The recent statements from the European Central Bank hints of possible policy changes in December. To add to that, the EU economy has a high chance of showing greater growth than in the 3rd quarter, however, it does not reduce market expectations regarding the expansion of assistance programs from the ECB. New stimulus measures will directly hit the purchasing activity of the European currency, the demand for which, if not much will fall, will certainly be significantly lower than in the summer period, when everyone believed in a more active economic recovery after the pandemic.

At its meeting yesterday, the ECB gave a clear signal that, if necessary, it will adjust its stimulus measures, as well as prepare new forecasts for economic growth. ECB President Christine Lagarde, during her speech, talked a lot about the current deteriorating situation with the coronavirus, which poses a lot of threat to growth prospects. Many already see that economic recovery has started to slow down, and the short-term prospects have clearly worsened after the recent quarantine measures taken by the leading economies of the eurozone. And although Lagarde's optimism that the EU economy has regained half of what it lost in the 3rd quarter is encouraging, the significant weakening of economic activity in the 4th quarter will clearly not benefit the GDP, which by the end of the year will not be able to recover to the pre-crisis level.

In terms of future policy changes, Lagarde said that ambitious and coordinated fiscal stimulus is now critical, thus, she emphasized the importance of the recovery fund being available at the very beginning of next year. This is because the balance of risks is already shifted downward, and this requires a revision of the scale and duration of stimulus measures.

At the end of her speech, Lagarde also mentioned that she is monitoring the exchange rate of the euro very carefully, since a more active strengthening will hinder the pace of economic recovery. According to her, the central bank is ready to intervene if necessary.

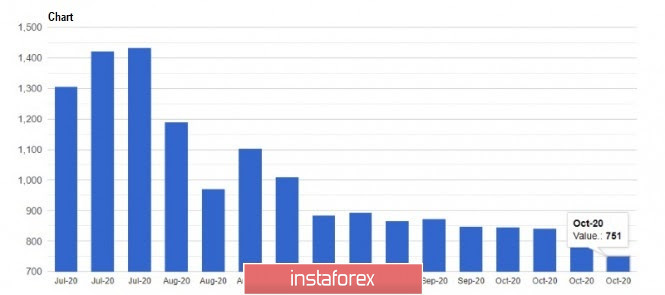

With regards to economic reports, the latest data on US jobless claims supported the dollar in rising in the markets, especially since the figures continue to improve. The recent report by the US Department of Labor said initial jobless claims for the week of October 18-24 fell by 40,000 to 751,000, the lowest record since the start of the coronavirus pandemic.

As for the US GDP for the 3rd quarter, an unprecedented growth was seen, which pleased not only the economists but also traders. The report published by the US Department of Commerce said the GDP grew by 7.4% in the 3rd quarter, and increased by 33.1% per annum. Such a powerful rise is directly related to the lifting of quarantine measures in the middle of this year, as well as the beginning of the full functioning of a number of companies and enterprises. However, the economic growth rate is still 3.5% lower than in the 4th quarter of 2019, and for a full economic recovery in the 4th quarter of this year, an increase of 15.2% per annum is required. But considering the current deteriorating situation with the coronavirus, this option is highly unlikely.

About the EUR/USD pair, there is a high chance that the quote will close in a sideways channel today, mainly because first, the bears will try to break below 1.1650, which will ultimately fail. Then, the bulls will try to break above 1.1710, however, their efforts will meet active resistance from the bears, who, as mentioned earlier, are betting on the further decline in risky assets.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română