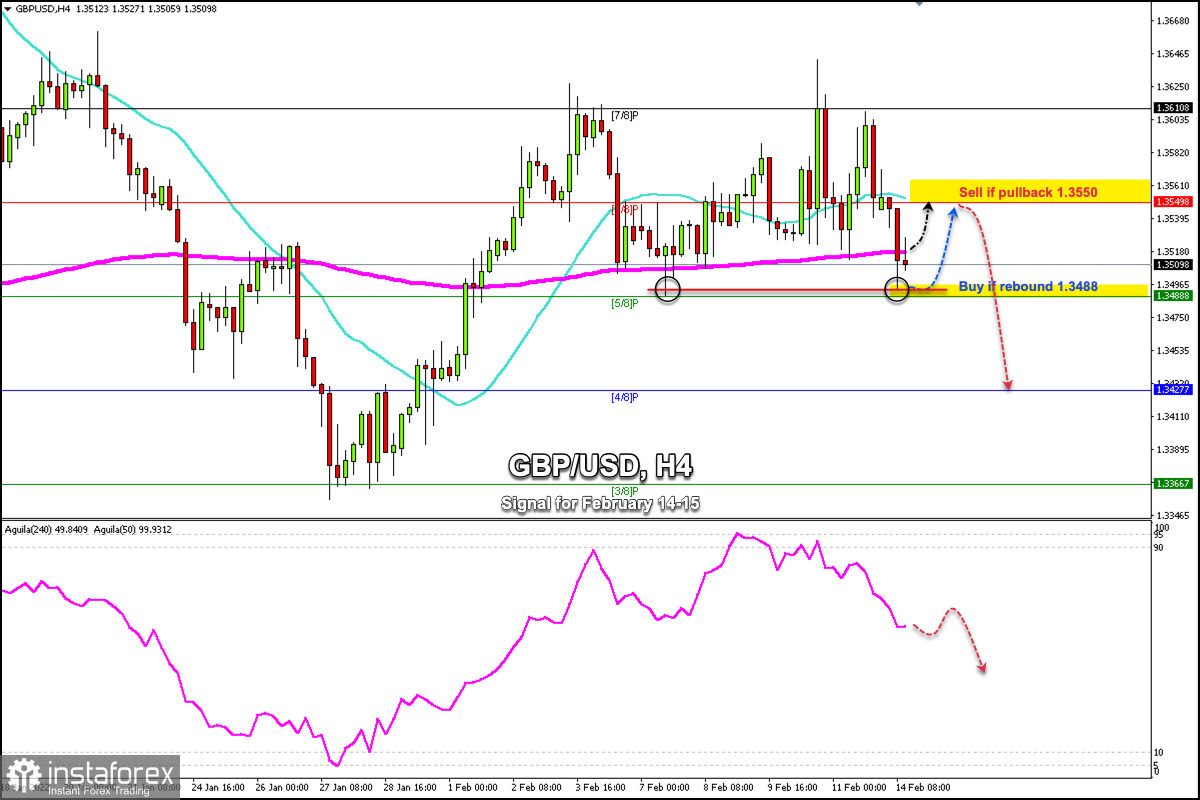

At the beginning of the American session, GBP/USD is trading at 1.3509, below the 200 EMA and above 5/8 Murray.

The British pound has strong support at the zone of 1.3488. On the H4 chart, a double bottom has formed around this area.

News that Russia could invade Ukraine this week is causing investors to seek safe haven in the US dollar.

This could cause investors to stop buying GBP/USD and an acceleration to the downside could occur towards the support level at 1.3427 (4/8 Murray) and at a low of Jan 27 at 1.3366.

GBP/USD is expected to remain consolidated above 3/8 Murray in the coming hours. That will give us the opportunity to buy with targets towards the 21 SMA located at 1.3550.

On the other hand, a sharp break below 1.3488 could cause an acceleration to the downside towards 1.3427 and even 1.3366.

In case bullish sentiment returns to the market, the area of 1.3550 emerges as the initial barrier that coincides with SMA 21. A close above this level on the daily chart could give us a strong bullish momentum towards 1.3610 (7/8 Murray)

The market sentiment report shows that there are 52.82% of traders who are buying the GBP/USD pair. This is a negative sign. If this figure is increasing, a drop in the pair could occur in the coming days.

Support and Resistance Levels for February 14 - 15, 2022

Resistance (3) 1.3604

Resistance (2) 1.3603

Resistance (1) 1.3549

----------------------------

Support (1) 1.3588

Support (2) 1.3462

Support (3) 1.3427

***********************************************************

Scenario

Timeframe H4

Recommendation: Buy if rebound

Entry Point 1.3488

Take Profit 1.3509, 1,3488, 1.3427

Stop Loss 1.3525

Murray Levels 1.3610 (7/8), 1.3549(6/8), 1.3488 (5/8), 1.3427 (4/8)

Alternative scenario

Timeframe H4

Recommendation: sell if it pullback

Entry Point 1.3550

Take Profit 1.3427

Stop Loss 1.3590

***************************************************************************

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română