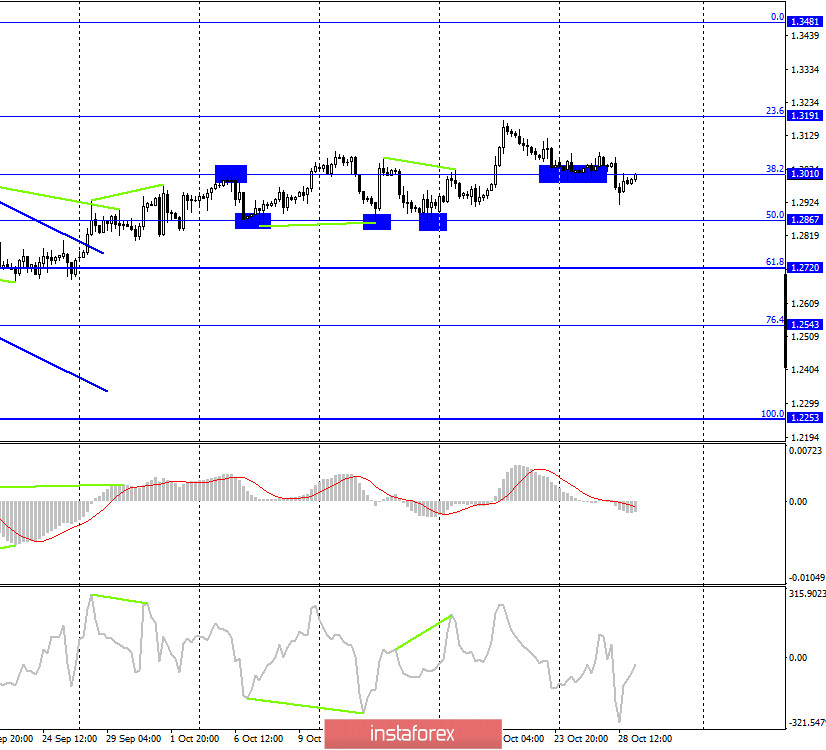

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair fell to the corrective level of 76.4% (1.2928), rebounded from it, and turned in favor of the British with further growth to the Fibo level of 100.0% (1.3006). Fixing the pair's rate above this level will allow traders to expect continued growth in the direction of the next corrective level of 127.2% (1.3096). The British, like the Europeans, continues to trade quite chaotically. If the European clearly shows a side corridor, then the British still have an upward slope, however, it is extremely weak and also looks like a side corridor. Simply put, there is no clear trend right now. Traders are confused and frantically trying to figure out how to trade the pound. Major traders (according to the COT report) are closing more contracts for the British dollar than opening new ones. The information background could help traders, however, it is not available now. Throughout the current week, the markets receive information about progress in negotiations on a trade agreement. Each time, European publications refer to some sources close to the European and British governments. However, it is extremely difficult to judge whether this is true. I would recommend waiting for official information on this issue and not paying attention to rumors. The same opinion is shared by most traders, as the pound continues to trade in different directions. Traders are also wary of rising levels of COVID in the UK.

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair has secured a corrective level of 38.2% (1.3010), however, it may close above it in the next few hours. Thus, as we can see, the special value of fixing/rebounding is not played now. Traders do not have a clear strategy, thus, the pound moves mainly in different directions. Accordingly, I recommend paying more attention to the lowest chart, the hourly chart, and trading relative to its levels.

GBP/USD – Daily.

On the daily chart, the pair's quotes were fixed above the corrective level of 76.4% (1.3016), and a couple of days later – below it. So the conclusions are the same as for the 4-hour chart. It is best to trade using the lower chart now.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, thus, a false breakout of this line followed earlier. However, in recent weeks, it has made new attempts to gain a foothold over both trend lines.

Overview of fundamentals:

On Wednesday, the UK again did not have any economic reports. There was also no official information about the progress of negotiations between the UK and the European Union.

News calendar for the US and the UK:

US - change in GDP for the quarter (12:30 GMT).

US - number of primary and secondary applications for unemployment benefits (12:30 GMT).

On October 29, the UK news calendar again does not contain a single report or event, but at any time there may be important information from London about whether Michel Barnier and David Frost have agreed or not this time. Also today, an important report on GDP in America for the third quarter will be released.

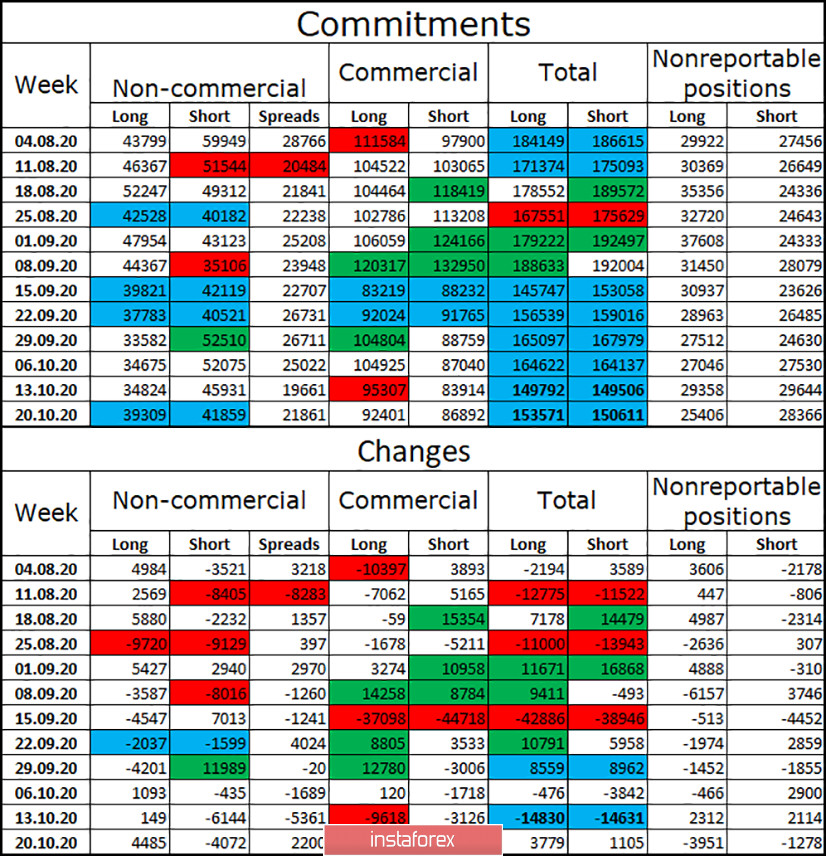

COT (Commitments of Traders) report:

The latest COT report on the British pound that was released last Friday showed that the mood of the "Non-commercial" category of traders has become more "bullish". Speculators immediately increased to 4.5 thousand long-contracts and got rid of 4 thousand short-contracts. Thus, after three weeks of "bearish" advantage, speculators are again inclined to buy the British. However, I believe that such a change in mood does not mean anything specific. In a week or two, major players can start building up short contracts again. And the total number of long and short contracts focused on their hands is almost the same. Thus, I would conclude that the major players are now in disarray.

Forecast for GBP/USD and recommendations for traders:

Today, I recommend selling the GBP/USD pair with a target of 1.2928, if a new consolidation is made under the corrective level of 100.0% (1.3006) on the hourly chart. I recommend buying the British dollar with a target of 1.3096, as the close was made above the level of 100.0% on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română