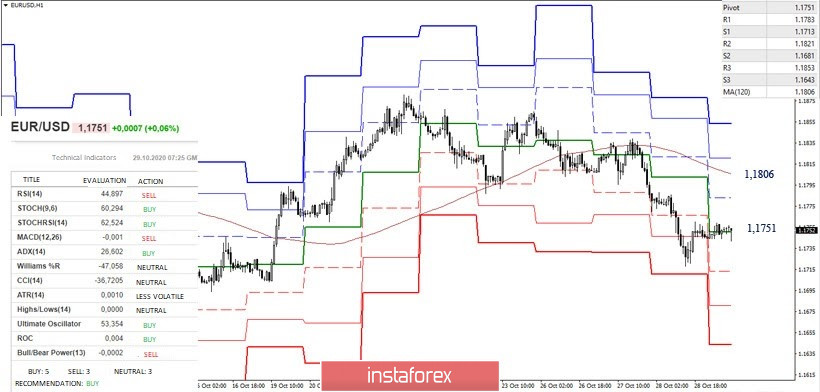

EUR/USD

Over the past day, players on the downside realized a fairly deep decline, descending to the support of the daily Fibo Kijun at 1.1715 but by the end of the day they returned to the zone of influence and attraction of the daily medium-term trend at 1.1746. The levels passed the day are now joining forces, forming an important resistance zone of 1.1792 -1.1811 (weekly Tenkan + daily Tenkan + upper limit of the daily cloud). Fixing above these resistances can once again level the achievements of the bears and create prerequisites for the resumption of the rise. Working below resistances keeps the trend towards strengthening bearish sentiment. The nearest significant supports are 1.1715 and 1.1688 (the lower limit of the monthly cloud).

On the downtrend of the lower halves, there is another pause and correction which has already enlisted the support of the analyzed technical indicators and is fighting for possession of the Central Pivot level of the day at 1.1751. The next important benchmark for the rise is the weekly long-term trend at 1.1806, the intermediate resistance today can be noted at 1.1783 (R1). If the downside players manage to complete the development of the correction and overcome the support of the higher halves at 1.1746, the downward trend will continue then the support of the classic Pivot levels which can be used for intraday trading is currently located at 1,1713 – 1,1681 – 1,1643 and have a gain from the levels of the higher halves.

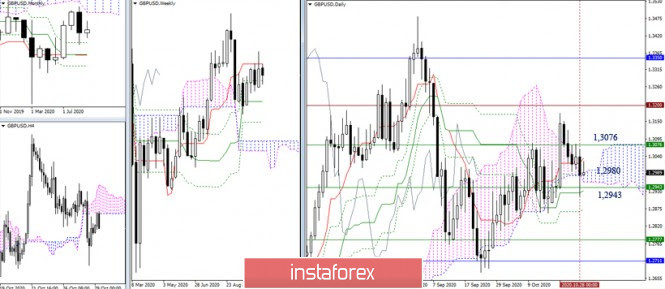

GBP/USD

The pound also showed a positive movement yesterday. The downside players tested the important support levels around 1.2943-25 (daily Kijun + weekly Fibo Kijun), but they could not get rid of the attraction of the daily cloud at 1.2980 (daily cloud + daily Fibo Kijun) and returned to it at the close of the day. As expected, the accumulation of such strong levels has an impact and hinders the development of the situation. A confirmed exit beyond 1.3076 (weekly Tenkan) or 1.2943 (weekly Fibo Kijun) may reduce the attraction and create opportunities for the development of directional movement.

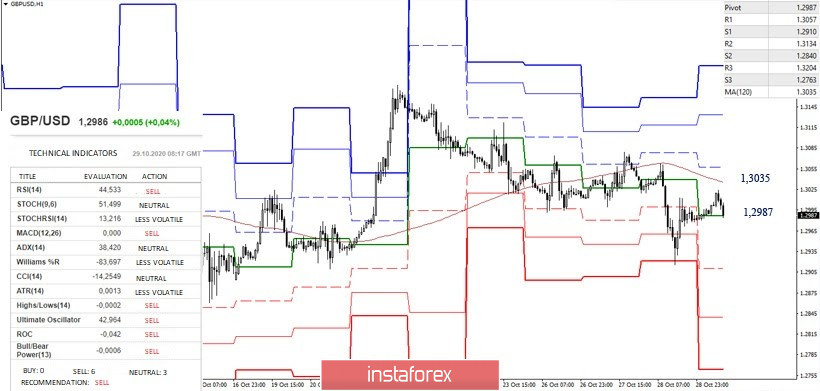

The lower half acts upward with correction which led to key levels 1,2987 (Central Pivot-the level of day) and 1,3035 (weekly long-term trend) on the H1. A break above will affect the current balance of power and provide new opportunities for testing important resistance senior halves 1,3076, while resistance classical Pivot levels of today can mark at 1,3057 – 1,3134 – 1,3204. Recovery of the downtrend is possible only after passing 1.2943-25 (support for the higher halves), as already noted, this can be a significant result that opens up new opportunities. The next supports for the classic Pivot levels are located at 1.2840 and 1.2763 today.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română