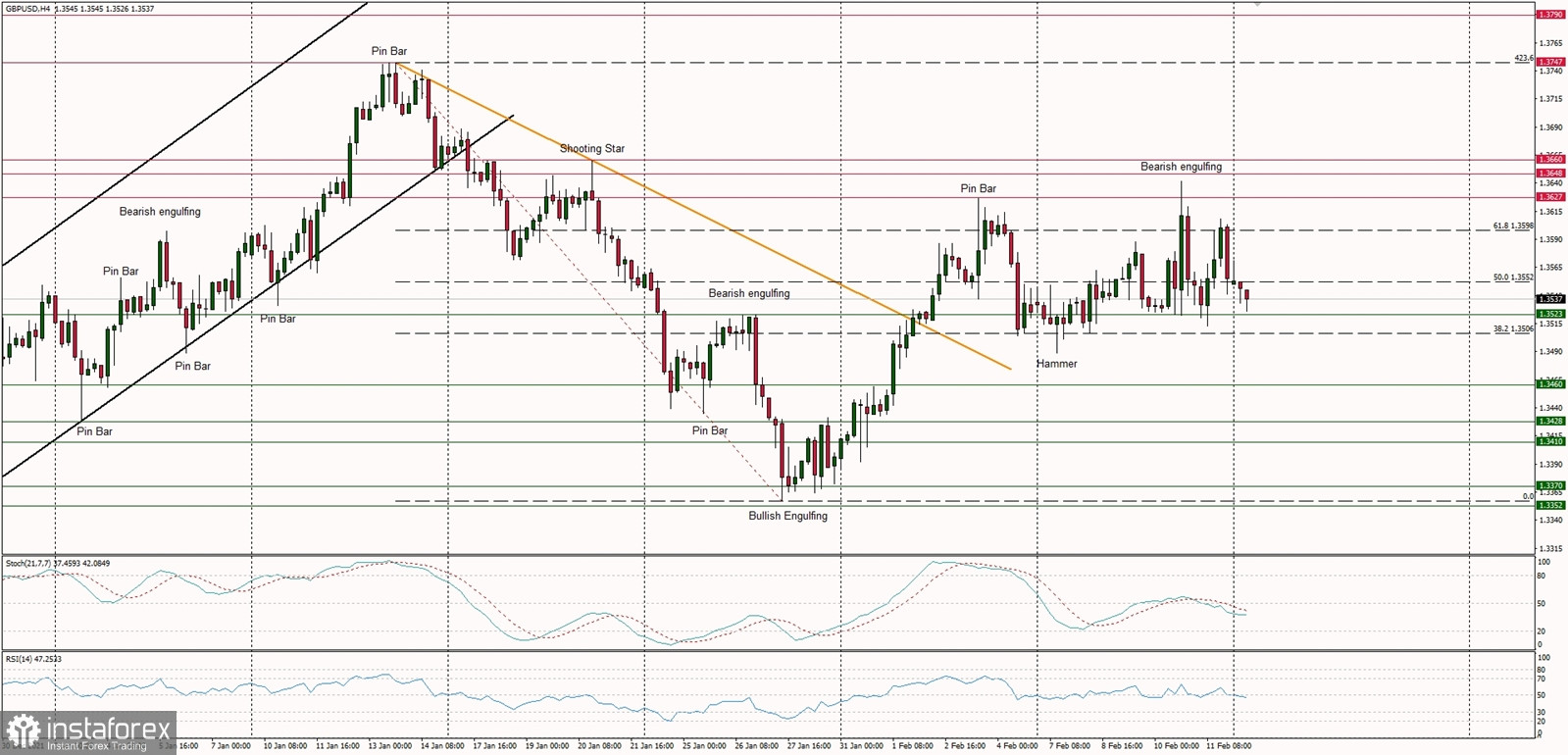

Technical Market Outlook

Another attempt to rally above the 61% Fibonacci retracement had been capped after the second Bearish Engulfing pattern was made again at the H4 time frame chart. The volatility has increased and the market is trading out of the narrow intraday range seen between the levels of 1.3523 - 1.3537. The breakout above the short-term trend line resistance is a positive signal of the bullish strength, so after the test of the trend line (around the level of 1.3475) the up move might be continued. If the bears push down harder below the trend line support, the next target is seen at the level of 1.3460 and 1.3428.

Weekly Pivot Points:

WR3 - 1.3778

WR2 - 1.3707

WR1 - 1.3619

Weekly Pivot - 1.3549

WS1 - 1.3473

WS2 - 1.3403

WS3 - 1.3319

Trading Outlook:

The up trend is being continued, but the up move might be terminated due to the Shooting Star candlestick pattern made at the daily time frame chart at the level of 1.3717. The overall move from the level of 1.3170 looks like a V-shape reversal pattern, so in the long-term the trend might be about to change from the multi-month down trend to the up trend. Please keep an eye on the level of 1.3500, because any sustained breakout below this level will change the outlook back to the bearish again.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română