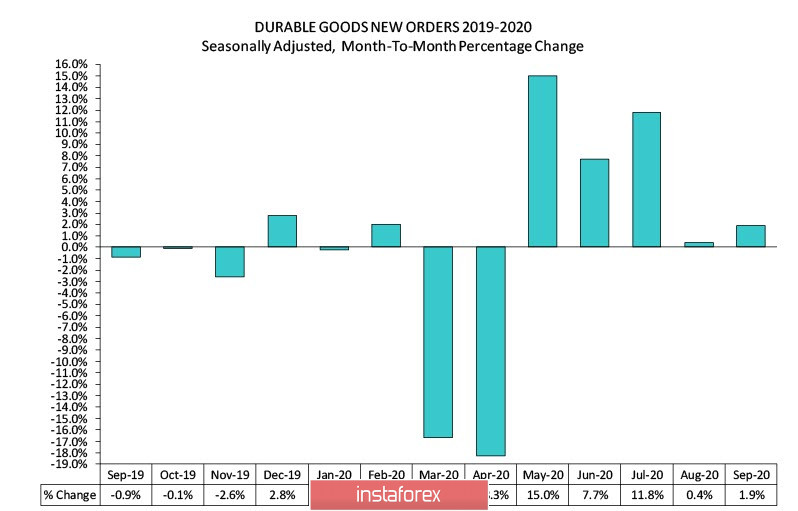

Orders for durable goods increased by 1.9% in September, which significantly exceeded forecasts and indicates a still stable capacity utilization.

There is growth in regional indices of industrial activity (Kansas FRB in October +23p against +18p a month earlier, Dallas Fed +19.8p against +13.6p, Richmond Fed +29p against +21p), so the recovery is likely to continue in October.

The published statistics are in favor of Trump, since it deprives the Democrats to claim that the economic program of the Republicans is collapsing against the background of the COVID-19 crisis. This is why Republicans are pushing for a smaller economic aid package than Democrats, since they see no reason to increase spending beyond what is necessary.

It was proven that there is a narrow gap between Mr. Biden and Mr. Trump in view of the election. Thus, we should expect a rising tension, since the chances of challenging the election results by any losing party will only increase. By the end of the week, demand for defensive assets is likely to increase, while commodity currencies will decline.

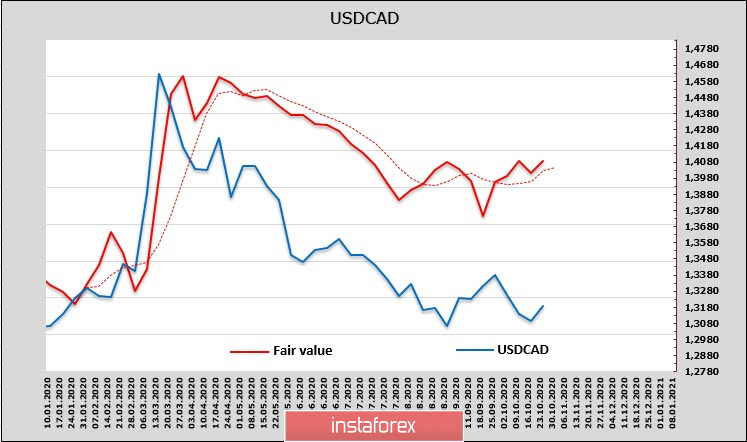

USD/CAD

Canadian dollar's net short position declined by 323 million over the reporting week, stopping at -1.032 billion. The advantage is still clearly visible. The reversal of the yield spread in favor of the dollar, which has become more strong in the last two weeks, contributes to the growth of the settlement price.

Today, the Bank of Canada will hold a regular meeting on monetary policy; however, most observers do not expect any changes, as there is no reason to do so. The indicated bank recently decided to scale back some of its liquidity support programs, suggesting that policy makers are much more comfortable operating in the market, and there was no desire to raise asset repurchases from any BoC officials.

The only significant factor that can be considered amid strong uncertainty is the correlation between the CAD rate and the fluctuations in the US stock market. The growth of stock indices contributed to the decline in USD/CAD pair relative to the estimated fair level. This movement was caused by massive cash injections into the US economy in March-April. At the current stage, we should expect USD/CAD to grow, since the issue of additional incentives is fading, which deprives the stock indices of the driving force.

The nearest target is 1.3260, while the next one is 1.3380/90.

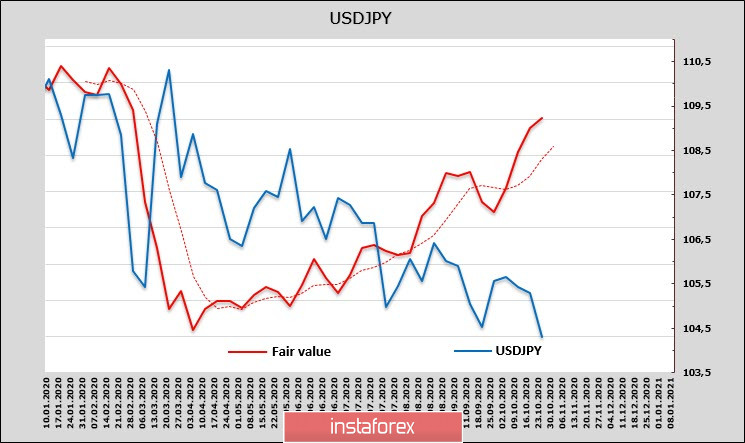

USD/JPY

The net long position declined to 1.68 billion, with a weekly decline of 687 million. This is the highest among all G10 currencies. Despite this, investors are still not selling the yen, which indicates the most obvious explanation for what is happening – COVID-19 crisis is strengthening and the Fed took a break against the background of the inability of Republicans and Democrats to agree on a new stimulus package.

Analyzing the dynamics of the yield spread, Bank Mizuho insists that the curve has shifted towards US bonds since July, which should lead to a growth in demand for the US dollar. Mizuho suggests that it is necessary to focus on the fact that US monetary institutions will promote reflation after the elections, the Fed will help move inflation towards the previously set targets, and the structural rationale for the yield spread will become clearer after the elections.

These are all arguments in favor of the dollar's growth, which sharply declined in February. The fair level of the dollar is growing, and there is a chance to finally see this growth on the spot after the elections, as the gap between the current and fair prices has become suggestively high.

Technically, the USD/JPY pair will try to find support at 104, which is the local low of September 21 and at the same time, the middle of the downward medium-term channel. Moreover, everything indicates that this level will be broken downwards, after which there will be a rapid decline. However, fundamental grounds suggest that an upturn will still take place after the elections.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română