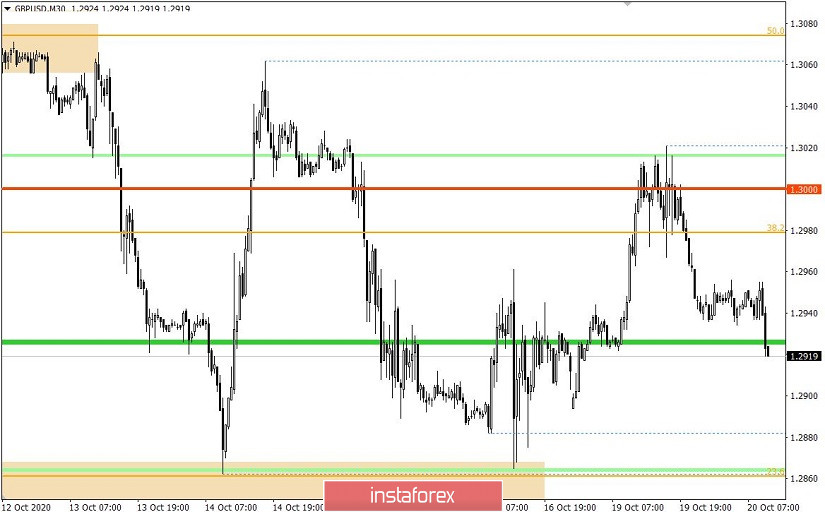

Yesterday, the GBP/USD pair showed high activity, which resulted in a formation of inertial movement. This led the quote to return to the psychological level of 1.3000, where there was a slowdown followed by the restoration of short positions.

Speculators, who have ruled the market for a week already, continue to widen their trading positions in the market, which is confirmed by the characteristic impulses that arise when a particular noise from the information flow appears. Thus, you don't need to be an expert in technical or fundamental analysis to prove who's the main player in the market.

It is because of the high speculative activity that you should be more careful with positions in the week-month perspective.

On the other hand, trade tactics are focused on short-term transactions of 1-2 days, where areas of interaction of trade forces serve as tools, as well as monitoring hot topics – Brexit, COVID-19, which serve as a lever for speculation.

Analyzing yesterday's fifteen-minute period, there was a surge in long positions at 5:30-9:30 UTC+00, where the quote reached the psychological level of 1.3000. After that, there was a stagnation. By 16:15 UTC+00, a lot of short positions appeared, which returned the quote to the area of 1.2935/1.2955, where there was a new stagnation.

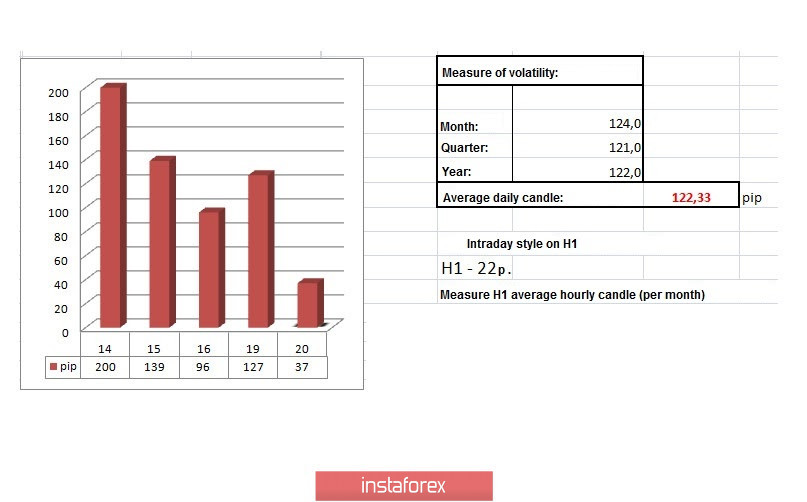

In terms of yesterday's daily dynamics, an indicator of 127 points is recorded, which is 3% higher than the average level and 32% higher than the dynamics of last Friday. The acceleration is visible, where the speculative ratio continues to rise.

As discussed in the previous analytical review, traders were prepared that the volume of long positions would decline in one of the coordinates of 1.3000 or 1.3060.

Looking at the trading chart in general terms (daily period), you can see that the quote is still in the structure of a corrective move from the local low of 1.2674, where there are prerequisites for the restoration of downward interest.

In terms of news background, there are no significant statistics on the UK and the US yesterday, due to this, speculators' attention was focused on the information background.

So, in terms of information flow, Boris Johnson announced yesterday that London is ready to amend the bill on the protection of the domestic market in order to relieve pressure from trade negotiations on Brexit, which is clearly positive news and it was on the basis of it that we saw the initial surge in long positions. It is worth considering that Mr. Johnson's words are not specific, and this was the reason why the growth stopped.

In turn, Maros Sefcovic, Eu Deputy Chairman, co-chaired the fourth meeting of the EU-UK joint committee in London, where he insisted removing all the hindrances immediately, so that the Brexit agreement will be fully implemented.

As you can see from the above material, speculators have enough tools to further manipulate the market.

In terms of the economic calendar, US construction data will be released today, where the sector is expected to grow. The number of new construction projects may grow by 2.8%, and building permits by another 1.8%.

Further development

Analyzing the current trading chart, you can see that there was a narrow flat at 1.2935/1.2955 during the start of the Asian session, which became a kind of leverage for speculators working on a breakdown of consolidation. If the price is kept below 1.2920, it does not exclude further decline in the direction of the pivot point 1.2860/1.1880, where a new slowdown is likely to occur.

In turn, do not forget to monitor hot topics (Brexit & COVID-19) from the resources Bloomberg, Wall Street Journal, and Reuters.

Indicator analysis

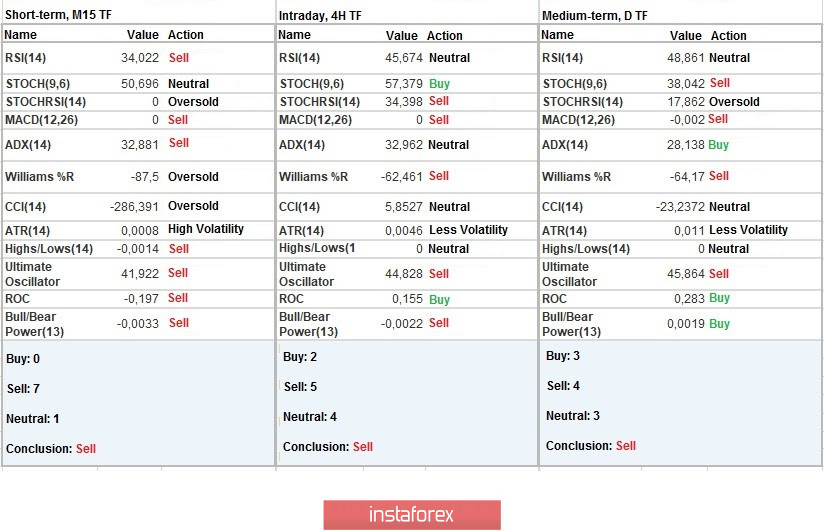

Analyzing different sectors of time frames (TF), we see that technical indicators hourly and minute TFs have a sell signal due to a speculative price surge. Meanwhile, the daily TF has a sell signal also, but the indicators are still volatile.

Weekly volatility / Volatility measurement: Month; Quarter; Year

The volatility measurement reflects the average daily fluctuations, calculated per Month / Quarter / Year.

The dynamics of the current time is 37 pips, which is 69% below the average. We can assume that speculative excitement will continue to surge activity on the market.

Key levels

Resistance zones: 1.3000 ***; 1.3200; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support zones: 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411).

* Periodic level

** Range level

*** Psychological level

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română