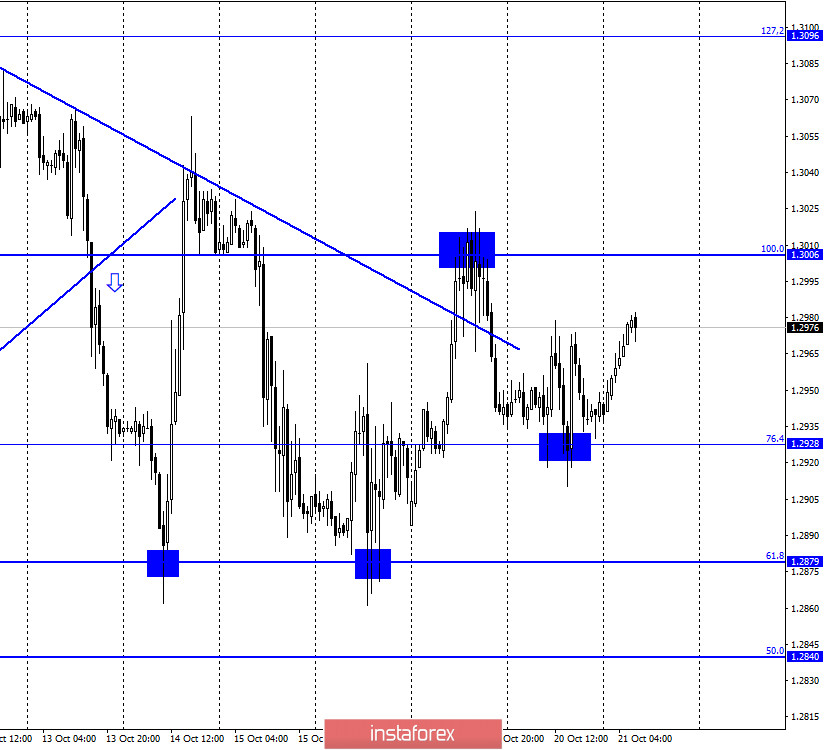

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair yesterday has fulfilled the fall to the level of 76.4% (1.2928), rebound off it and a turn in favor of the British currency, with the resumption of the process of growth towards the corrective level 100.0% (1.3006). Earlier, quotes of the pair performed a consolidation above the trend line, thus, no clear trends at the current time. Moreover, if you look at the trading in the last two weeks, it becomes clear that traders are in a state close to panic. The British can safely go 200 points up today, and tomorrow – the same amount down. According to the trade agreement, Brussels and London have not been able to agree, the coronavirus epidemic in the UK continues to gain momentum, the Bank of England will lower the key rate and expand the program to stimulate the economy. What awaits the British pound in 2021? I do not want to think at all now. However, one thing is clear – nothing good. Thus, from my point of view, the British can fall down almost at any time, since this is the most logical option. The UK currency does not have any support from the news and only far from the best information background from the US helps the British to balance on the edge of the abyss.

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a rebound from the corrective level of 38.2% (1.3010), but has already performed a reversal in favor of the British and resumed the growth process. A new rebound from the level of 38.2% will again work in favor of the US currency and a slight drop in quotes in the direction of the Fibo level of 50.0% (1.2867). Fixing the pair's rate above the level of 38.2% will increase the chances of continuing growth towards the next corrective level of 23.6% (1.3191).

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a reversal near the corrective level of 76.4% (1.3016) in favor of the US currency, however, the fall in quotes did not last long, and the lower charts now indicate that there is no clear downward trend.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, thus, a false breakout of this line followed earlier. The pair returns to a downward trend.

Overview of fundamentals:

There were no important economic reports or news in the UK on Tuesday. The same pattern was observed in the United States. Trading activity has declined in recent days, and the 4-hour chart stubbornly shows a sideways corridor.

The economic calendar for the US and the UK:

UK - consumer price index (06:00 GMT).

On October 21, the UK and American news calendars contain one report for two. We are talking about inflation in Britain and this report has already been released. In September, inflation rose to 0.5% y/y, which is exactly what traders were counting on. There was no reaction from the British to this report.

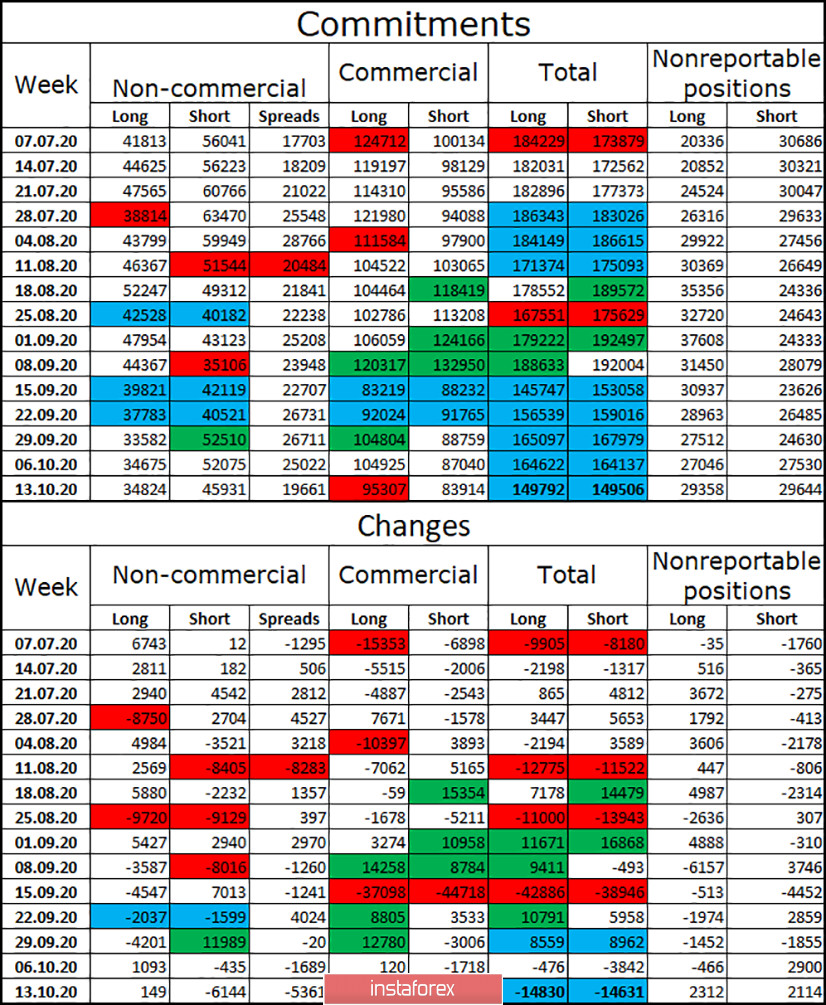

COT (Commitments of Traders) report:

The latest COT report on the British pound that was released last Friday showed that the category of "Non-commercial" traders got rid of short contracts in the reporting week, closing more than 6 thousand in total. Long-contracts speculators opened only 149. Thus, the mood of large speculators has become more "bullish", which is quite strange, since in recent months there has been a desire to sell the British, rather than buy it. However, the last three weeks are left to the bull traders. At the same time, it is very difficult to say that the pound sterling is showing strong growth. Most likely, the situation is as follows: due to the strong information background, major players often change their decisions, and the British often changes the direction of movement.

Forecast for GBP/USD and recommendations for traders:

Today, I recommend buying the GBP/USD pair with a target of 1.3096, if the consolidation above the corrective level of 100.0% (1.3006) is completed. I recommend selling the British dollar with a target of 1.2928 if there is a rebound from the level of 100.0% on the hourly chart.

Terms:

"Non-commercial" - large market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română