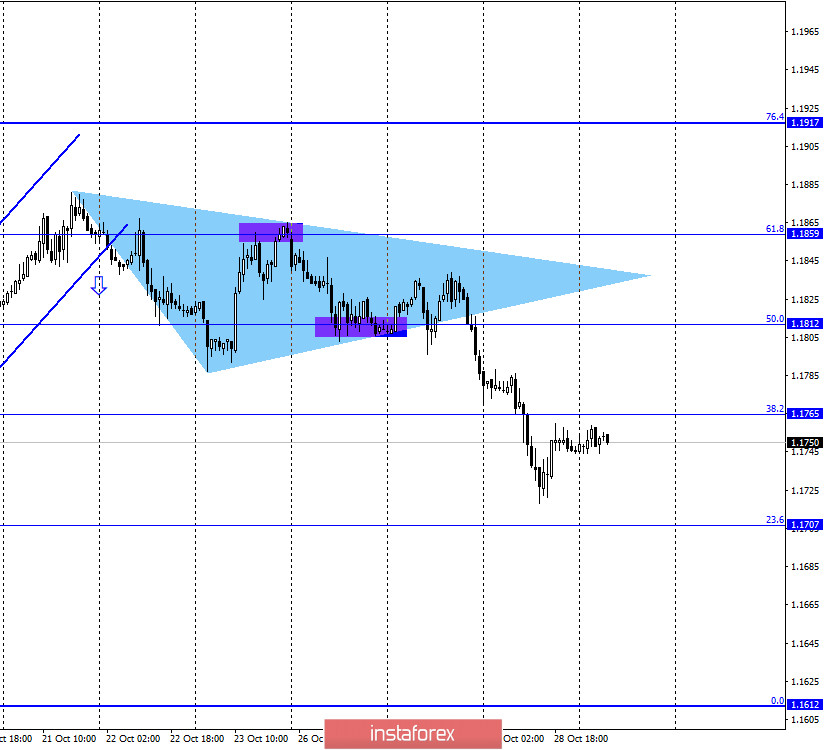

EUR/USD – 1H.

On October 28, the EUR/USD pair continued the process of falling after fixing under the corrective level of 38.2% (1.1765), and only when approaching the Fibo level of 23.6% performed a reversal in favor of the European currency and began the process of returning to 38.2%. Thus, the pair's rebound from the Fibo level of 38.2% will work in favor of the US dollar and resume the fall. The US currency found support from traders yesterday. However, I remind you that the side corridor is preserved and all trades are held exclusively inside it. This corridor is clearly visible on the 4-hour chart. Thus, it is quite possible that there were no special reasons for the fall of the euro yesterday. There were just regular trades of the pair inside the sidewall, no more. Nevertheless, the situation in the Eurozone and America continues to escalate. Or get worse. The US has not yet adopted a package of assistance to the economy, and since the election is less than a week away, it is unlikely to be adopted in the near future. Most likely, Democrats and Republicans will return to this issue after November 3. Meanwhile, in Europe, the number of diseases and deaths from coronavirus is growing. Very difficult situations have developed in France, Italy, Spain, Portugal, Great Britain, and the Czech Republic. However, these countries were in the most difficult situation in the spring. It is rumored that new "lockdowns" may be introduced in them, which is very bad for the European currency, which has risen in price over the past six months, and now may begin to fall. Anyway, while we are waiting for the pair to leave the side corridor, only then can I draw any conclusions.

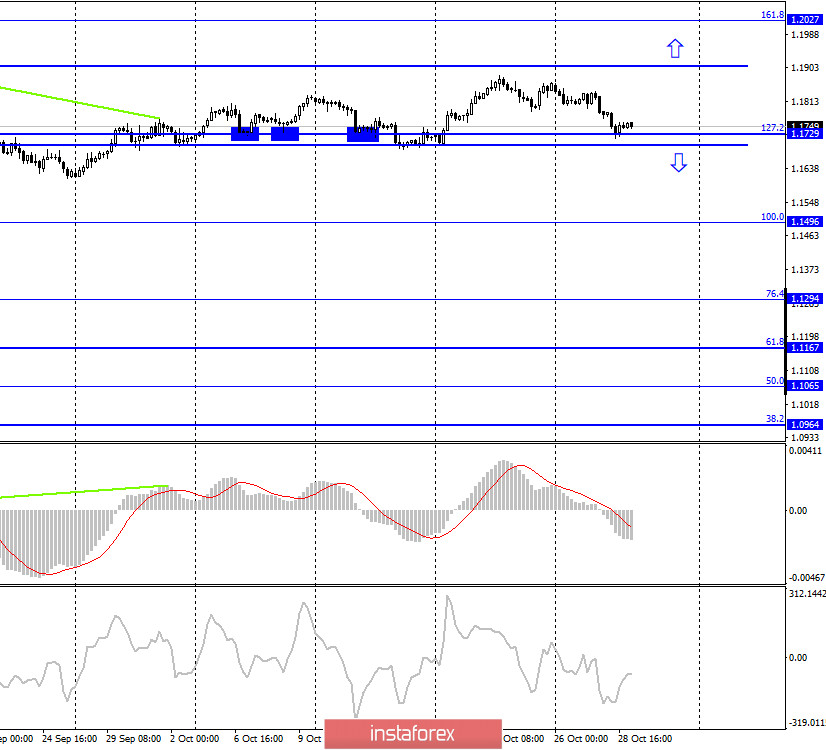

EUR/USD – 4H.

On the 4-hour chart, the graphical picture remains very boring, as the pair continues to trade inside the side corridor. The pair's quotes fell to the Fibo level of 127.2% (1.1729), which passes near the lower border of the side corridor. A rebound from it will work in favor of the EU currency and the beginning of growth in the direction of 1.1907, and also leave the pair inside the side corridor. Fixing quotes under the corridor will significantly increase the probability of continuing to fall in the direction of the corrective level of 100.0% (1.1496).

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed a new rebound from the corrective level of 261.8% (1.1825), which allows us to count on a slight drop. However, on the 4-hour chart, the pair remains inside the side corridor, which is the most important factor right now.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair has consolidated above the "narrowing triangle", which now allows us to count on further growth of the euro currency, which may be strong, but in the long term.

Overview of fundamentals:

On October 28, the European Union and America did not have any economic reports or other important news, so the information background again had no effect on the mood of traders.

News calendar for the United States and the European Union:

US - change in GDP per quarter (12:30 GMT).

US - number of primary and secondary applications for unemployment benefits (12:30 GMT).

EU - publication of ECB decision on the basic interest rate (12:45 GMT).

EU - press conference of the ECB (13:30 GMT).

On October 29, important events appear in both the European and American calendars. The information background will be quite strong today.

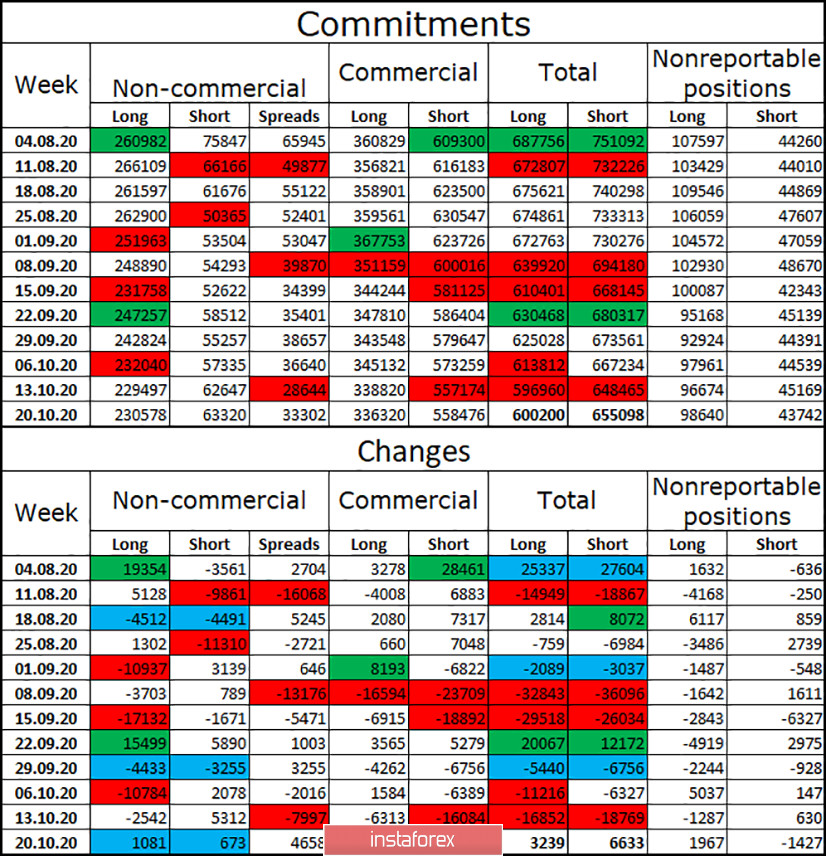

COT (Commitments of Traders) report:

The latest COT report was rather boring and uninformative. The most important category of non-commercial traders increased only 1 thousand long contracts and 700 short contracts during the reporting week. Thus, changes in their mood can be described as minimal and insignificant. Over the past few weeks, changes in this category are generally quite weak. Only on October 6, a fairly strong drop in the number of long contracts was registered. However, it is the lack of serious changes among speculators that reflects what has been happening on the market in recent months. Namely, trade in the side corridor. We are less interested in other categories of traders, but in any case, there are no major changes that deserve attention.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro with a target of 1.1707, if the rebound from the corrective level of 38.2% (1.1765) on the hourly chart is completed. Purchases of the pair will be possible with targets of 1.1765 and 1.1812 if the quotes perform a rebound from the lower border of the side corridor on the 4-hour chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română