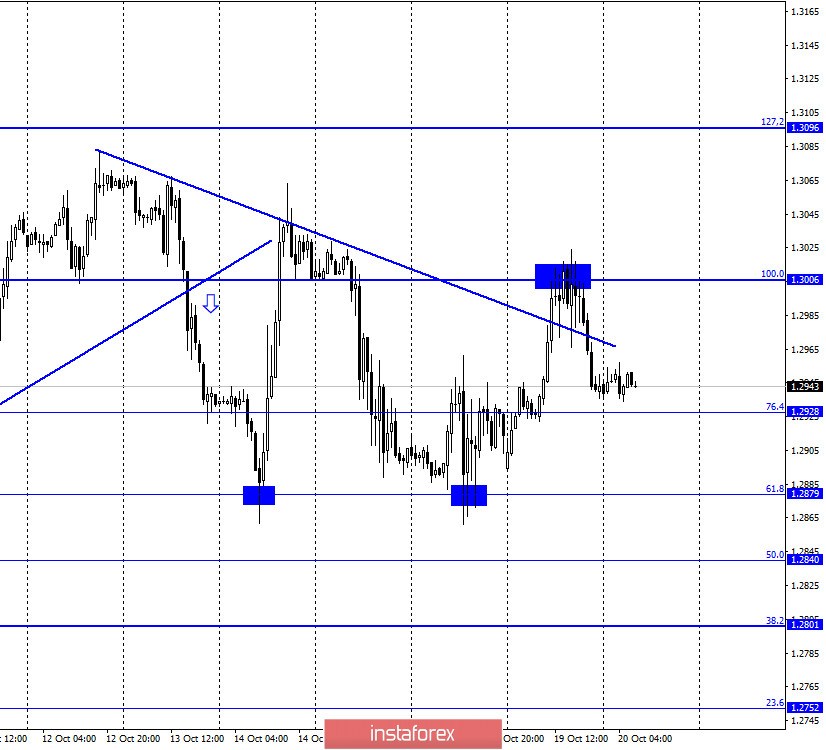

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair performed yesterday an increase to the corrective level of 100.0% (1.3006), a rebound from it, a reversal in favor of the US dollar, and a fall almost to the Fibo level of 76.4% (1.2928). Thus, the rebound of quotes from this level will work in favor of the British and the resumption of the growth process in the direction of the level of 100.0%. Since the quotes have been fixed above the trend line, it is now impossible to say exactly what is the mood of traders. All trades in recent days and even weeks for the British are quite complex. On the topic of Brexit in recent weeks (starting from September 1), there has been such a huge amount of negative news that I personally wonder how the pound manages to stay afloat. At first (in early September), its quotes of course collapsed down, but after that, the British are trading quite confidently. Perhaps, traders are once again optimistic about the future. Let me remind you that in previous years when Brexit has already begun, the British dollar has repeatedly grown simply on the positive expectations of traders. It may be the same situation now. Traders believe that eventually a deal between Brussels and London will be concluded and do not want to take into account the negative. Formally, the negotiations continue, despite "loud" statements from both sides about the beginning of preparations for Brexit without an agreement. At the same time, Brexit itself is less than 10 weeks away, so the chances continue to fade before our eyes, and there is still no progress in resolving key issues.

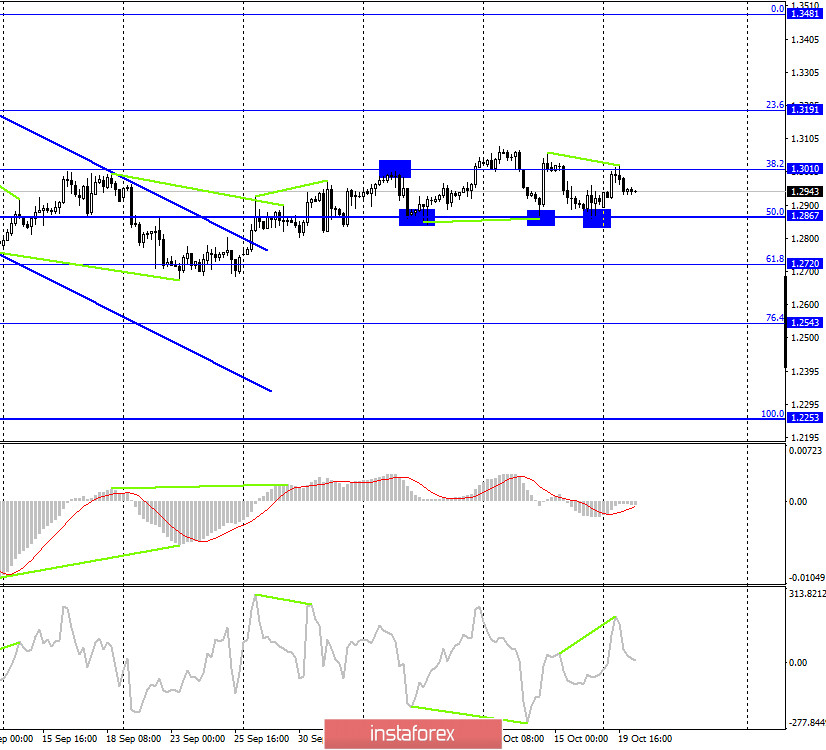

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a rebound from the Fibo level of 50.0% (1.2867), a reversal in favor of the British currency, and an increase to the corrective level of 38.2% (1.3010). The rebound of quotes from this level worked in favor of the US currency and the resumption of the fall towards the level of 50.0%. The bearish divergence of the CCI indicator also worked in favor of the beginning of the fall in quotes. Closing below the Fibo level of 50.0% will increase the chances of continuing the fall towards the next corrective level of 61.8% (1.2720).

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a reversal near the corrective level of 76.4% (1.3016) in favor of the US currency and began the process of falling in the direction of the corrective level of 61.8% (1.2709). However, the lower charts now indicate that there is no clear downward trend.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, thus, a false breakout of this line followed earlier. The pair returns to a downward trend.

Overview of fundamentals:

There were no important economic reports or news in the UK on Monday. The results of the EU summit are disappointing for the British. Jerome Powell's speech did not affect the mood of traders.

News calendar for the United States and the United Kingdom:

On October 20, the news calendars of the United Kingdom and America do not contain anything interesting. Thus, the information background for this pair will be absent today.

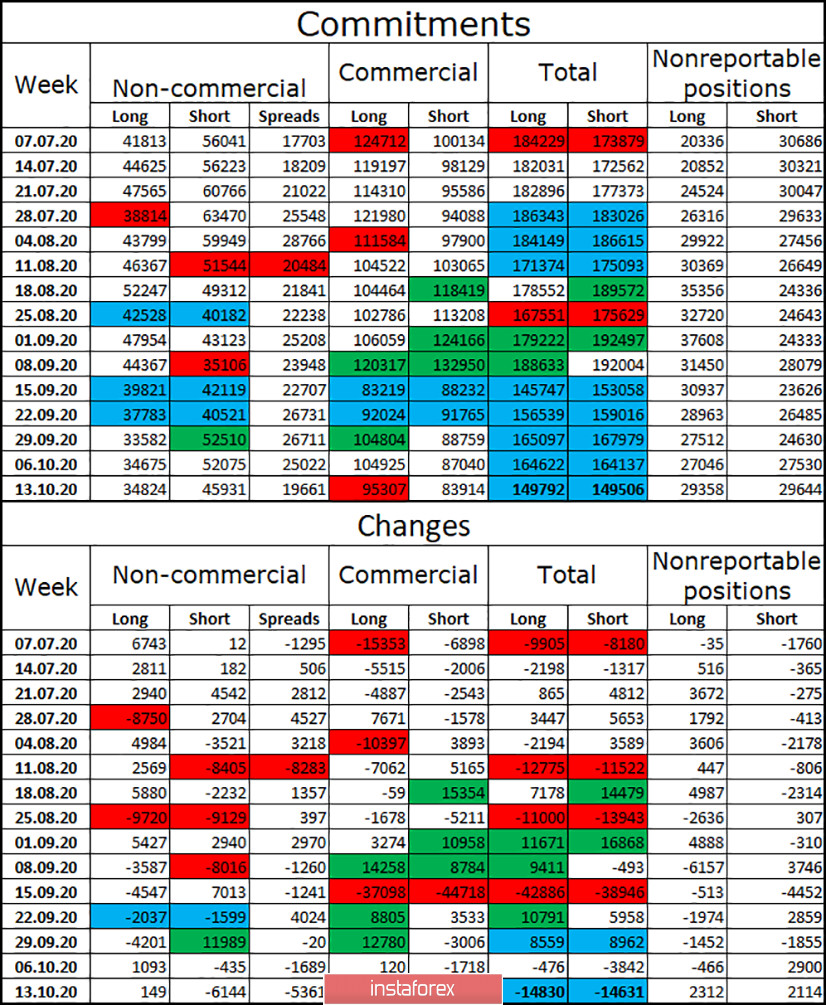

COT (Commitments of Traders) report:

The latest COT report on the British pound that was released last Friday showed that the category of "Non-commercial" traders got rid of short contracts in the reporting week, closing more than 6 thousand in total. Long-contracts speculators opened only 149. Thus, the mood of major speculators has become more "bullish", which is quite strange, since in recent months there has been a desire to sell the British, rather than buy it. However, the last three weeks are left to the bull traders. At the same time, it is very difficult to say that the pound sterling is showing strong growth. Most likely, the situation is as follows: due to the strong information background, major players often change their decisions, and the British often changes the direction of movement.

Forecast for GBP/USD and recommendations for traders:

Today, I recommend buying the GBP/USD pair with a target of 1.3006, if the rebound from the corrective level of 76.4% (1.2928) is completed. I recommend selling the British dollar with the targets of 1.2879 and 1.2840 if the close is made under the level of 76.4% on the hourly chart.

Terms:

"Non-commercial" - large market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română