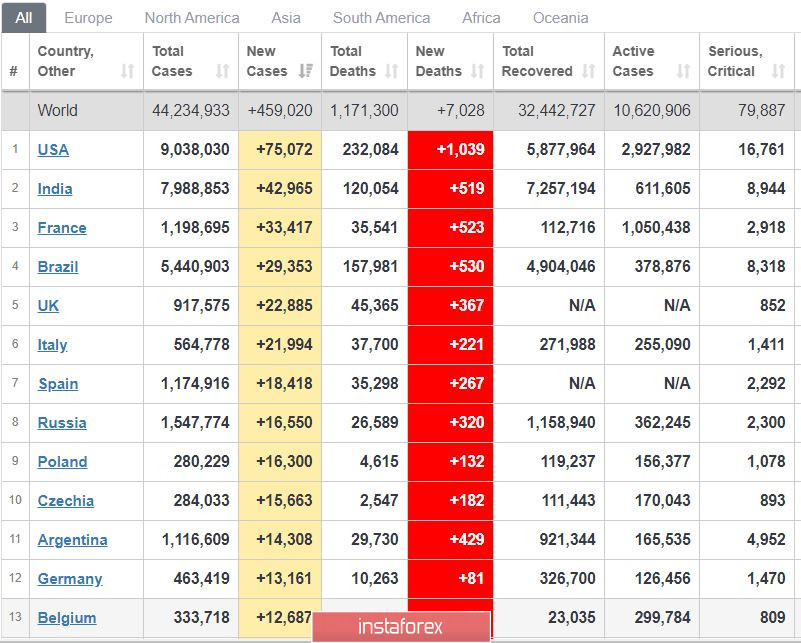

COVID-19 cases continue to surge in Europe. At the moment, France has already risen third place on the largest incident rate around the world, having recorded 33 thousand new infections a day. Next is Italy and Spain with about 20 thousand, followed by Poland and Czech Republic at 16 thousand. Lastly, Germany and Belgium has a record of 13 thousand

EUR/USD - Demand for the euro has fallen sharply in the market. As a result, the quote has dropped below the level of 1.1785, emitting a strong bearish signal. However, this could also turn out to be just a false breakout again.

Open short positions from 1.1785 to 1.1830

In case of an upward reversal, open long positions from 1.1840 to 1.1795.

News on the US GDP, as well as statements from the ECB, could affect the direction of the market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română