The EUR/USD pair plunged in the short term as the Dollar Index rebounded. DXY's rally forced the greenback to appreciate versus its rivals. It's traded at 1.1317 level at the time of writing. After its massive drop, we cannot exclude a temporary rebound. It could try to come back higher to test and retest the immediate upside obstacles before dropping deeper.

Fundamentally, the German ZEW Economic Sentiment is expected at 55.1 points above 51.7 in the previous reporting period, while the Euro-zone ZEW Economic Sentiment could jump from 49.4 to 54.4 points.

On the other hand, the US is to release the PPI which could report a 0.5% growth, and the Core PPI. The volatility could be high around these economic figures, that's why you have to be careful.

EUR/USD Bearish Bias!

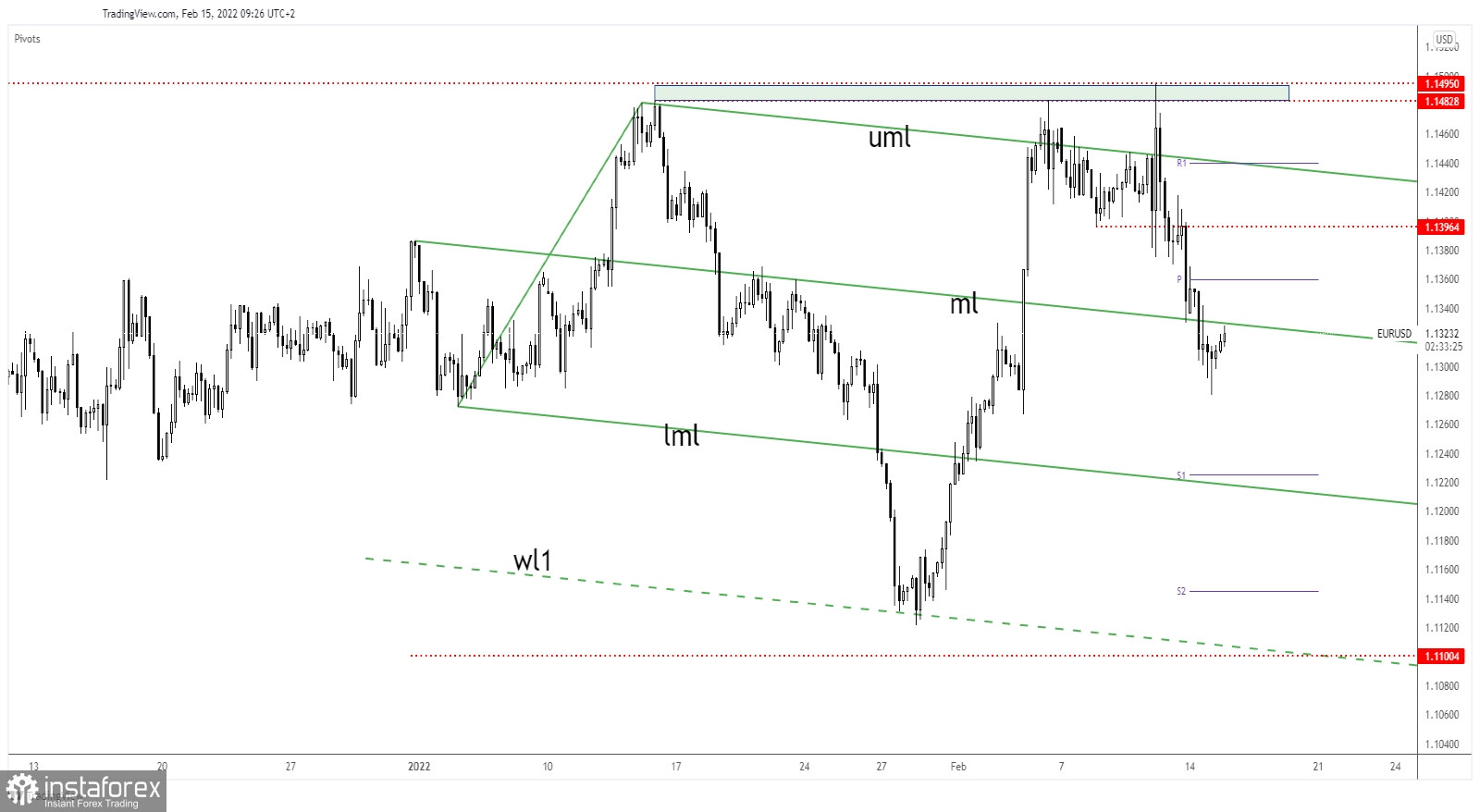

EUR/USD tries to retest the descending pitchfork's median line (ml) which stands as a dynamic resistance. The price was somehow expected to turn to the downside after registering a false breakout with great separation above the 1.1482 - 1.1495 area.

Also, its failure to stabilize above the upper median line (uml), EUR/USD signaled that it could come back down. A minor rebound or a sideways movement could represent a bearish continuation pattern.

EUR/USD Outlook!

The bias remains bearish despite temporary rebounds. Testing and retesting the median line (ml) and the 1.13 psychological level, registering only false breakouts could bring new selling opportunities. 1.1200 and the descending pitchfork's lower median line (lml) could be used as downside obsatcles.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română