The euro-dollar pair continues to trade amid a contradictory fundamental background. The dollar is guided by the ongoing negotiation process between Democrats and representatives of the White House, while the euro is more worried about the coronavirus, which is gradually beginning to "close" the EU countries. And if the focus was on American events (which put pressure on the dollar) for over the past three days, today the market is concerned about the prospects for the European economy. This fact made it possible for EUR/USD to seize the initiative - at the moment the price is trying to return to the area of the 17th figure.

Take note that the market approaches the issue of the spread of coronavirus in Europe on its own - it is quite pragmatic. Traders are primarily concerned about the reaction of the authorities and the possible economic consequences of the second wave of the epidemic, while the growth in the number of infected itself serves as a kind of barometer. Until the countries began to tighten quarantine restrictions, coronavirus outbreaks in Europe were of little concern to the foreign exchange market - firstly, these outbreaks were of a local nature, and secondly, they did not affect (dramatically) economic processes.

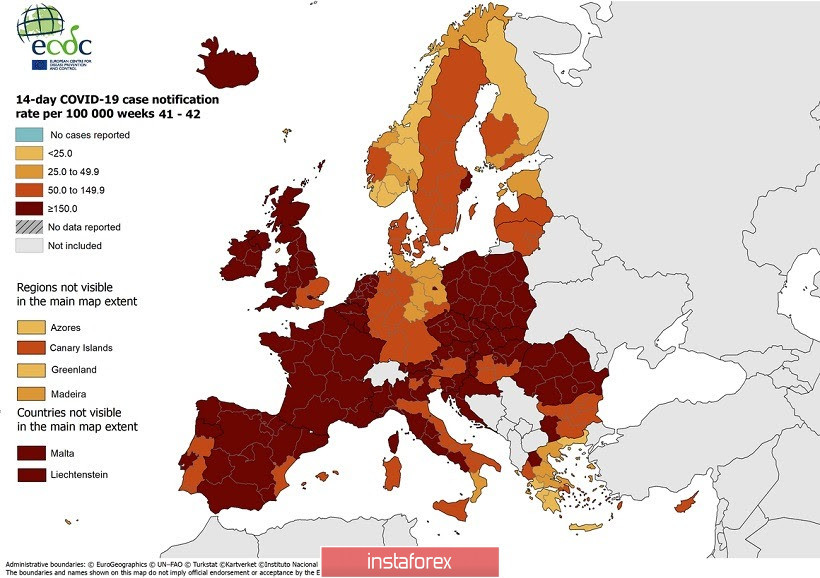

But the events of recent days have alarmed investors. The market began to talk more and more often that the spring scenario could repeat itself, while the key macroeconomic indicators had just begun to show signs of recovery. The successes of pharmacists who are developing a vaccine for COVID-19 do not reduce the overall degree of heat. On the one hand, some pharmaceutical companies (such as Moranda, for example) have already entered the home stretch of clinical trials. On the other hand, in the most optimistic scenario, mass vaccination will begin not earlier than December, and most likely - at the beginning of next year. While the coronavirus is spreading at a crazy pace right now, forcing the leaders of the EU countries to re-impose strict quarantine restrictions.

In particular, a curfew has been introduced in the largest cities of France (Paris, Lille, Grenoble, Lyon, Marseille, etc.), which will be in effect at least until the end of November. Similar measures were also used in Belgium, the Netherlands and Slovenia. In the Czech Republic, the lockdown was actually returned: shops, schools and universities, entertainment establishments and catering establishments were closed in the country. Cinema and theaters were closed, sports events were canceled, and meetings of more than six people were prohibited. They even banned the use of alcoholic beverages in the open air (there was no such measure in the spring). Quarantine restrictions have also been tightened in Germany, Poland, Ireland, Spain and Italy.

Traders could not ignore such a negative news flow - the euro-dollar pair initially slowed down its growth, and then headed towards the bottom of the 18th figure.

But pay attention to the fact that the coronavirus factor could not reverse the trend - at the moment we can only talk about a correction, and a relatively small one. By and large, the bears were able to win back only fifty points, afterwards the downward momentum began to fade little by little.

All this suggests that the euro-dollar pair is a struggle of the "weak against the weak". At a point where the negative factors against the euro or the dollar begin to prevail, and the pair goes in one direction. Then the roles change. For example, this week the pair has been growing steadily for three days, since traders were focused on American events. Today the focus of attention has shifted to Europe, after which the pair retreated from the boundaries of the 19th figure.

Selling the pair looks quite risky in such conditions, since traders will focus on the United States tomorrow. First, another deadline in negotiations between the Democrats and the White House regarding the fate of the new stimulus package will expire tomorrow. Any decision by politicians will provoke volatility in the pair. In my opinion, this fundamental factor will not be in favor of the dollar. According to most experts, the likelihood of a political deal being concluded is rather small. In addition, many Republican senators oppose the bill under discussion. Therefore, even if the Democrats and White House representatives come to a compromise solution, the greenback may still be under pressure. After all, not so long ago the Senate did not support even the 500-billion-dollar bill of the Republicans (remember, the Democrats insist on $2.2 trillion)

Secondly, tomorrow the last televised debate between Trump and Biden will take place. According to American political scientists, this is the last chance for the head of the White House to turn the tide in his favor. If he loses the verbal battle this time, the probability of Joe Biden's victory will increase as much as possible. According to the latest polls, the Democratic leader is 11% ahead of his opponent, and that lead could be widened if Trump does not convince vacillating Americans of his exclusivity.

Meanwhile, according to The Wall Street Journal, Biden's campaign headquarters "is preparing for a possible refusal of the incumbent head of state to transfer power in case of losing the election." Earlier, Donald Trump said that the elections could be rigged in favor of a Democrat, and hinted that the results of the vote would be announced by the Supreme Court. According to WSJ journalists, uncertainty about the results (if there is no clear winner) can significantly complicate the transfer of power.

Summarizing all of the above, we can conclude that the coronavirus factor certainly serves as an anchor for the euro. But dollar bulls are more vulnerable. Moreover, political turbulence will only increase every day, right up to the moment the results of the presidential elections are announced (or rather, until Trump admits his possible loss). Therefore, short positions on the pair look quite risky under current conditions. If the pair does not go below the support level of 1.1780 (Tenkan-sen line on the daily chart), it is advisable to consider buy positions while aiming for 1.1900 as the first growth target (upper Bollinger Bands line on the daily chart) and further at 1.1950.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română