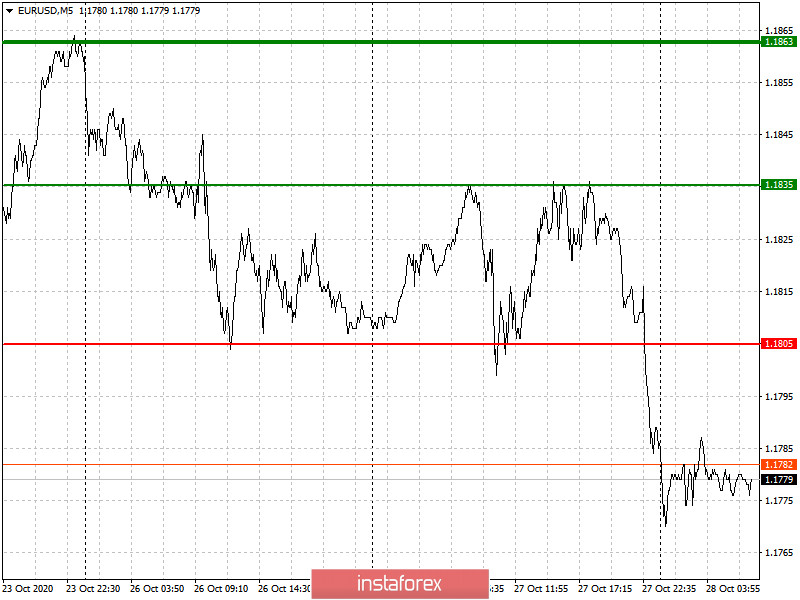

Analysis of transactions in the EUR / USD pair

Yesterday was not the best day for traders of the European currency, as the deals only brought losses, and the pair did not even go in any direction until the end of the day. Nonetheless, pressure remains on the euro, which suggests that it is better to trade short positions in the market.

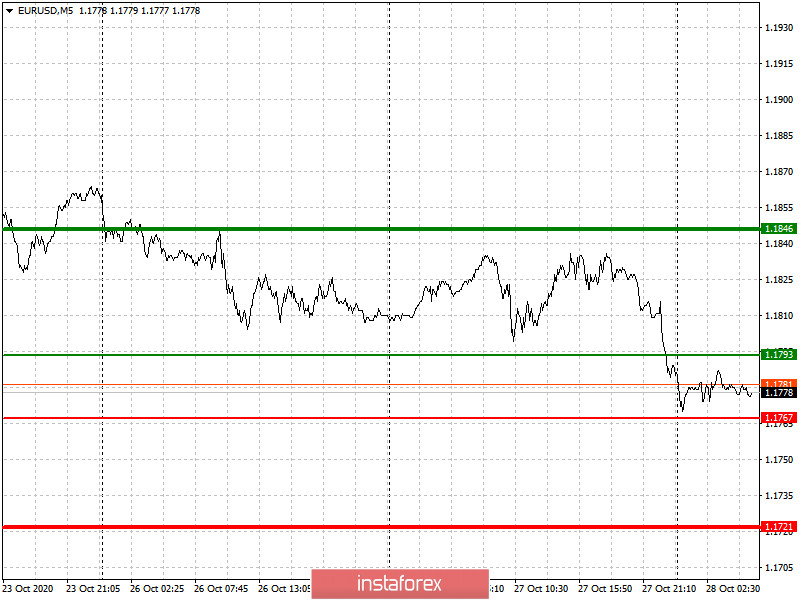

Trading recommendations for October 28

Yesterday's report on US consumer confidence, which declined amid the coronavirus pandemic, increased pressure on the EUR / USD pair. Then, Trump's announcement that he would sign a new aid program when he wins the election led to additional demand for the US dollar.

- Open a long position when the euro reaches a quote of 1.1793 (green line on the chart), and then take profit at the level of 1.1846.

- Open a short position when the euro reaches a quote of 1.1767 (red line on the chart, and then take profit around the level of 1.1721. Bad news on Brexit will push the euro even lower.

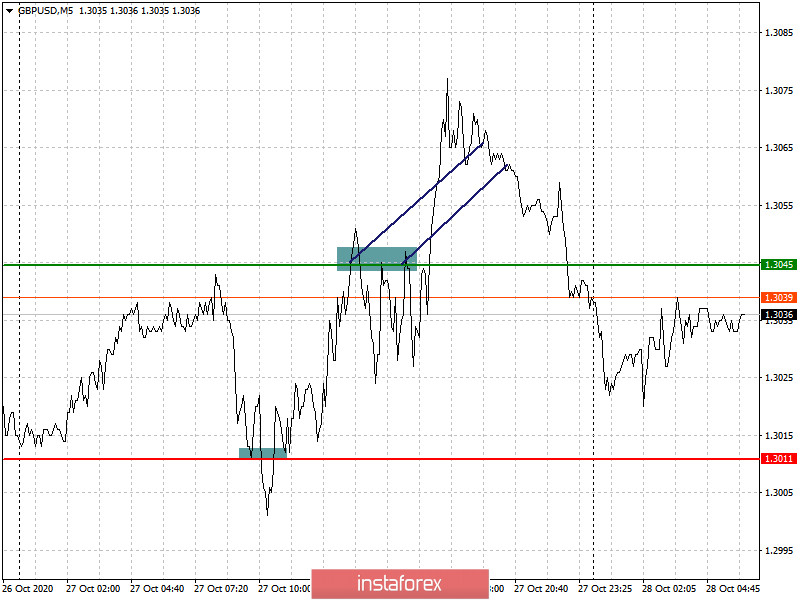

Analysis of transactions in the GBP / USD pair

The pound continued to trade in a sideways channel yesterday, so as a result, short positions from 1.3011 saw losses. Meanwhile, long positions from 1.3045 gave profit, however, it was no more than 20 pips.

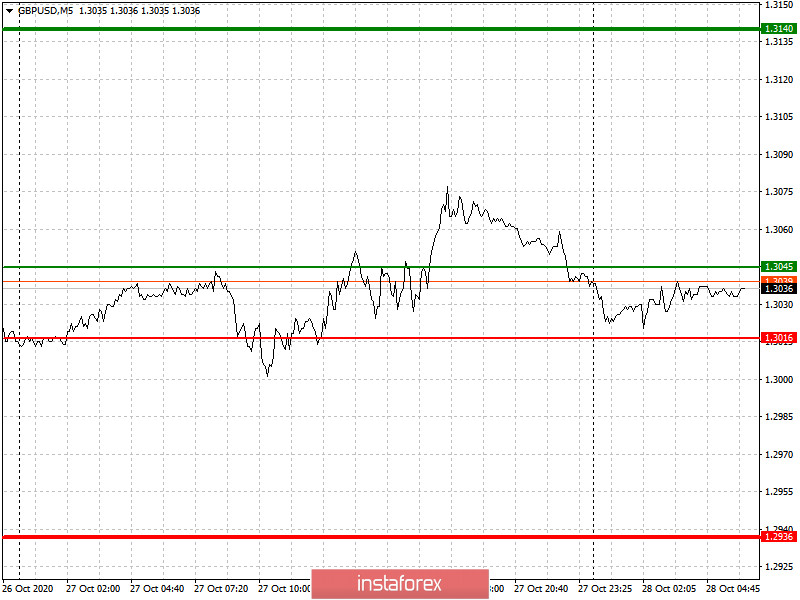

Trading recommendations for October 28

Since there are no economic reports scheduled for release today, the attention of traders will be shifted on the next round of negotiations between the UK and the EU over the long-disputed post-Brexit trade deal. Good news about it will lead to a new wave of growth on the British pound, whereas a bad news could lead to another decline in the GBP / USD pair.

- Open a long position when the pound reaches a quote of 1.3045 (green line on the chart), and then take profit around the level of 1.3140 (thicker green line on the chart).

- Open a short position when the pound reaches a quote of 1.3016 (red line on the chart), and then take profit at least at the level of 1.2935. Bad news on Brexit will resume the downward trend in the GBP/USD pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română