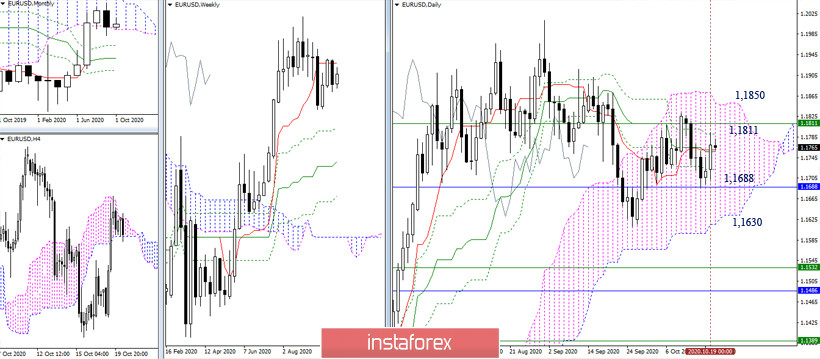

EUR / USD

The bulls managed to return to the middle, which is currently the daily cross, while continuing to interact with its levels (1.1722 - 1.1757-60 - 1.1791). The most significant support level 1.1688 (lower limit of the monthly cloud) and resistance level 1.1811 (weekly short-term trend) retain their value and location. If these levels will be broken, the main task will be to leave the daily bullish cloud (1.1850 or 1.1630).

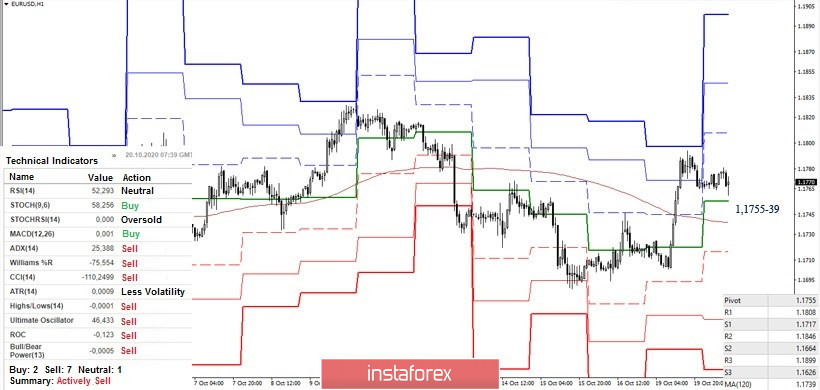

The bulls took the lead and turned the key levels on the hourly TF (central pivot level 1.1755 and weekly long-term trend 1.1739) into support. A bullish advantage in this period will be guaranteed if we work above these levels. Now, the next targets within the day for the growth to continue are 1.1808 - 1.1846 - 1.1899 (classic pivot levels). A reliable consolidation below the range of 1.1755-39 will swing the scales again in favor of the bears. Today, the pivot points (support levels) are located at 1.1717 (S1) - 1.164 (S2) - 1.1626 (S3).

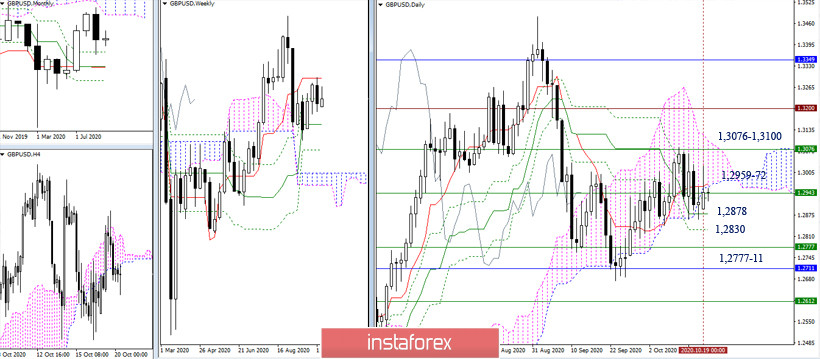

GBP / USD

The uncertainty continues. Yesterday, the bulls failed to stay in the daily cloud and take over the daily short-term, but it is by breaking through these limits (1.2959-72) that will allow them to rely on the current advantage and make further plans to reach important limits in this area 1.3076 - 1.3100 (weekly Tenkan + exit from the daily cloud to the bullish zone). Meanwhile, for the bears, the levels of 1.2878 (daily Kijun) - 1.2830 (daily Fibo Kijun) - 1.2777 (weekly Kijun) - 1.2711 (monthly Fibo Kijun) are still the important stages of strengthening their positions and moods.

There is also uncertainty on smaller time frames. The pound/dollar pair cannot leave the key attraction zone formed by the main levels of the lower time frames, the central pivot level (1.2954) and the weekly long-term trend (1.2952). On the other hard, bears consider the support levels of 1.2883 - 1.2824 - 1.2753 as intraday targets, while for the bulls, their pivot points are located today at 1.3013 - 1.3084 - 1.3143.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română