Yesterday's trading on the pound/dollar currency pair ended without a preponderance of one of the parties. I believe that this was caused by conflicting information about trade negotiations between the UK and the European Union. Thus, British Prime Minister Boris Johnson actually delivered an ultimatum, saying that if the European Union does not radically change its position, trade negotiations will not continue. Such a statement increases the chances of a hard Brexit, that is, the UK leaving the EU without a deal. It's no secret that Johnson has previously taken a very categorical position and was a supporter of a hard Brexit.

However, officials from the EU and the UK responsible for Brexit negotiations, despite the statements of the British Prime Minister, are calling for them to resume. I believe this is nothing more than a political and psychological game played by both sides involved in the protracted divorce process. However, no one said that it would be easy and painless to escape from the clutches of Brussels officials and leave the European Union.

Now about yesterday's speech by the representative of the Bank of England, Gertjan Vlieghe, in which he stated the need for more stimulus measures. According to Vlieghe, due to the increased number of cases of COVID-19 infection, the risks to the British economy are significantly increasing. In this case, it is necessary to carefully consider the introduction of negative interest rates, as well as an increase in the asset purchase program by another 100 billion pounds. Many experts believe that at its next meeting, the Bank of England may announce such a step and expand the volume of asset purchases.

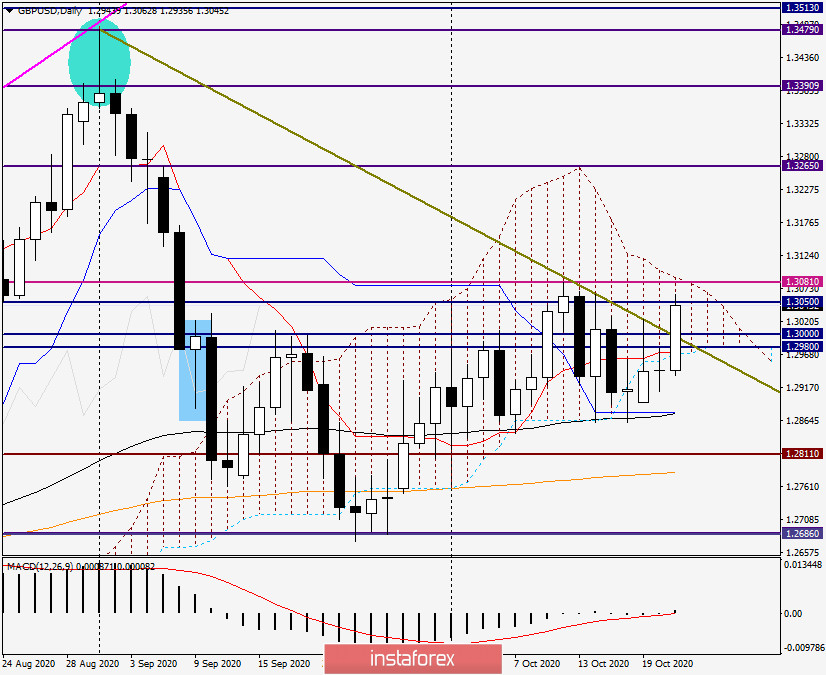

Daily

As a rule, on such messages, the British pound is immediately under strong selling pressure, and its rate is significantly reduced. However, this did not happen yesterday. The bears' attempts to put the price under pressure were limited at 1.2910. Bulls on the pound also showed activity and tried to return the quote to the limits of the Ichimoku indicator cloud. As a result, a draw in the form of a doji candle with equidistant shadows. But today, at the time of writing, the British pound is showing quite strong growth, which could be caused by a large block of macroeconomic statistics received from the UK, published at 07:00 London time. However, if you look at the economic calendar and look at today's British reports on retail, purchasing, selling, and consumer prices, you can see that the data is quite ambiguous. In other words, mixed. I do not rule out that such strong growth in sterling is caused by the current weakness of the US currency.

The GBP/USD pair breaks through resistance after resistance and rushes to the upper limit of the daily Ichimoku indicator cloud. If the pound bulls manage to bring the price up from the cloud and gain a foothold over its broken upper border, you can try buying the "British" on the rollback to it. The same trading strategy can be applied after the breakout of the resistance level of 1.3081, especially since it passes near the upper border of the cloud.

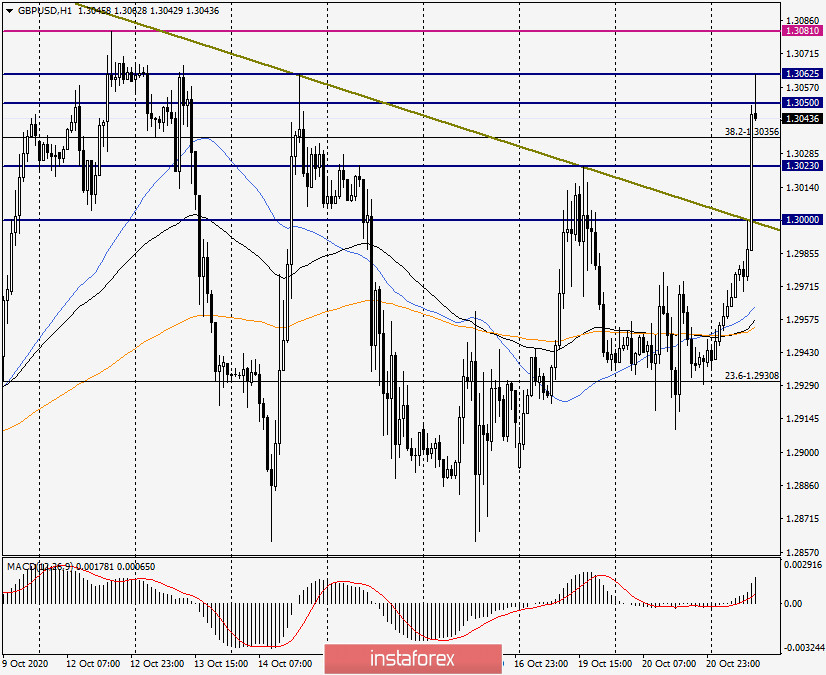

H1

At the end of this article, the pair is testing the resistance of sellers at 1.3062 for a breakdown. Turning to the trading recommendations, I believe that buying right here and now is not wise. You need to wait for either the breakdown itself, and buy on the rollback to it, or consider buying on the rollback to the broken resistance level of 1.3023, where the highs of yesterday's session were shown. Given such strong growth, the pullback may be very small, thus, the zone for purchases can be expanded and determined in the area of 1.3035-1.3025.

If the breakout of 1.3062 does not take place and a bearish candlestick pattern appears, this will be the basis for opening sales with the nearest target near 1.3023. The same goes for the next resistance level of 1.3081. I think that now you should not rush and jump on the outgoing train. It is better and safer to wait for the stop and calmly enter it.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română