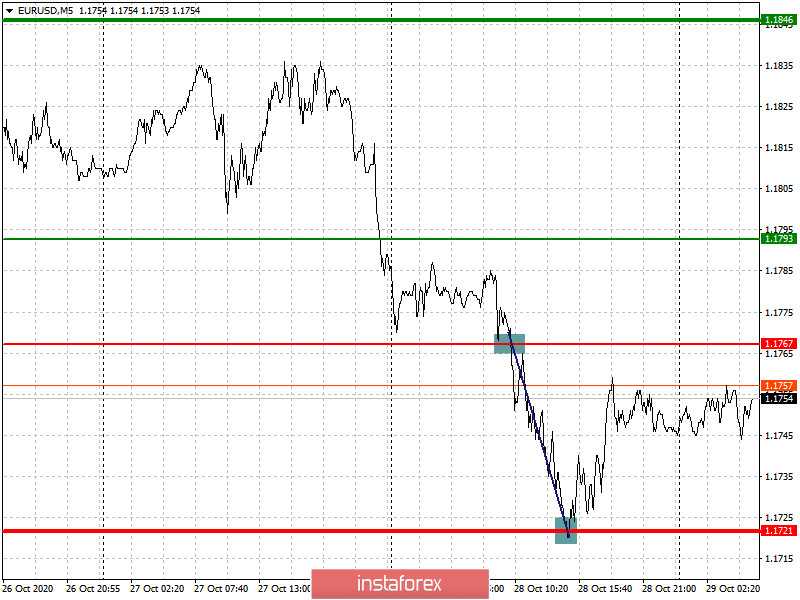

Analysis of transactions in the EUR / USD pair

The bears got ahold of the market yesterday, as a result of which the euro moved 45 pips down from the level of 1.1767. It was one of the most profitable days this week.

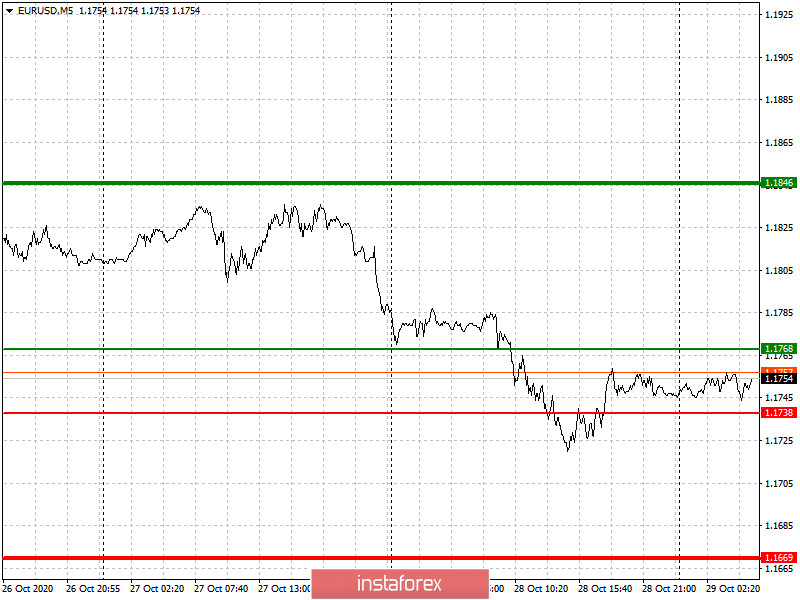

Trading recommendations for October 29

A number of economic reports are scheduled for release today, one of which is the data on US GDP. At the same time, the European Central Bank will announce its decision on interest rates, which is expected to lead to a surge in volatility in the EUR / USD pair. If the ECB softens its monetary policy, the pressure on the euro will increase.

- Open a long position when the euro reaches a quote of 1.1768 (green line on the chart), and then take profit at the level of 1.1846.

- Open a short position when the euro reaches a quote of 1.1738 (red line on the chart, and then take profit around the level of 1.1669. If the ECB hints of a rate cut, the pressure on the euro will intensify.

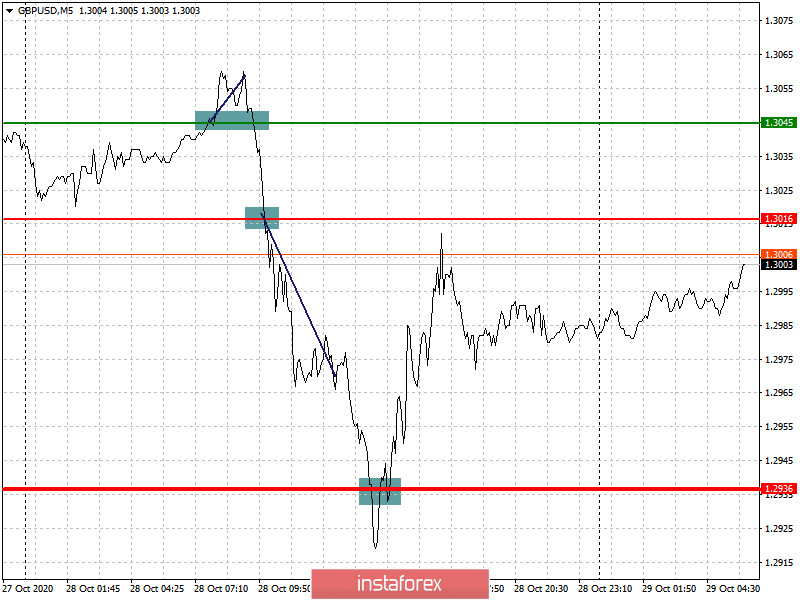

Analysis of transactions in the GBP / USD pair

The pound moved 20 pips up from 1.3045 yesterday, however, afterwards, it fell down again from the level of 1.3016. And although the quote failed to reach the target price of 1.2936, closing at 1.2970 was still profitable.

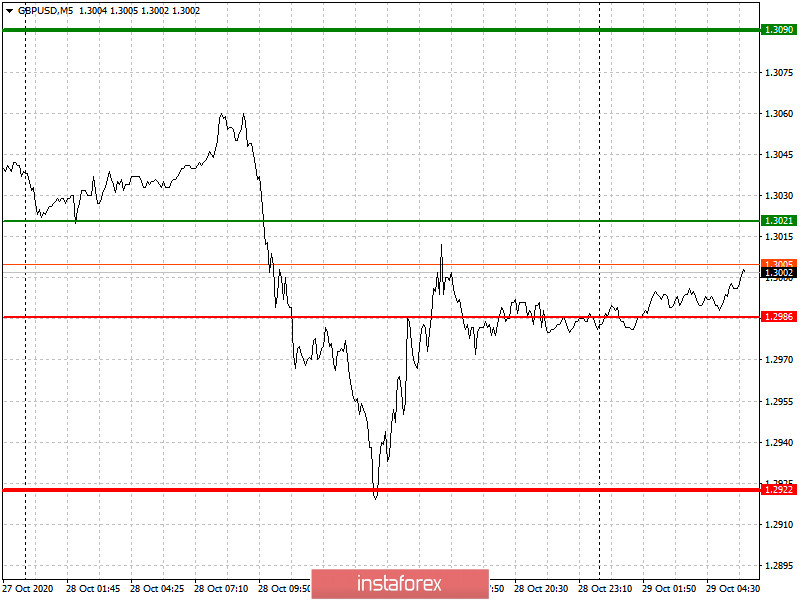

Trading recommendations for October 29

Since there are no economic reports scheduled for release today, the attention of traders will be shifted on the next round of negotiations between the UK and the EU over the long-disputed post-Brexit trade deal. Good news about it will lead to a new wave of growth on the British pound, whereas a bad news could lead to another decline in the GBP / USD pair.

- Open a long position when the quote reaches the level of 1.3021 (green line on the chart), and then take profit around the level of 1.3090 (thicker green line on the chart).

- Open a short position when the quote reaches the level of 1.2986 (red line on the chart), and then take profit at least at the level of 1.2922. Bad news on Brexit will continue the downward trend in the GBP/USD pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română