Crypto Industry News:

Twitter recently introduced the bitcoin tip feature. Now, however, the social media giant has gone a step further. The company added another cryptocurrency to its offer - ether. So far, ETH can only be used on mobile devices.

According to Twitter's updated tip policy, users who consent can "copy someone's bitcoin or ether address and paste it into whatever wallet they use."

In September, the platform introduced bitcoin tips powered by the Lightning Network. Nevertheless, some hackers already noticed that Ether wallet compatibility was also built into the Twitter code.

The late introduction of the second largest cryptocurrency can therefore be attributed to Jack Dorsey, who headed Twitter last year. The billionaire left the company in December and has since dedicated himself to building a bitcoin infrastructure at Block.

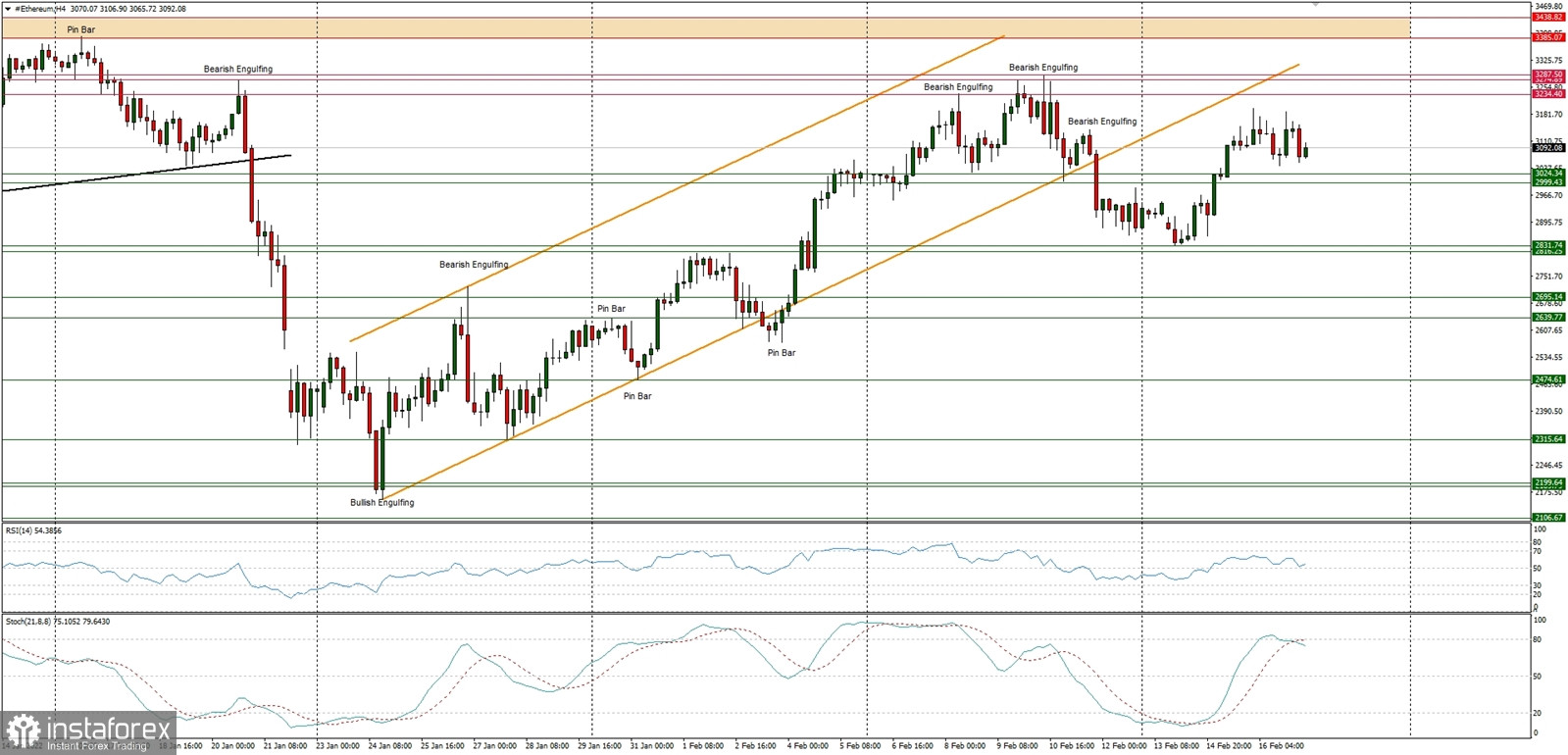

Technical Market Outlook

The ETH/USD pair has made the local high at $3,198 and is consolidating around the level of $3,100. The next target for bulls is the supply zone located between the levels of $3,385 - $3,438. The nearest technical support is seen at $3,024 and $2,999. The intraday technical resistance is located at $3,234. The bulls are in control of the market on the higher time frames as the momentum is strong and positive on the daily time frame chart as well, so the market is bouncing from the extremely oversold conditions. The sustained breakout above the 38% Fibonacci retracement located at the level of $3,198 is needed to continue the up move.

Weekly Pivot Points:

WR3 - $3,490

WR2 - $3,400

WR1 - $3,079

Weekly Pivot - $2,975

WS1 - $2,651

WS2 - $2,541

WS3 - $2,228

Trading Outlook:

The market is bouncing after over the 50% retracement made since the ATH at the level of $4,868 was made. The level of $3,436 is the next key technical resistance for bulls. On the other hand, the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română