steps. The ECB has made it clear that at its next December meeting, it will go for a new easing of monetary policy. In particular, this was stated by the head of the ECB, Christine Lagarde, during her traditional press conference. The President of the European Central Bank noted the ECB's very fast and quite strong reaction to the first wave of COVID-19. Now that the situation has changed and Europe has been hit by the second wave of the pandemic, the regulator intends to respond as decisively and quickly. At the next meeting, which will be held on December 10, based on macroeconomic forecasts, additional support measures will be considered to counter the negative impact of the coronavirus epidemic on the region's economy. Increased risks force the ECB to apply additional tools, which have been repeatedly mentioned, for economic recovery and achieving inflation goals in the region of 2%. The introduction of new restrictions caused by the second wave of COVID-19 negates expectations that the Eurozone economy will return to pre-pandemic levels in 2022, and inflation will not reach its goal for a long period. Well, new realities force the European regulator to act, and on December 10, the nature of these actions will be known. However, we can already assume that the ECB will at least increase the volume of asset purchases by another 500-700 billion euros. Let me remind you that the current volume of bond purchases, calculated until mid-2021, is 1.35 trillion euros.

Another important event of yesterday and the entire trading week was the preliminary data on US GDP for the third quarter, which showed an acceleration in economic growth by 33.1%, while economists had expected a figure of 31%. This factor once again points to a gradual but steady recovery of the world's largest economy. However, it seems that difficulties are still ahead since the extent of the impact of the second wave of COVID-19 on the American economy is still unknown. Also, a new incentive program will be adopted, the volume of which is still a stumbling block in negotiations between the White House administration and Democrats from the House of Representatives. Do not discount the US presidential election, which carries the threat of uncertainty. Today is very full of macroeconomic statistics, so the closing of the week and month will be fun. You can find out more about all the events of today by looking at the economic calendar.

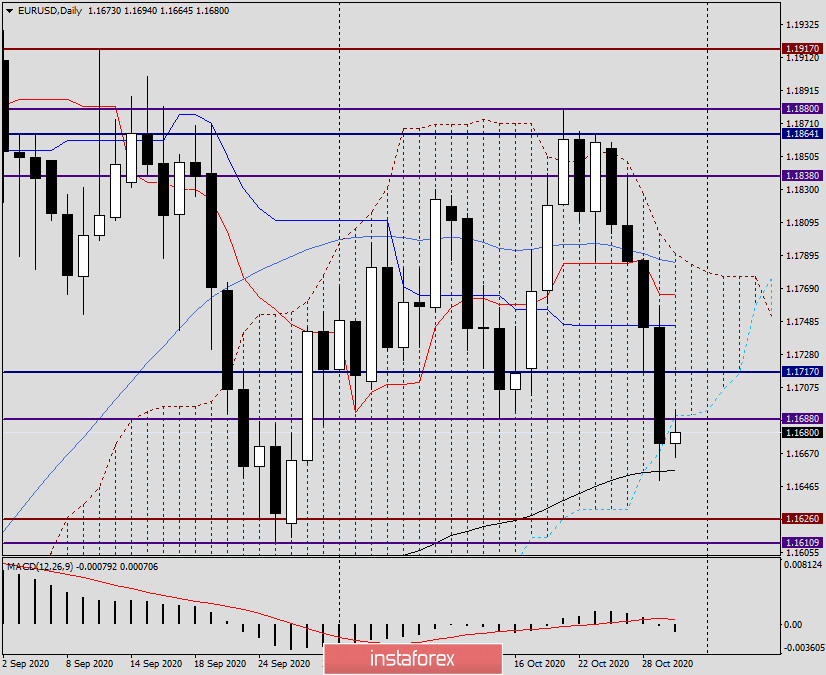

Daily

As a result of yesterday's important events, the single European currency collapsed against the US dollar. Thursday's trading on EUR/USD ended with the formation of a large bearish candle with a closing price of 1.1673. Thus, during yesterday's fall, the support levels 1.1717 and 1.1688 were broken, as well as the very important mark 1.1700. The pair were kept from further decline by the black 89 exponential moving average. Today, at the end of this article, a pullback was already given to the support level of 1.1688 broken the day before, after which the pair shows readiness to resume the downward trend. As you can see, the quote has already come down from the Ichimoku indicator cloud, and attempts to return are not yet successful. For those who want to open fresh positions today, on the last day of weekly trading, I recommend considering selling EUR/USD. Aggressive and risky from the current price of 1.1674. It is less risky to wait for a pullback to the price area of 1.1690-1.1717 and from there consider sales, which will be confirmed by the corresponding candlestick signals on the four-hour and (or) hourly timeframes. At the same time, given the closing of the month and week, I do not recommend setting large goals and closing trades today without moving open positions to Monday.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română