Yesterday's assumptions that the main currency pair is likely to continue its upward trend were fully justified. Uncertainty about fiscal stimulus, as well as expectations for the US presidential election, are putting pressure on the US currency at this stage in time. Market participants believe that Joe Biden's victory may lead to additional stimulus measures, which will weaken the US dollar. On the other hand, postal voting can lead to contesting the results of presidential elections and cause destabilization of the situation in the United States of America itself. In this scenario, investors will probably prefer to go to safe havens. Thus, the current market sentiment should not be considered clearly defined and consistent.

As for macroeconomic statistics, yesterday's data on the US housing market came out mixed. Construction permits exceeded the forecast value of 1.52 and amounted to 1.553. However, the bookmarks of new housing were weaker than the forecast of 1.457 and were at 1.415. However, I do not think that yesterday's reports on the US housing market had a significant impact on the price dynamics of the main currency pair. Investors are now much more interested in the adoption of a new package of stimulus measures in the United States and the same painful topic of the spread of COVID-19. In Europe, a sharp spike in coronavirus infections continues, which leads to the introduction of strict restrictions, for example in Ireland and France. Several Western European countries have already imposed or will continue to impose curfews. The situation continues to be alarming in countries such as Belgium, the Czech Republic, Italy, and Spain.

Even though market participants are not paying such close attention to macroeconomic statistics, it is worth noting today's regular speech by ECB head Christine Lagarde, which will take place at 08:30 London time. Further, from the US monetary policymakers, speeches will be made by members of the Open Market Committee Brainard and Mester.

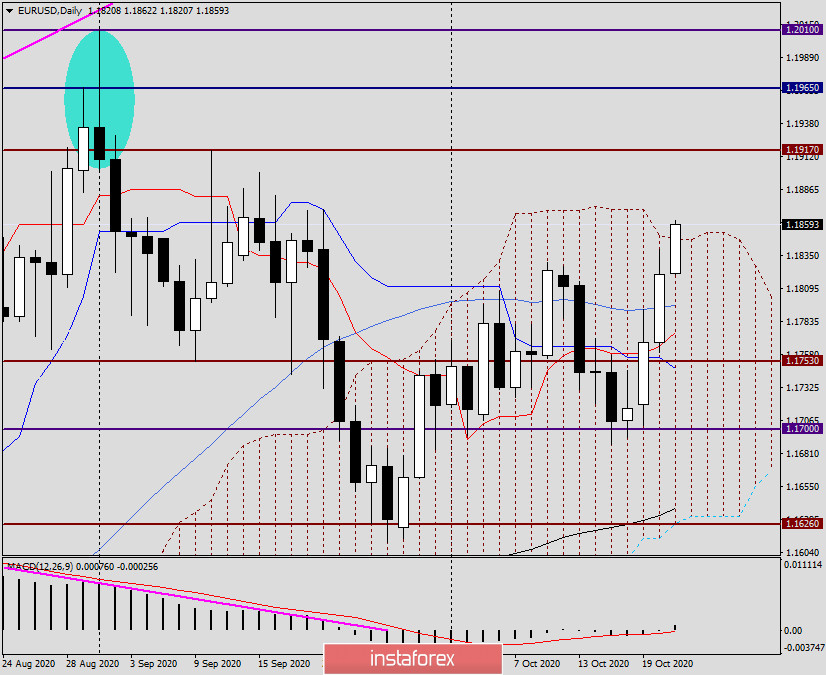

Daily

Looking at the daily chart of the euro/dollar pair, we see that the quote is already breaking through the upper limit of the Ichimoku indicator cloud, the true exit up from which will further strengthen the bullish mood for EUR/USD. At the end of the review, this is exactly what happens: the pair is trading above the upper boundary of the cloud, near the important technical level of 1.1860. If the quote is fixed above the cloud, you can plan purchases on the rollback to its broken upper border. This is for those traders who focus on the daily timeframe. However, in my personal opinion, it is better to look for options for entering the market in smaller time intervals.

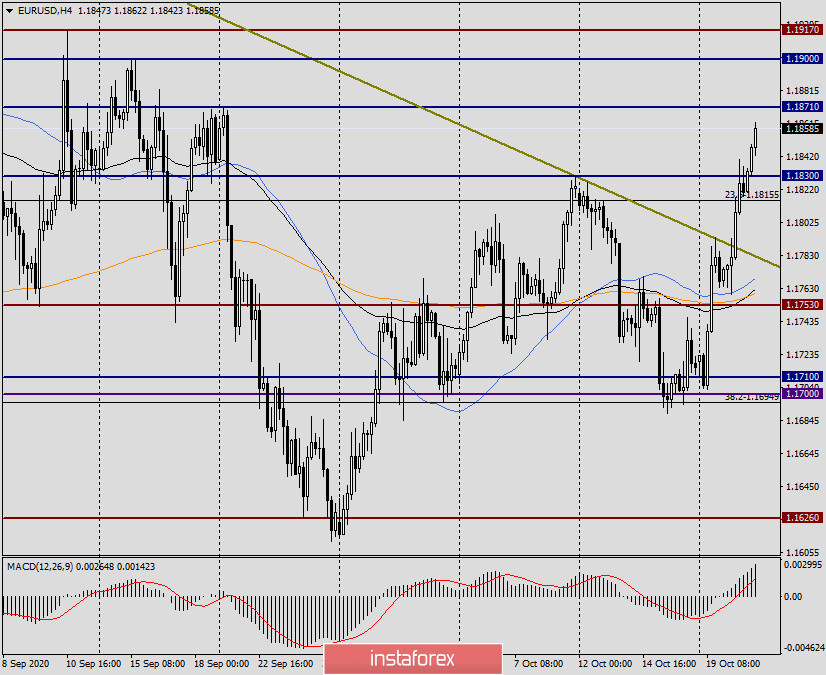

H4

In this timeframe, the breakdown of the strong resistance of sellers at 1.1830 is visible. If the quote is fixed above this level, purchases with targets 1.1871, 1.1900, and 1.1917 can be considered on the rollback to the broken mark. I would like to note that all of these goals represent the following resistances, thus, those who are buying or intend to open long positions on EUR/USD should be very careful and do not set large goals yet. In the event of a change in market sentiment in favor of the US dollar, a sharp downward reversal may occur from the designated target marks. In the meantime, taking into account yesterday's highs shown at 1.1840, the main trading recommendation for EUR/USD is to buy after a pullback to the price zone of 1.1845-1.1830.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română