Investors are analyzing data on US inflation in January, which has updated a 40-year record. Domestic consumer prices rose 7.5% year-on-year last month, compared with a 7% rise in December. Rising inflation raises expectations for a more aggressive tightening of monetary policy by the Federal Reserve System (Fed), Market Watch notes.

Louis Federal Reserve Bank (FRB) President James Ballard said in an interview with Bloomberg that he is ready to support a 100 basis point hike in the base interest rate in the first half of the year, that is, for the next three meetings to be held in March, May and June.

Meanwhile, German inflation slowed to 5.1% in January from 5.7% in December, final data from the country's Federal Statistical Office (Destatis) showed. Inflation in monthly terms amounted to 0.9% compared to 0.3% in the previous month. The dynamics of both indicators coincided with the previously announced data and the average forecasts of analysts surveyed by Trading Economics.

The UK economy grew by 1% in the fourth quarter compared to the previous three months, according to preliminary data from the Office for National Statistics (ONS). Analysts on average expected a rise of 1.1%, according to Trading Economics. According to the revised data, in the third quarter, GDP also grew by 1%, and not by 1.1%, as previously announced.

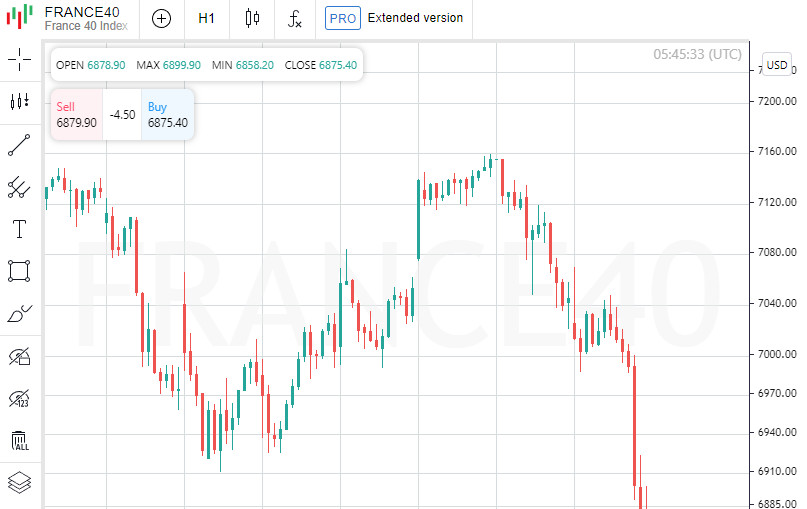

The composite index of the largest enterprises in Europe Stoxx Europe 600 on Friday fell by 0.59% and amounted to 469.57 points.

The French CAC 40 index fell by 1.27%, the German DAX - by 0.42%, the British FTSE 100 - by 0.15%. The Italian FTSE MIB and the Spanish IBEX 35 lost 0.8% and 1% respectively.

Traders continued to follow the financial statements of large companies.

Swedish automaker Volvo Cars cut its fourth-quarter 2021 net profit by 56% and revenue by 6.1% amid component shortages. The company's shares fell 4.7%.

Saab AB, another Swedish automaker and military equipment maker, also reported a 4.4% fall in fourth-quarter revenue to 11.94 billion kroner due to problems in the supply of components. Its shares fell 2.8%.

French generating company Electricite de France SA on Friday lowered its forecast for the country's nuclear power generation in 2023 after downgrading its estimate for the current year earlier this week. EDF shares fell 2.4%.

Tobacco concern British American Tobacco PLC increased its pre-tax profit by 5.7% in 2021 and announced the launch of a share buyback program worth up to 2 billion pounds ($2.71 billion). BAT shares rose 3%.

Mercedes-Benz's market value jumped 6.7% after the German luxury car maker released its 2021 preliminary financials, which showed its adjusted EBIT of 14 billion euros and a return on sales of 12.7%, which turned out to be above the expected 10-12%.

British food ingredients supplier Tate & Lyle PLC increased revenue in the third quarter by 18% and confirmed its guidance for the entire 2022 fiscal year. The company's capitalization grew by almost 10%.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română