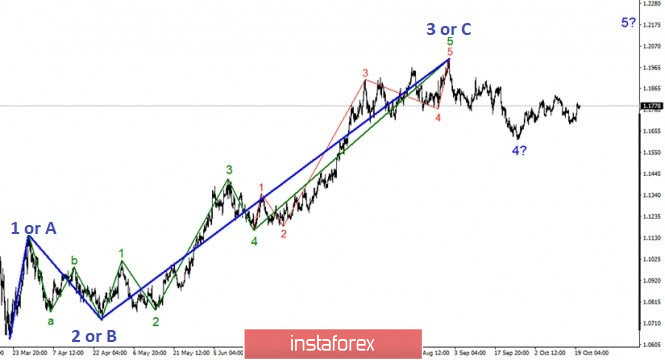

The wave marking of the EUR/USD instrument in looks quite convincing and has not changed at all recently. The main option remains to increase quotes from the current levels within the framework of building wave 5 with goals located above the maximum of the expected wave 3 or C. This means that the instrument will increase to at least 20 figures and most likely even higher. There is no question of adopting a more complex form of wave 4 at this time. Wave 5 already takes a rather complex form, since its internal wave structure is not similar to the standard pulse one.

Smaller-scale wave markings still show that the proposed wave 4 has assumed a three-wave form and is most likely complete. If this is true, then the price increase will resume within wave 5. However, in recent days, doubts have begun to arise that the current price increase is really wave 5. It is quite possible that wave 4 becomes more complex and takes the form a-b-c-d-e. This option is supported by the fact that the instrument failed to make a successful attempt to break the maximum of wave b at 4. However, until a successful attempt to break through the 23.6% Fibonacci level, this option remains secondary.

The Euro was in high demand on Monday. Though there were no specific reasons for this, the markets found reasons to buy. Christine Lagarde's rhetoric on Monday was not in favor of the Euro. The head of the ECB announced that there will most likely be a slowdown in the EU economy due to the second wave of the Coronavirus. Jerome Powell's speech was about digital currencies. The head of the Federal Reserve said that the central bank has not yet made a final decision on the introduction of a state digital currency in the United States. "We strive to carefully evaluate the potential costs and benefits of digital currency for the US economy and payment system. We have not yet made a decision on the introduction of a digital currency," said Powell. Thus, the speeches of the heads of the ECB and the Federal Reserve could not cause a strong increase in the instrument.

At the same time, there was barely any other news. In America, the conflict between Donald trump and the country's chief epidemiologist, Anthony Fauci, continues. Fauci repeatedly refuted the words of Trump. The American media and citizens believed more in Fauci's credibility, and not Trump, who repeatedly made absurd statements about the pandemic. Now, reporters are reporting that Trump said the following in a phone call: "Fauci is a disaster. If I listened to it, we would have half a million deaths." Given the current realities, Fauci changed his forecast for mortality in the United States from 200 thousand to 400 thousand people and the country is moving towards this figure.

General conclusions and recommendations:

EUR / USD will presumably continue the formation of wave 5. However, the absence of a break of the high of wave b in 4 suggests the possible complication of wave 4. Thus, at this time, I would still recommend purchasing the instrument with the objectives located about settlement marks 1,2012 (which corresponds to 0.0% of Fibonacci )on every MACD signal up, based on building a global wave 5. However, in the case of a successful attempt to break 23.6% level will result in the increase of the complexity of wave 4.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română