The Washington stimulus drama is creating a deja vu effect. It now resembles the never-ending Brexit saga. How long could the whole story last? The main victim in this situation is the US dollar. Notably, the dollar's rate is falling amid a noticeable increase in the yield of the US government bonds. All this could be explained by the expectations of a new stimulus package. The growing US budget deficit implies an increase in the yield curve of the government bonds and a decline in the US dollar.

Regarding the US government debt securities, the results of today's 20-year Treasury bond auction should show whether the market has reached a balance following the recent hike in interest rates. The same does not work for the greenback. To define its further direction, we need to look at the price of precious metals, gold and silver, which have resumed their growth.

The tendency to bet on the US dollar's decline worries the dollar bears. And there is a reason for that. A large volume of speculative deals based on expectations of a rise or fall in any currency can provoke a sharp trend reversal.

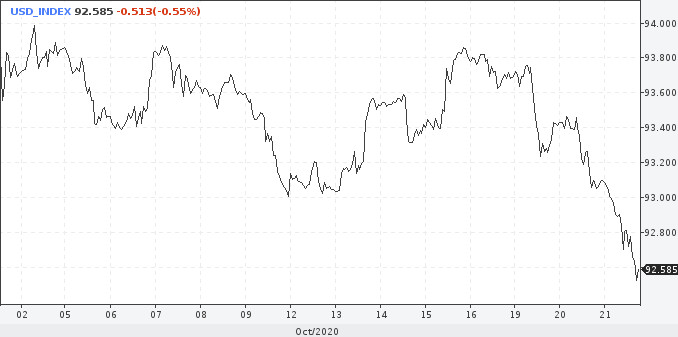

Notably, in the second half of the year, the US dollar index has lost about 4% of its value. Traders hope for a continuation of the downtrend. Thus, on Wednesday the market saw a larger than normal volume of long positions in the euro and the aussie against the American currency. The data itself does not say much. However, such positioning creates conditions for a sharp change in the US dollar rate in the event of new economic or political shocks. And there are plenty of such potentially shocking events in the near future.

As a rule, when a currency strongly depreciates against the US dollar after a certain event, traders open a large number of long positions on it. This creates a domino effect, and the dollar starts to rally.

At the moment, the American currency looks rather weak. The dollar bears pushed the price down to the levels of 93.00 and 92.70. Maybe it's time for the US dollar to start a correction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română