Crypto Industry News:

Gyorgy Matolcsy, president of the Hungarian National Bank, proposed a complete ban on cryptocurrency trading and mining operations throughout the European Union.

Governor Matolcsy, in a blog post shared by the Hungarian Central Bank aka Magyar Nemzeti Bank (MNB), titled "It's time to ban cryptocurrency trading and mining in the EU," cited a recent cryptocurrency ban imposed by China.

He also drew attention to the proposal of the Russian central bank, which calls for a complete ban on domestic trading and mining of cryptocurrencies. Back on the proposal to ban cryptocurrencies, Matolcsy said:

"I completely agree with this proposal, and also support the position of the EU's senior financial regulator that the EU should ban the mining method used to produce most of the new Bitcoins."

The governor strongly believes in the potential of cryptocurrencies to "facilitate illegal activities and build financial pyramids." Matolcsy also highlighted the concerns of the Russian central bank - that the market value of cryptocurrencies is determined by "speculative demand for future growth that creates bubbles."

Lastly, Governor Matolcsy called for a total ban on cryptocurrencies to counter the risks of pyramid schemes and bubbles.

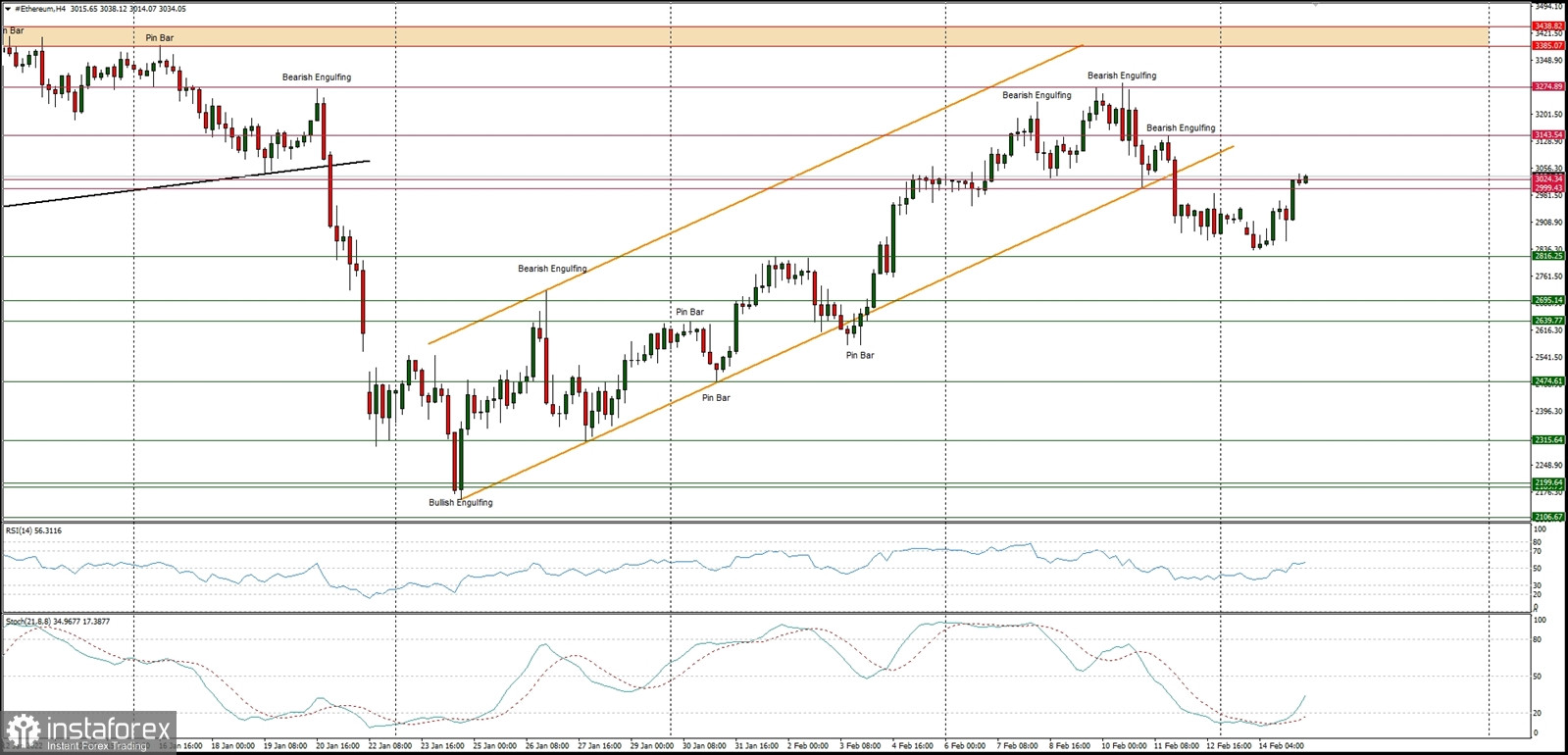

Technical Market Outlook

The ETH/USD pair has bounced back above the level of $3k and made the local high at $3,046 (at the time of writing the article). The nearest technical support is seen at $2,816 and $2,999. The intraday technical resistance is located at $3,024. The next target for bulls is the supply zone located between the levels of $3,385 - $3,438. The bulls are in control of the market on the higher time frames as the momentum is strong and positive on the daily time frame chart as well, so the market is bouncing from the extremely oversold conditions.

Weekly Pivot Points:

WR3 - $3,490

WR2 - $3,400

WR1 - $3,079

Weekly Pivot - $2,975

WS1 - $2,651

WS2 - $2,541

WS3 - $2,228

Trading Outlook:

The market is bouncing after over the 50% retracement made since the ATH at the level of $4,868 was made. The level of $3,436 is the next key technical resistance for bulls. On the other hand, the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term retracement level for bulls.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română