Technical Market Outlook

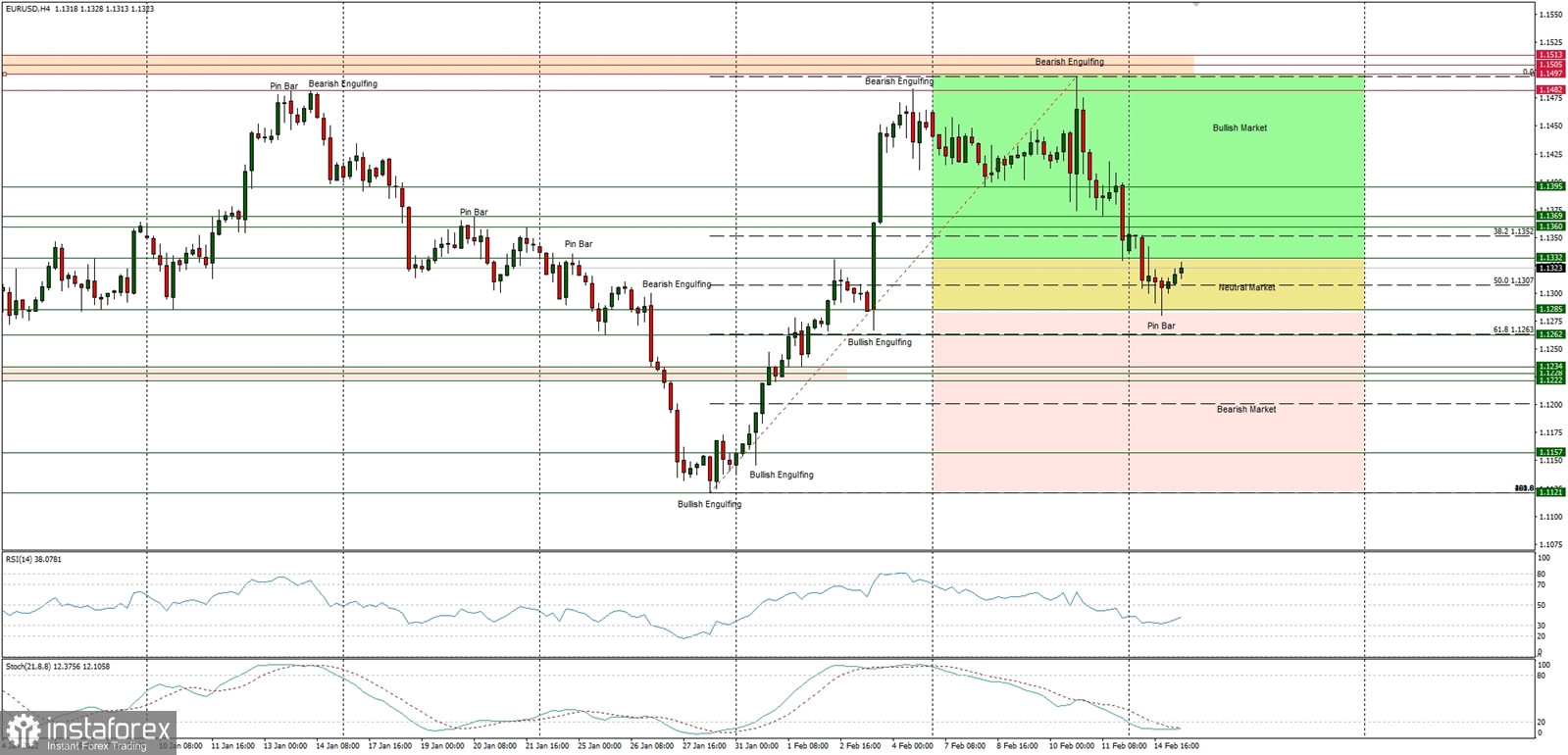

The EUR/USD bears had made a Bearish Engulfing pattern twice already, so the bulls are in retreat. The pull-back has hit the neutral market edge located at the level of 1.1265. The Pin Bar candle made at this support might be the firs indication of the bounce, however, the next target for EUR/USD bulls is the key short-term supply zone located between the levels of 1.1497 - 1.1513 and if this zone is clearly violated, then the market might continue the up move for the longer period of time. This is why this zone is so important and bears are defending the zone. The immediate technical support is seen at 1.1265. The weak and negative momentum on the H4 time frame char indicated the strong bearish pressure during the pull-back, but the market conditions might start to bounce the overbought levels. The wave up could resume any time soon.

Weekly Pivot Points:

WR3 - 1.1591

WR2 - 1.1535

WR1 - 1.1426

Weekly Pivot - 1.1377

WS1 - 1.1255

WS2 - 1.1207

WS3 - 1.1092

Trading Outlook:

The recent big Bullish Engulfing candlestick pattern seen at the weekly time frame chart indicates a strong rebound, but the market is still in control by bears that pushed the price way below the level of 1.1501, so a breakout above this level is a must for bulls for a trend reversal. The next long-term technical support is located at 1.1167. The up trend can be continued towards the next long-term target located at the level of 1.2350 (high from 06.01.2021) only if bullish cycle scenario is confirmed by breakout above the level of 1.1501 and 1.1599,m otherwise the bears will push the price lower towards the next long-term target at the level of 1.1166.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română