To open long positions on GBP/USD, you need to:

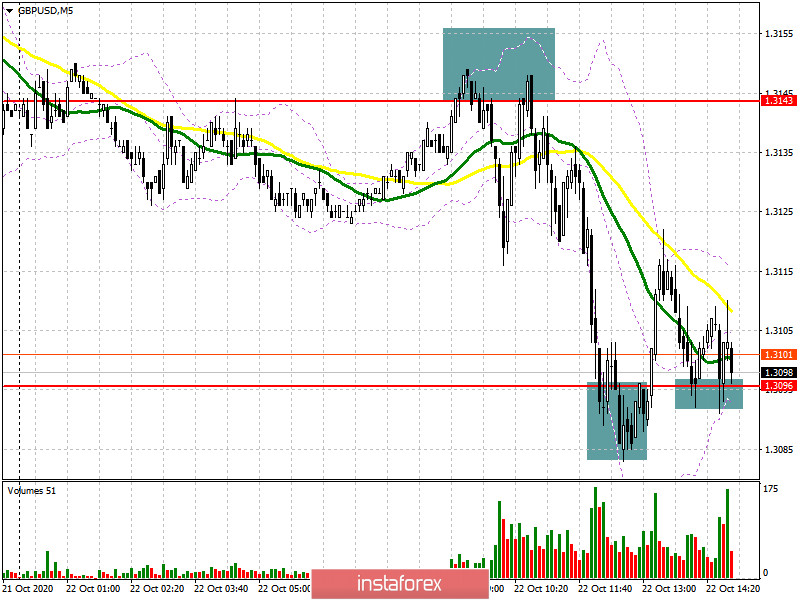

In the morning forecast, I paid attention to the sale of the pound from the level of 1.3143, which happened. Let's take a look at the deals. On the 5-minute chart, the formation of a false breakout at the level of 1.3143 can be seen, which led to the formation of a sell signal for the pound in the support area of 1.3096 and brought about 50 points of profit. By the middle of the day, the bears tried to take this level under them and even made their way lower. However, there was no consolidation. Immediately, buyers stepped in and formed a good entry point for long positions, but so far there has not been a major increase from this level, and, in all likelihood, it will not happen.

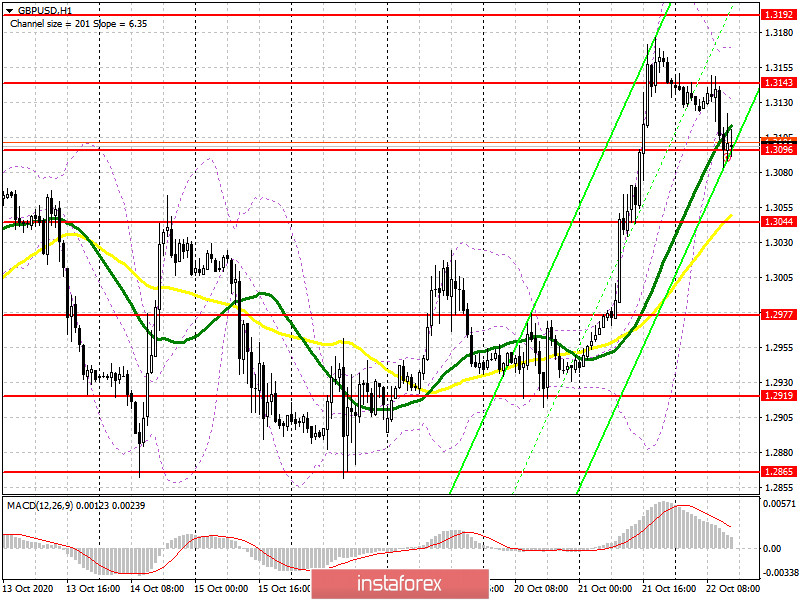

But, as long as the trade is conducted above the range of 1.3096, the buy signal will work. In this scenario, we can expect the GBP/USD to return to the resistance area of 1.3143, from which the main fall of the pound occurred today. A breakout and consolidation above this range will open a direct path to a new monthly high of 1.3192, where I recommend taking the profit. If the trade again moves below the level of 1.3096, it is best to exit short positions and wait for the test of a larger minimum of 1.3044 for purchases, based on a correction of 20-30 points within the day.

To open short positions on GBP/USD, you need:

All the hype with yesterday's statements that the UK is ready to continue dialogue with the EU is gradually fading, as is the bullish momentum. The bears have already returned the pair to the support of 1.3096 and all they can do now is to achieve another breakdown and consolidate below this range, similar to the morning entry point, which I marked under this level on the 5-minute chart. If this happens, we can expect the pair to fall to the low of 1.3044, where I recommend taking the profit. A break in this range will completely negate all bullish momentum and return GBP/USD to the support of 1.2977. If the pair grows in the second half of the day, the bears will still actively defend the resistance of 1.3143, however, you can still sell from it only if a false breakout is formed, similar to the morning sale that I discussed above. I recommend selling GBP/USD immediately for a rebound only from the new weekly high of 1.3192, based on a correction of 20-30 points within the day.

Let me remind you that in the COT reports (Commitment of Traders) for October 13, there was a reduction in both long and short non-commercial positions. Long non-commercial positions declined from the level of 40,698 up to level 36 195. At the same time, short non-commercial positions fell more significantly from the level of 51,996 to the level of 45,997. As a result, the negative value of the non-commercial net position increased slightly to -9,802, against -11,298 a week earlier, which indicates that sellers of the British pound remain in control and have a minimal advantage in the current situation.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily averages, which limits the downward correction of the pound.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

If the pair grows in the second half of the day, the upper limit of the indicator around 1.3170 will act as a resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română